What is a real estate agent commission?

Commission is the fee you pay to your real estate agent when they sell your property. As it tends to be the largest single cost in selling your home, it's important to understand how commissions work.

Real estate commission rates aren't regulated and are set by individual agents, which means they can vary from suburb to suburb as well as between agents within a suburb. While the difference between 2.0% and 2.5% may not seem like a lot, this can actually mean thousands of dollars difference in what you pay your real estate agent.

The different types of agent commissions

There are two main options when it comes to commissions: fixed commission and tiered commission.

Fixed commission is the traditional method when it comes to calculating commissions. It's based on the sale price multiplied by the negotiated commission rate. For example, if you were to sell a home for $600,000 and were charged a commission rate of 2.5% you'd pay $15,000 in commission ($600,000 x 2.5%).

A tiered commission rate is based on performance, and is used as a way to encourage real estate agents to get a higher sale price. For example, let’s say you expect a sale price of $830,000. Instead of going for a flat 2.5% commission rate, you could agree on paying a lower rate of 2.0% under $830,000 and a higher rate of 6% on everything above $830,000. This means the agent has a greater incentive to achieve a price above your expected sale price.

What to consider when negotiating commissions

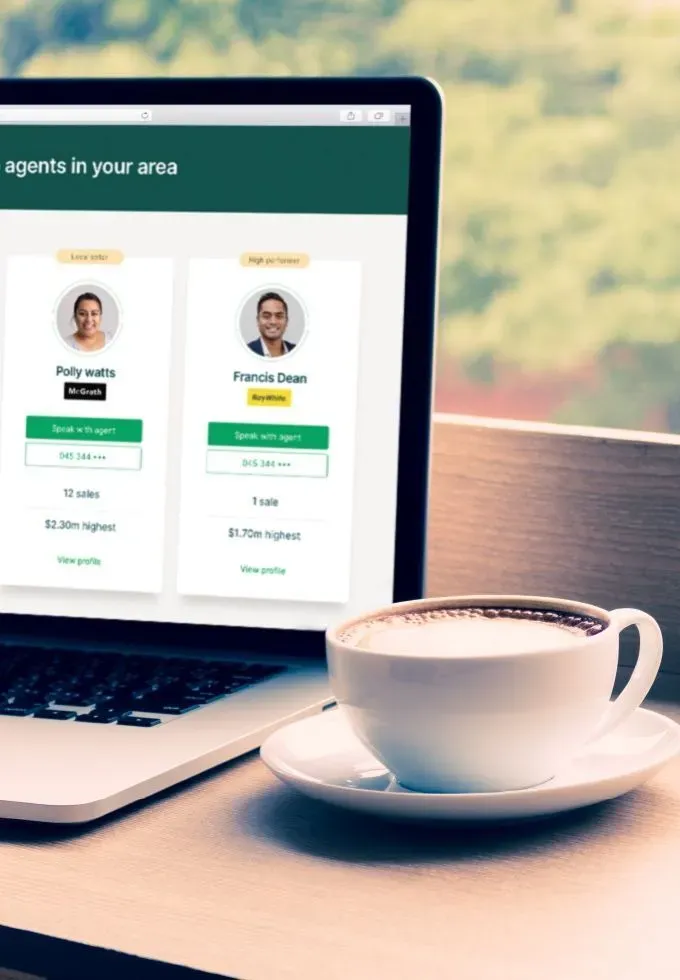

It is possible to negotiate on commissions. It's worth seeing a few agents in your area to see what they are including in their commission rate as not all agents structure their fees the same way. For example some agents include some advertising as part of their commissions rate.

When comparing agents, look at their past history of sales and experience to see if they are right for you. You might be willing to pay a slightly higher commission if they have a proven track record of selling above market rate. As mentioned above, tiered commission rates are also a great negotiation tool to get you the best price result on your sale.

What are the other costs involved in selling your home?

Commissions aren't the only cost involved in selling your home. Some other costs can include; advertising and marketing, an auctioneer, your solicitor or conveyancer, any lender fees, moving costs and any pre-sale renovations you might want to make. Have a look at our fees guide to find out more on each of these.

*The figures used in the commission calculator are based on data provided to us by real estate agents who use our services.