What property prices will reach if forecasts are accurate

Learn more about our editorial guidelines.

Back in May 2020, many major banks and leading economists were predicting steep declines of anywhere between -10 and -32 per cent in Australia’s property market as a result of the unfolding pandemic.

Nearly 12 months on, with prices reaching record levels and growth rates soaring, analysts are painting a vastly different picture.

The most recent Westpac forecast from the bank’s chief and senior economists Bill Evans and Matthew Hassan outlines an expected +15 per cent national uplift in dwelling prices by the close of 2021, totalling +20 per cent by 2022’s end.

“The strong upswing that emerged late last year has seen price growth run well ahead of expectations over the first few months of the year,” Evans and Hassan explain.

“At the current cracking pace, our forecast +10 per cent lift in prices for 2021 set down in February will be achieved by around mid-June.”

A month earlier in March, an ANZ Research report predicted a similarly optimistic average gain of +17 per cent for Australia’s capital cities.

CBA’s latest Global Economic and Markets Research report makes a more conservative projection of an +8 per cent rise in 2021 and subsequent +6 per cent rise in 2022.

If these forecasts play out, the market boom we’ve seen so far in 2021 is just the beginning.

What influenced the turnaround?

The outlook for the property market and Australia’s economy as a whole has shifted dramatically over the past 12 months.

This time last year, with most of the country in lockdown and normal life thrown into unprecedented disarray by the unfolding pandemic, forecasters used what immediate data was available to try to map out what might happen next.

As it turns out, Australia’s economic path through the crisis hasn’t been as dire as first thought for a handful of reasons, not least:

- Unemployment, which the Treasury forecast to peak at 10 per cent, has reduced from a high of 7.5 per cent in July 2020 to 5.6 per cent now.

- The RBA cutting the cash rate to the bone has returned personal loan borrowing to pre-Covid levels and has seen record levels of new home loan commitments.

- Historic government stimulus programs like JobKeeper, JobSeeker, HomeBuilder, mortgage deferrals and more have sustained a lively economy.

- The global Covid vaccine rollout has helped improve market sentiment.

Those factors, along with a perfect storm of market conditions, have turned property price outlooks on their head.

Projecting the numbers by year’s end

So what will property prices look like around the country if the current round of forecasts turn out to be correct?

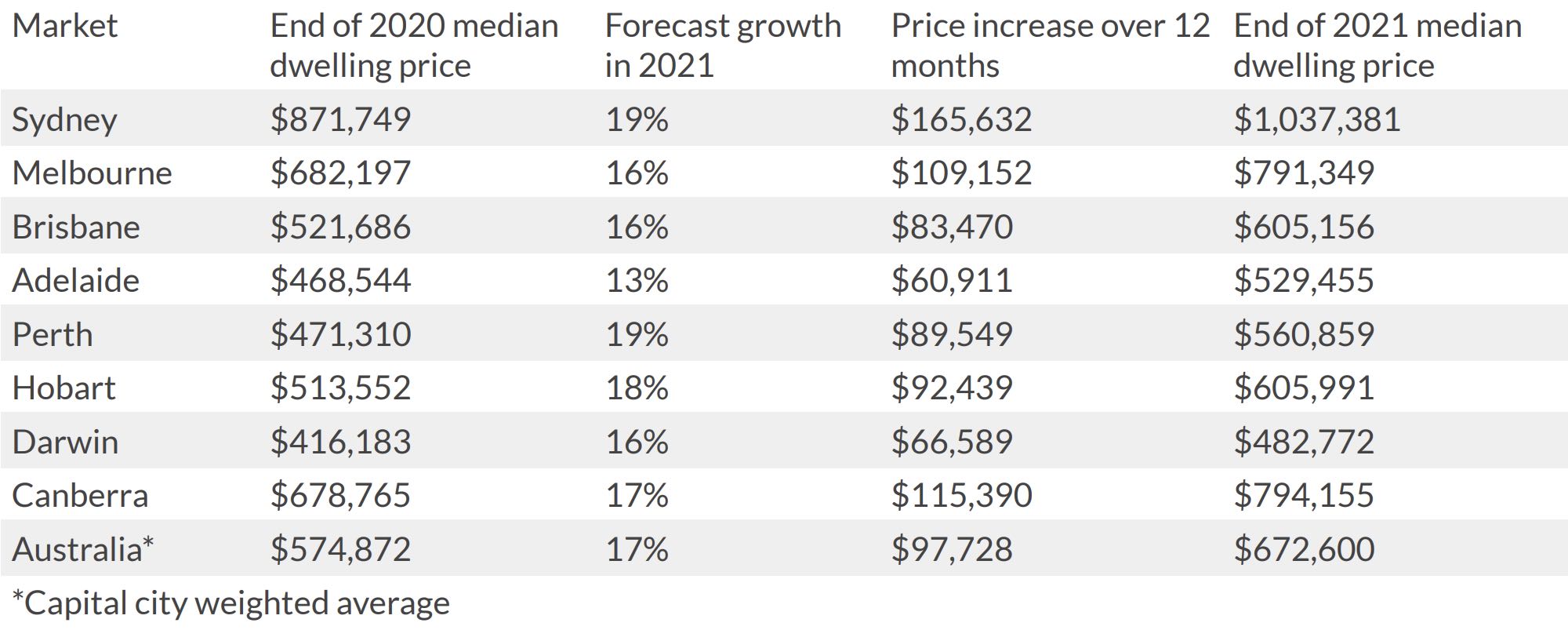

CoreLogic’s Hedonic Home Value Index data from December 31st, 2020 shows that the national median dwelling value at the end of last year was $574,872.

Applying Westpac’s +15 per cent forecast to that baseline would result in a rise to a $661,103 price by the end of 2021, just shy of a $90,000 jump.

That number is a slightly more modest $620,862 if the CBA’s +8 per cent prediction turns out to be correct.

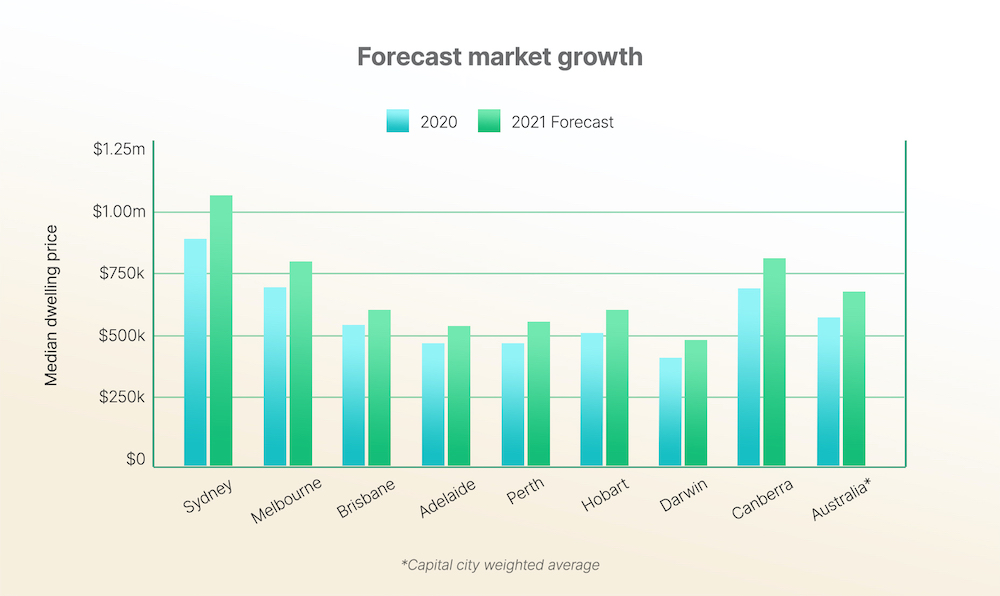

ANZ’s loftier projections for the year are broken down by capital city:

- Sydney and Perth median dwelling prices up +19 per cent

- Hobart median dwelling prices up +18 per cent

- Canberra median dwelling prices up +17 per cent

- Melbourne, Brisbane and Darwin median dwelling prices up +16 per cent

- Adelaide median dwelling prices up +13 per cent

Here’s what those increases translate to when applied to CoreLogic’s December 2020 median price data for each city.

In the cases of Sydney, Melbourne and Canberra, there are jumps of more than $100,000.

These numbers are, of course, far from a sure thing, and if 2020 taught us anything it’s that nothing is certain and any forecasts should be taken with a grain of salt.

Among an endless number of contributing factors, the full economic fallout of JobKeeper’s end is yet to be seen, the Covid vaccine rollout is still only in its early stages, and any potential future lockdowns could throw a major spanner in the works.

What else needs to be considered?

For one thing, the divide between house and unit performance is stark and looks to be growing in some areas.

Median unit prices rose +2.3 per cent nationally over the past 12 months compared to a +7.4 per cent boost for houses, according to CoreLogic.

Major capitals like Sydney and Melbourne have shown unit price gains of just +0.2 per cent and +0.9 per cent respectively, with some key areas that rely heavily on international students and workers for rental returns falling deep into the red.

Houses continue to be the driving force of the property boom as the appetite for more space and the flexibility for many to work remotely mean workplace proximity is not the priority it once was.

There’s also a broad expectation that the velocity of the market’s growth is going to slow.

While there seems to be a unanimous optimism from the major banks about growth in 2021, there’s also a strong sense that regulators are likely to take action to cool the market down by the first half of next year.

ANZ economists Felicity Emmett and Adelaide Timbrell say “By June [2021] ANZ Research expects prices to be rising at a more moderate pace given the end of government programs like JobKeeper and HomeBuilder and a lift in fixed mortgage rates.”

“By year end though, ANZ Research expects regulators will step in with macroprudential controls to address the overheating market with the exact measures likely to be dependent on how the market develops over the next six months or so.”

Westpac’s Evans and Hassan also note that growth in 2022 is also likely to be limited, as “deteriorating affordability will become a more binding constraint for owner occupiers as prices rise.”

While nobody knows for sure what’s coming next, at this stage all signs point to more strong months ahead for the Australian property market.