Recent home buyers more at risk in a housing market crash

Samantha is a Sydney-based real estate and home improvement writer. She is currently Head of Marketing at OpenAgent.

Learn more about our editorial guidelines.

The deadline for the JobKeeper and JobSeeker stimulus to wind back is looming, and experts are warning that this could be disastrous for the housing market.

The team of urban researchers from Swinburne University and the University of Melbourne have said that the housing market is at risk of a significant downturn unless the jobless rate recovers quickly.

Their research explores the risk for people who bought their first property during the peak of the housing boom.

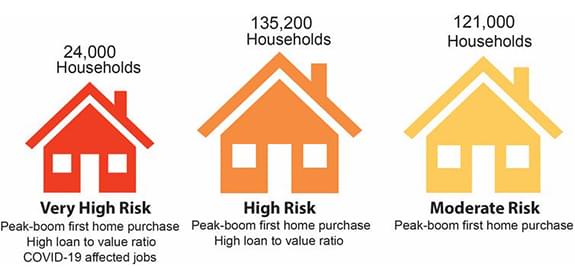

From the analysis, it’s estimated that 24,000 households are at very high risk because they took out large loans that may soon exceed the value of their property. In addition, these households work in sectors that have been most affected by job losses as a result of Covid-19. Another 135,200 are considered ‘high risk,’ while 121,000 are at ‘moderate risk.’

Growth in unemployment is the main threat to housing growth

Industry commentators, analysts and economists have all pointed to an uptick in unemployment as being the main factor that will have a negative affect on house prices.

According to the ABS, over the seven weeks from mid-March to May, total payroll jobs fell by 7.3 per cent. The largest job losses were in Victoria and New South Wales, the states with our biggest real estate markets.

The researchers state that unless employment rapidly recovers, the housing market will face a major downturn. Forecasters from major banks have released various house price predictions, with CommBank winning the prize for ‘most horrifying’ by forecasting a price fall of 32% by the end of 2022.

Over the seven weeks from mid-March to May, total payroll jobs fell by 7.3 per cent.

It’s crucial that we take this, and similar predictions with a very big grain of salt - as these are very much worst-case scenarios. The Real Estate Industry of Australia agrees, and publicly stated that forecasts of housing price drops of 30% or more are highly questionable and cannot be relied upon with any degree of confidence.

However, if there is persistent levels of high unemployment and a sustained economic downturn, this is undoubtedly going to have an effect on the housing market.

Established home owners and landlords least affected by a housing crash

According to the analysis, if there is a downturn, recent first-time buyers are most vulnerable.

Established owners are the least vulnerable. These are owners who have benefited the most from price increases and larger reductions in debt because they bought their properties before the boom, or early during the property boom.

The report refers to the 2008 US housing crisis which showed households who purchased homes with no or very low deposits in the time just before the housing crash were most affected. These households were essentially left with an asset worth less than what they owed to the banks. Many defaulted on their mortgages, which super charged the housing market’s descent.

According to the analysis, if there is a downturn, recent first-time buyers are most vulnerable.

The study shows that the 24,000 households who are most at risk during a downturn are those who:

Purchased their first home between 2014-15 and 2017-18

Borrowed over 80% of the value of their home

Were employed in industries most affected by job losses

Researchers state that another 135,200 recent first home buyers with high loan-to-valuation ratios are also at risk, with homes worth less than their debt.

And what about the rental market? Well, at the moment, in some areas the rental market is contending with a surplus of vacant properties. This is due to rising unemployment, a decline in international students and a sluggish tourism industry which has forced short-term accommodation hosts to transition their properties into long-term rentals. This has resulted in declining rental prices, particularly in the upper end of the market.

The researchers believe that this current over-supply of rentals and weekly asking rent discounting will be short-lived. This will mostly be due to a slowdown in the housing construction industry, which will create housing supply shortages, resulting in low rental vacancies and high rents. The researchers add that rents will need to remain high in order for ‘mum and dad’ investors to hold onto their investment properties.

Those who are currently renting may have hoped that a fall in house prices and rents would allow them to a) save for a deposit and b) finally be able to enter the housing market. However, researchers say that the perfect storm could worsen rental affordability in the long run.

Avoiding a housing downturn

Since the biggest driver of a weakening housing market is deterioration of household income, government stimulus to keep the economy afloat is imperative right now. This is especially important in the face of restrictions on personal movement and an extended fall in migration, which both weigh heavily on house price growth.

This loss of income drives down sentiment, making consumers less willing to commit to buying a property or building a new home. In addition, lower migration means less demand for property.

Home loan deferrals have so far helped to prevent forced sales, and the JobKeeper and JobSeeker government stimulus has kept money in the pockets of our most vulnerable. But these stimulus packages, along with mortgage repayment holidays are scheduled to end by September-October. The end of stimulus and support is being referred to as the ‘September cliff,’ and could be disastrous for the economy.

"Lenders are likely to extend as much support as they can to homeowners, which will avoid a flood of forced property sales on the market."

According to Ms Eliza Owen, CoreLogic’s Head of Research, lenders are likely to extend as much support as they can to homeowners, which will avoid a flood of forced property sales on the market.

“Already we are seeing institutions trying to extend interest-only periods or help mortgage holders get onto plans that reduce their borrowing costs.

“The current situation just exacerbates part of the risk in the Australian economy, which is that we have high housing debt,” she told the ABC.

Already, the Australian government has introduced more stimulus measures to try and stimulate the property market, as well as residential housing construction. Earlier this month, the Federal Government revealed its $25,000 HomeBuilder grant to stimulate the construction industry. The $25,000 can be accessed on top of any existing grants for first home buyers, and can also be used by homeowners undertaking major renovations.

In addition, the ACT has paused stamp duty for one year, with analysts predicting it is likely to be abolished in New South Wales and Victoria, which will be welcome news for buyers.

When it comes to JobSeeker and JobKeeper, the Prime Minister has been firm on ending subsidies, stating that the economy is on the right track. Nonetheless, the stimulus is set to be reviewed on the 23rd of July.

The bottom line

Avoiding a significant housing downturn will depend on how quickly the economy can recover and get back to a pre-Covid state of operation. Ensuring that incomes are safeguarded will help to avoid a glut of distressed sales.

According to researchers, if you’re an established homeowner or investor who purchased before the boom, you’re way more likely to weather the storm if Covid-19 causes a severe housing downturn. In addition, you’re more likely to benefit if there is a post-downturn boom.