What are the risks and opportunities in today's property market?

Learn more about our editorial guidelines.

Property prices continue to gallop ahead all over Australia, and the ongoing pace poses a number of important questions.

Is this rate of growth sustainable? Where can market participants still capitalise on the current conditions and what should they be wary of?

RiskWise Property Research's latest Residential Property Risks & Opportunities Report delves into these questions and outlines where the ground looks solid and where it looks shaky.

We spoke to Pete Wargent, co-founder and COO of BuyersBuyers, to look at some key takeaways from the report.

Houses are still on the up

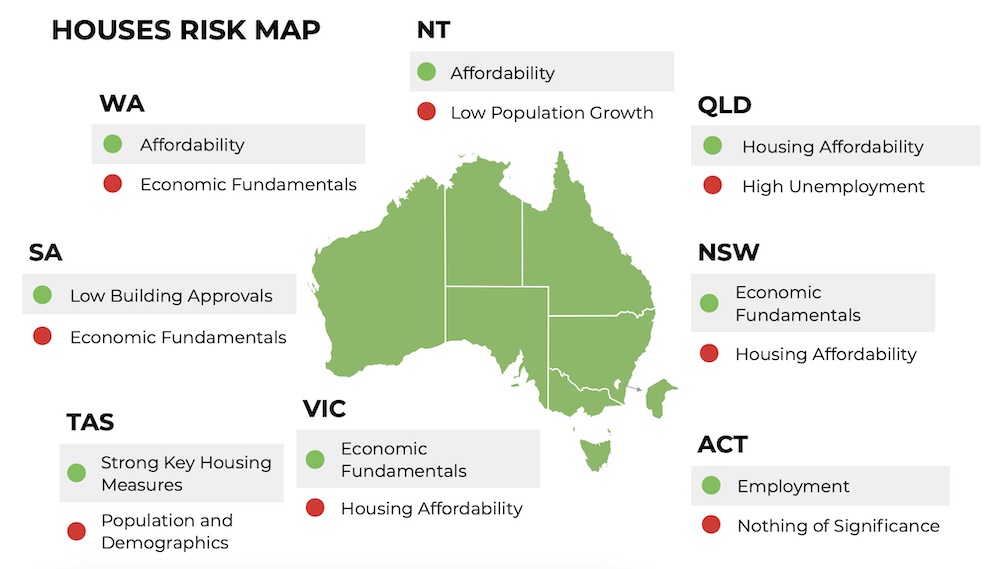

The report uses a green-to-red colour coding system to measure levels of risk, and across Australia, the house market is a sea of green.

It notes that houses either in desirable lifestyle areas, with significant land value or with scarcity value—or a combination of the three—are especially likely to "enjoy very strong demand and capital growth, both in the short and long term."

"The year on year growth is pretty much unprecedented," Mr Wargent comments.

"The slightly unusual thing is it's not particularly focused in one particular city or region, it's right across the entire country. There is definitely a nationwide upcycle."

He notes that houses are now being built at the highest rate ever seen, thanks in part to government incentives like HomeBuilder, and somewhere down the line that new supply is likely to make an impact.

"I think for the next year or two though we'll see quite strong demand simply because it's never been so cheap to borrow," he says.

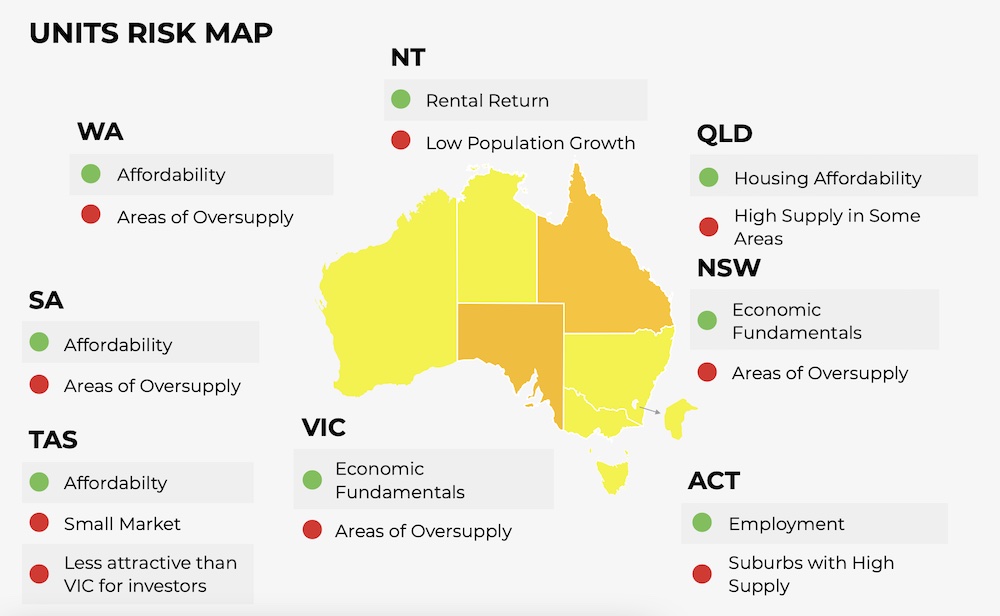

Units have a patchy outlook but opportunities are out there

Where houses look to be exceptionally healthy at the moment, units are more of a mixed bag, with each state hovering in the yellow or orange range.

The report warns that inner-city apartments in oversupplied areas—particularly in Sydney and Melbourne—are seeing low rental returns and high vacancy rates.

With the reopening of the international border still an unknown, those properties remain risky propositions.

But while newer builds may be struggling, Mr Wargent points out that there are still opportunities in older, lower-density unit blocks with greater owner-occupier appeal.

"Certainly the more established, boutique developments are relatively popular," he says.

Housing affordability is an increasing issue

As prices continue to grow right around the country, so too does concern around affordability issues and how they will impact the market.

"Housing affordability has deteriorated and is projected to deteriorate further," the report states, adding "while internal migration to regional areas somewhat mitigates the problem, there is still a major undersupply of family suitable properties in popular areas with proximity to the major employment hubs."

It's tipped to be a "chronic issue" in Greater Sydney, Greater Melbourne and areas in south-east Queensland in particular.

Mr Wargent explains that, with new entrants to the market requiring higher and higher deposits, demand may be pushed towards lower price brackets.

"The first home buyer numbers have been absolutely pumping along because of government stimulus, but over the next 12 months, that will wind back," he says.

"So it will start to become a constraint, especially on houses I think."

Some regional markets may have grown too quickly

A potential risk the report highlights is unsustainably high levels of growth in regional areas as a result of Covid-influenced internal migration.

"Some of the regional markets have seen such phenomenal price growth in a short period of time," Mr Wargent says.

Income growth has remained relatively low in many of these regional areas over the past decade while property values have soared, creating a concerning imbalance.

"Plus we've got the biggest detached housing construction boom we've ever seen in Australia, so there is a risk that if you pay absolute top dollar now to move to a regional market—well what happens to those markets with new supply?" he asks.

Mr Wargent points out that the risks may be lower in high-demand areas like Byron Bay or the NSW Central Coast, but the mismatch between median property value and median income still presents an issue.

Australia's economic recovery continues to excel

Considering last year's economic predictions in the wake of the pandemic were dire, to say the least, Australia has exceeded expectations at every turn this year.

"Even since we wrote this report, the economic news just keeps getting stronger and stronger for Australia," Mr Wargent says.

"The nominal GDP is at record highs, job advertisements are at the highest level in 12-and-a-half years, unemployment's falling, commodity prices are absolutely booming."

That's meant consumer sentiment has roared back and, with many households finding some extra cash in their pockets thanks to government stimulus and no overseas holidays to spend it on, plenty of that money continues to be funnelled into the property market.

"Household wealth is at record highs, asset prices are rising, we might even start to see a bit of wages growth as unemployment falls," he says.

The buoyant economic conditions should continue to mean good news for sellers.

FOMO is driving prices higher, but will it die down?

It's the acronym that's been on every property pundit's lips this year, and buyers' fear of missing out is still a major contributing factor in the current boom.

Mr Wargent expects the mania will wind down, though.

"You generally find that frenzies don't last for that long because it just naturally balances out for a number of reasons," he says.

"One: affordability. Two: people start to get a bit twitchy that they've probably missed most of the cycle, so buyers become a bit more reticent. Thirdly, more sellers come into the market, so it naturally levels out."

Ultimately, he thinks the peak of FOMO fever is passing in Melbourne and is just beginning to ease off in Sydney, and overall rates of growth should simmer down over the next quarter or two.

Overall, growth looks set to continue well into 2022

Even if things cool off to some degree over the coming months, the report indicates double-digit growth is broadly expected around the country, both this year and next.

While an increase in stock on the market is forecast, the extended period of record-low interest rates should keep transactions ticking along and competition high, and "it appears that only macroprudential measures or other external intervention will cool the housing market."

Mr Wargent's read on what's to come is "pretty bullish," saying things should be "overall buoyant but maybe a bit less frenzy as the year goes on."

"Things have changed a heck of a lot from a year ago when there was a huge amount of uncertainty. I think people have realised the world's not ending now, at least for Australia, so there's a bit more confidence around."

From a seller's perspective, the current market certainly isn't risk-free, but opportunities look to be plentiful for the next 12 months at least.