82% of Australians believe property prices will increase in the next six months

2020 was a turbulent year for consumer confidence as COVID-19 greatly impacted various sectors of the economy, including real estate.

Home values, listing volumes and auction clearance rates were all negatively affected at the start of the pandemic due to increasing cases, financial uncertainty and lockdowns.

At OpenAgent, we conducted a consumer sentiment survey to capture the market perspective of sellers and gain insight into whether they think property prices will increase in the next six months.

These are the results.

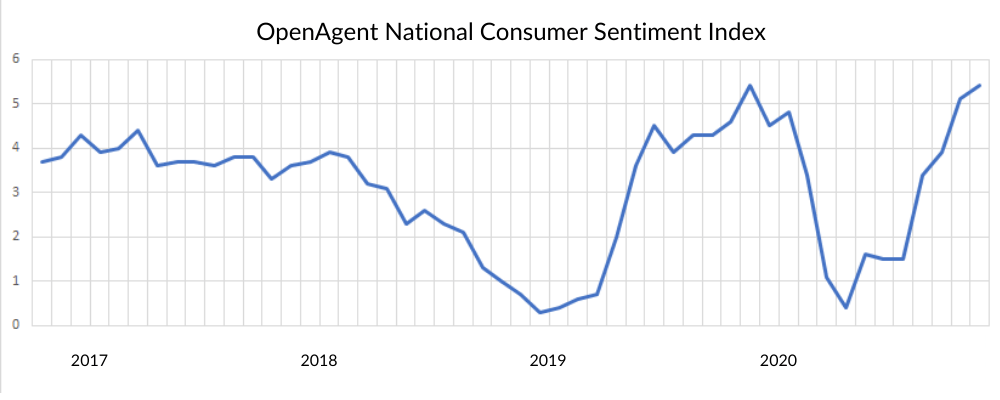

National consumer sentiment tops previous high

2020 started off strong, with 77% of respondents in February believing prices would go up. By May, and well into the pandemic, that number dropped significantly to 33%.

While consumer confidence dropped significantly at the start of the year, it recovered just as quickly, rebounding, and even exceeding, pre-COVID levels in just seven months.

In December 2020, 82% of respondents believed that property prices would increase in the next six months. This tops the previous high of 80% of respondents optimistic about property prices in December 2019.

State consumer confidence rebounding strongly

When we look at data at a state level, we can see a similar pattern, in that the lockdowns and restrictions as a result of Covid-19 had a direct impact on how Australians were feeling about the future of house prices. By March, consumer sentiment in all states dropped sharply, but how quickly they recovered depended greatly on how well the virus was contained.

However, by December, all states have recorded positive sentiment in line with pre-pandemic levels, with most respondents believing prices will rise in the next six months.

Let's dive into a state-by-state breakdown below.

Victorian sentiment recovering quickly

82%

VIC respondents believe prices will rise in the next six months

16%

VIC respondents believe prices will stay the same in the next six months

2%

VIC respondents believe prices will fall in the next six months

Melbourne consumer confidence dipped twice in 2020, once in May during the National lockdown, and then again in August when Victoria declared a state of disaster and began stage 4 restrictions. Interestingly, there was a difference between the extent of these declines. In May, 30% of respondents believed property prices would go down, however the number of pessimists dropped by half to 15% in August.

According to OpenAgent Data Analyst, Carson Teh, the improved sentiment in August could be due to the success of the first lockdown.

“It’s likely that respondents were more optimistic the second time around because they’d already experienced the first lockdown where the property market turned out to be more resilient than expected,” he said.

The most recent figures in December show that 82% of Victorian respondents believe prices will go up in the next six months, which is 9% higher than at the beginning of the year in January.

Queensland sentiment highest ever recorded

87%

QLD respondents believe prices will rise in the next six months

10%

QLD respondents believe prices will stay the same in the next six months

2%

QLD respondents believe prices will fall in the next six months

COVID-19 cases in Queensland remained quite controlled throughout 2020 with no major breakouts since April.

It was the only state where sentiment did not continue to plummet in the second half of the year. As a result, there’s no surprise that sentiment has been on an upward trend since its April low.

In December 2020, almost 88% of QLD respondents believe that property prices will increase in the next six months - the highest confidence ever recorded. This is compared to a previous record of 74% in December 2019.

Almost 90% of SA respondents believe property prices will rise

89%

SA respondents believe prices will rise in the next six months

6%

SA respondents believe prices will stay the same in the next six months

6%

SA respondents believe prices will fall in the next six months

Over 2020, Consumer sentiment in South Australia followed a similar pattern to Victoria, dipping in both May and August.

Mr Teh believes the increased pessimism is due to new COVID cases in and around South Australia at the time.

“In May, around 12% of South Australian respondents believed prices would decrease. Three months later in August, this number almost doubled to 22% of respondents.

“The plunge in confidence can be attributed to a number of factors. The first being the fear of cases in neighbouring NSW and VIC potentially spilling over to South Australian borders and secondly, the state recording its first known local transmission case in late July - the first locally acquired case in more than two months,” he said.

Despite this, consumer confidence in South Australia has held up during the outbreak with the quick Government response to lockdown successfully controlling the cluster within two weeks. By December, we can see that almost 90% of South Australian respondents believe property prices will rise in the next six months.

New South Wales sentiment rebounding

75%

NSW respondents believe prices will rise in the next six months

22%

NSW respondents believe prices will stay the same in the next six months

3%

NSW respondents believe prices will fall in the next six months

The recovery of NSW consumer sentiment has fluctuated more than the other states.

In May consumer confidence dipped, with only 31.3% of respondents believing property prices would increase.

However, this outlook was more positive than the sentiment recorded during the last property downturn in 2019 - where in March of that year, only 22% of respondents believed property prices would increase.

According to Mr Teh, there is a correlation between how people feel about property prices and how well the virus is being contained.

"We see it in the data... when outbreaks happen, some respondents clearly start to feel a little uncertain or pessimistic about the future of property prices," he said.

In August 2020, consumer sentiment dipped slightly due to the Sydney CBD outbreak of cases while stalled sentiment in October was likely linked to the Lakemba GP cluster.

In November around 80% of respondents believed property prices would increase. The proportion of optimistic respondents declined to around 74% in December due to the Avalon cluster.

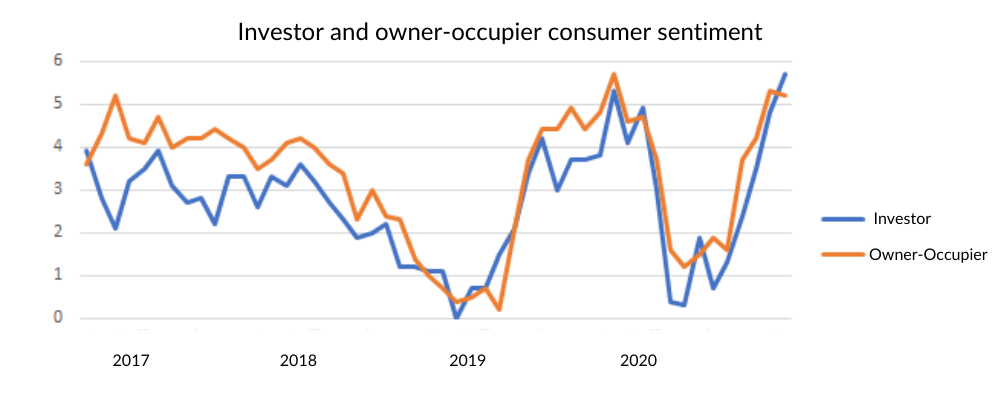

Investor and owner-occupier sentiment trending up

Investor confidence went full circle in 2020 with the latest OpenAgent data showing that investor sentiment went from an all-time high in December 2019 to the second-lowest recorded index in May 2020.

Investor confidence is now at the highest levels we’ve ever recorded, with around 85% of respondents believing property prices will go up in the next six months and only 1% of respondents believing they will go down.

While the latest figures show overall positive investor sentiment, it’s important to note that sentiment differs depending on the type and location of an investment property. It's now widely known that high-rise apartment markets in the inner-city areas of Sydney and Melbourne have experienced a decline in rents and prices due to stalled migration and a lack of international students.

Investor confidence is now at the highest levels we’ve ever recorded, with around 85% of respondents believing property prices will go up in the next six months

On the other hand, investments in some regional areas or in the smaller territories and states of Darwin and Perth have performed exceptionally well.

For owner-occupiers, sentiment was at its lowest in May 2020 where 21% of respondents had a negative outlook for property prices. After May, consumer confidence continued to increase until November with a negligible decrease in December.

According to Mr Teh, the rapid bounce back in investor and owner-occupier confidence can be attributed to a few different factors.

“The Government's proven ability to effectively control outbreaks and the RBA’s record low interest rates of 0.1% have significantly helped to stimulate the economy and subsequently, the property market,” he said.

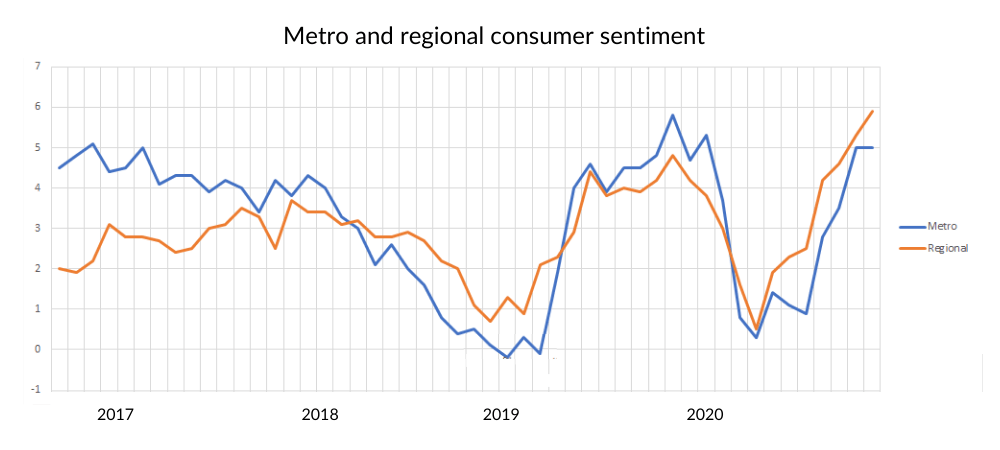

Metro and regional sentiment climbing strongly

In December 2019, sentiment in both metro and regional areas were high, with 83% of metro residents and 74.3% of regional residents believing property prices would increase. This sentiment was the most positive outlook for property prices recorded since 2016.

As a result of the pandemic, consumer confidence in metro and regional areas took a beating, with sentiment plummeting in May.

While the latest data shows that sentiment for metro respondents is increasing, it’s not yet back to pre-Covid levels. In December, 80% of metro residents believed property prices would go up, compared to a high of 83% one year earlier.

In regional areas, sentiment recovery has been a “v” shape and rebounded strongly.

In December 2020, just seven months after the lowest regional sentiment recording in three years, the index is now the highest it has ever been, surpassing the previous peak in 2019. 86.4% of regional residents now believe property prices will increase in the next six months.

The primary factor of this incredible boost in confidence in regional sentiment is the shift in buyer demand.

Increased affordability in regional areas coupled with the prevalence of remote working conditions has prompted many to move away from the city.

This increase in demand has driven up regional property prices with the latest CoreLogic Home Value Index showing that combined regional dwelling values rose 6.9 per cent over the year, a rate of capital gain more than three times higher than the combined capitals, where property values were up 2.0 per cent.