Why are property prices so high?

Learn more about our editorial guidelines.

It’s been one of the most turbulent years in history across just about every industry and market, yet property markets all around Australia are soaring with no end in sight. It begs the simple question: why?

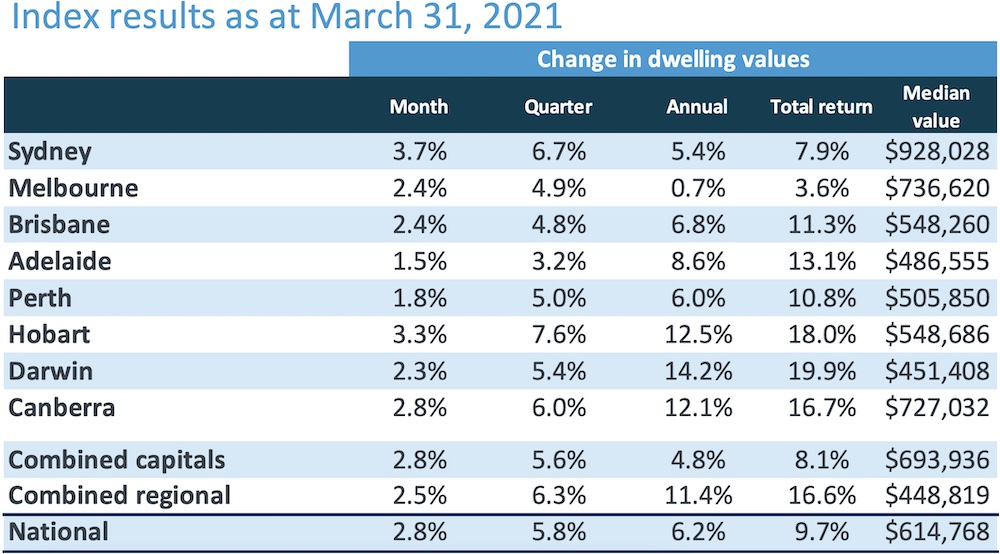

A +2.8 per cent national surge in March alone—the fastest rate of monthly growth since 1988—capped off a bullish first quarter of 2021 that saw a +5.8 per cent increase in dwelling prices according to CoreLogic’s national home value index.

A few key factors have aligned to create a perfect storm that’s seen prices rise to their highest levels ever in many cities and regions despite the country’s recent recession.

Interest rates remain at a record low

Since November 2020 the Reserve Bank’s cash rate has held at 0.1 per cent, its lowest in history, and RBA governor Philip Lowe’s most recent statement maintains the central bank’s message: it’s here to stay.

With interest rates not forecast to rise until inflation is sustainably in the 2 to 3 per cent range—a target Lowe doesn’t expect Australia to hit until 2024 at the earliest—buyers are scrambling to capitalise on low-cost borrowing.

According to RateCity, the lowest available mortgage rates currently sit comfortably under 2 per cent for both variable rate and fixed rate options up to four years.

With a potential 2024 rate hike in mind, RateCity’s research director Sally Tindall told the ABC that a majority of four and five-year fixed rate home loans are just now beginning to rise, saying “I think that's a sign that [lenders] are now factoring in cash rate increases and cost of funding increases that are coming down the line.”

It’s possible that mortgage rates have hit their lowest point, pushing buyers to take action now to secure what they believe to be the best deal.

That action is reflected in the Australian Bureau of Statistics’ latest numbers, with owner occupier loan data showing a total of $21.7 billion in new loan commitments for February 2021 alone, up +55.2 per cent from the previous February.

Within that group, first home buyers borrowed +66.8 per cent more than they did in February 2020.

Investors have also been taking advantage, with a +31.6 per cent increase in loan commitments for the same February year-on-year period, totalling nearly $7 billion lent.

There’s low stock on the market

Among the biggest factors driving property prices skyward is a lack of supply.

CoreLogic’s data shows that, over the first four weeks of March, the number of properties listed across the country was a startling -25.5 per cent below the five year average.

The ratio of new listings to sales sits at around 1.1, meaning for every new property that’s listed, 1.1 properties are sold.

While there is a broad sense that, with the market’s heat echoing 2017 boom levels, selling now could mean receiving a high return, uncertainty about having to buy within that same market has presented property owners with a tricky decision.

“Last year, sellers were more inclined to sell before they bought because there was so much uncertainty about prices,” Domain’s senior research analyst Nicola Powell notes.

“If you sell before you purchase, what many may now be finding is that the market is running away from them and gaining in price.”

“In the ideal scenario, your transactions are as close as possible, but that’s not always possible.”

Rather than choosing to buy first and sell after or vice versa, many homeowners have opted to hold out on listing their properties, causing the squeeze on supply.

The more sellers delay putting their property on the market, the more that supply squeeze tightens, creating a compounding effect reflected in April’s Realestate.com.au Property Seeker report.

Commenting on the report, REA Group’s director of economic research Cameron Kusher explains “Because there has been a low supply of stock for sale, that in itself becomes a bit of a self-fulfilling prophecy in that sellers say ‘I won’t sell because there is nothing to purchase’.”

With seller confidence appearing to be on the rise, though, that bottleneck could ease in the near future.

“I get the sense that many people decided simply to not sell in 2020 and now that case numbers are low and there is a bit more certainty this year, they are more comfortable selling,” Kusher said.

“I expect supply to increase for the next few months and ramp up quite a bit during spring this year, assuming we aren’t forced back into lockdowns at some time.”

Buyer demand continues to grow

On the other side of the equation, there’s been a frenzy of buyers making the market extremely competitive.

A number of factors are driving that swell in addition to low interest rates, not least a suite of first home buyer schemes enticing new entrants into the property market across the country.

In addition to first home owner grants and the federal government’s First Home Loan Deposit Scheme, states have introduced a variety of incentives like stamp duty reductions or exemptions and concessions for properties within certain price brackets.

In Victoria, for example, first home buyers are eligible to pay $0 stamp duty on homes worth up to $600,000, with concessions available above that up to $750,000.

Many of these schemes are due to expire in 2021, pushing new market entrants to make a move sooner rather than later and take advantage of the situation.

The residual impacts of government support and travel restrictions throughout the pandemic have also helped many Australians save substantially over the past 12 months.

“Wage subsidies programs like JobKeeper and stimulus packages such as HomeBuilder, as well as the ban on international travel, meant more people were in a position to buy a home despite sweeping job losses,” Kusher said on another recent REA Group Housing Market Indicators report.

“I think people are looking to spend, and one of those ways they can spend is looking for a nicer house.”

With competition within the market so heated, there’s a psychological aspect too: the fear of missing out.

Considering the historic +2.8 per cent upswing in March alone, buyers are scrambling to secure a deal in case they’re left behind.

Michael Yardney of Michael Yardney’s Property Update explains that the frenzy is pumping prices well above vendors’ expectations, saying “some home buyers are so worried the market is going to pass them by that they are compromising their selection criteria just to get into this market.”

Should sellers take advantage of hot market conditions?