Westpac forecasts 20 per cent jump in house prices

Emily is a Sydney-based real estate writer.

Learn more about our editorial guidelines.

A recent report released by Westpac forecasts Australian property prices to increase 20 per cent over the next two years.

These forecasts have been sharply revised upwards from their previous predictions with economists from the financial institution expecting a steep rise in property prices in all capital cities.

Nationally, property prices are predicted to rise 10 per cent in 2021 with the same pace of growth continuing throughout 2022.

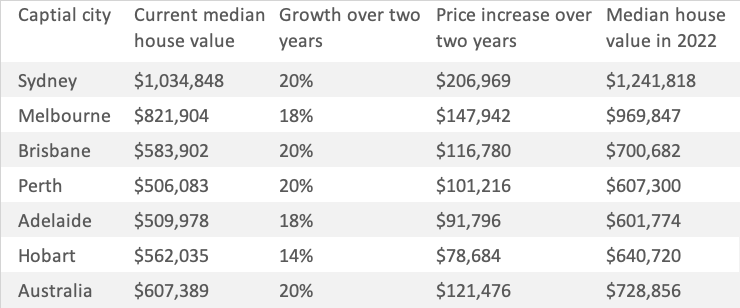

In Sydney, property prices are expected to grow in line with national forecasts, climbing 10 per cent over 2021 followed by a similar rise in 2022. This would see the median house price jump an incredible $206,000 from $1.03m to $1.24m in two years.

In Melbourne, prices are tipped to rise 8 per cent in 2021 followed by a 10 per cent increase in 2022. This would see the median price of houses jump from $821,904 to $969,847 — an increase of around $148,000.

In our smaller markets, strong price growth is also predicted.

Brisbane prices are expected to see strong gains in the next two years with a forecasted increase of 10 per cent over 2021 and similar rises in 2022. This would see an increase of over $116,000, bringing the median Brisbane house value up from $583,902 to $700,682.

Over in Perth property prices are predicted to spike 12 per cent in 2021, followed by an 8 per cent increase the following year. This would be an increase of over $100,000, raising the median house price from $506,083 to $607,300 in two years.

In Adelaide, property prices are forecasted to jump 10 per cent in 2021 and 8 per cent in 2022. This is an increase of around $91,000, bringing the median house price up from $509,978 to $601,774.

In Hobart, forecasts are the most subdued compared to the rest of the capital cities. Prices are predicted to rise 8 per cent in 2021 and a further 6 per cent in 2022. This would bring the median house price up by over $78,000 from $562,035 to $640,720.

Property price forecasts over 2021 & 2022

Westpac economists Bill Evans and Matthew Hassan describe current conditions as “clearly a seller’s market” with the level of buyer demand continuing to outstrip the number of properties on the market.

This is reflected in recent data, which shows strong momentum in buyer activity with dwelling approvals surging 22 per cent in the final quarter of 2020 and new lending for dwellings lifting by 16 per cent in the December quarter.

Mr Evans and Mr Hassan said that the optimistic forecast comes off the back of the faster and stronger than expected turnaround in the market over the past four months.

"Australia is expected to see growth well above trend this year and next."

“The upturn is being supported by record low interest rates, the confident expectation amongst borrowers that these rates will remain low for years to come, ample credit supply, and an improving economic backdrop, as the rollout of vaccines promises to bring the pandemic to an end and drives a sustained lift in confidence,” they said.

Mr Evans and Mr Hassan note that the rollout of the vaccine, which is currently underway in Australia and abroad, will impact the performance of different housing markets.

“The smaller capital cities and regions are well placed to continue to outperform in 2021 but growth will swing towards the three eastern capitals - Sydney, Melbourne and Brisbane in 2022 as the end of the pandemic allows international borders to reopen,” they said.

The positive momentum in the property market is predicted to drive growth into the economy and the labour market.

“Australia is expected to see growth well above trend this year and next. The unemployment rate is forecast to decline steadily to 6% by end 2021 and 5.3% by end 2022,” they said.

The forecast for 2021 has incorporated ongoing COVID-19 related headwinds such as the end of temporary loan repayment deferrals and the impact of closed international borders.

While the continued closure of international borders remains, concerns over the expiry of loan repayment holidays have since dissipated as deferral numbers recover quickly.

In September 2020, there were 460,000 house and small business loans that were deferring payment. In December, this number declined to 120,000.

While there are still questions around the impact of stalled migration on the housing market, Mr Evans and Mr Hassan expect the current upswing to generate strong price gains in the near term.

“The bottom line is that Australia’s housing upturn now has strong momentum that looks to be lifting further and will remain well supported by monetary conditions and an improving economic backdrop,” they said.