Brisbane property market news - key takeaways

- Price growth accelerates: Brisbane is seeing one of the highest rates of capital gain. Values jumped +1.8 per cent in October, marking the biggest monthly rise since February 2022. The unit market is leading the charge, with values up +1.9 per cent, while house values increased by +1.8 per cent.

- Demand outstrips supply: Brisbane's property market is grappling with a significant supply-demand imbalance. Listings are 31 per cent below the five-year average, while demand remains strong.

- Auction clearance rates moderate: Domain data shows Brisbane's auction clearance rate for the week of November 23, 2025, was 55 per cent. This indicates a moderate level of buyer activity and competition.

- Tight rental market: Brisbane's rental market remains tight, with a vacancy rate of just 1.0 per cent in October 2025, slightly above September’s 0.9 per cent. Weekly rents are steady at about $685, reflecting a +4.5 per cent annual increase, according to SQM and Cotality data.

- Stable interest rates: The Reserve Bank of Australia (RBA) kept its cash rate unchanged at 3.60 per cent on 5 November 2025, following earlier cuts in the year. This stability is boosting confidence in the Brisbane property market, as buyers feel reassured that borrowing costs have stabilised.

Get a free property value estimate

Find out how much your property is worth in today’s market.

Brisbane property price movements

The Brisbane property market is on the rise, showing one of the highest rates of capital gain among Australian cities. This growth is fuelled by low supply and strong demand, largely driven by interstate migration and the city's relative affordability.

Brisbane property prices - October 2025

In October, Brisbane's property prices climbed by +1.8 per cent, marking the largest monthly increase since February 2022. Over the quarter, prices jumped by +4.9 per cent, and annually, they surged by +10.8 per cent. The median property value in Brisbane reached $992,864.

| Property type | Month change | Quarter change | Annual change | Current median price |

|---|---|---|---|---|

| All Brisbane dwellings | 1.8% | 4.9% | 10.8% | $992,864 |

Source: Cotality

The Brisbane property market continues to benefit from a scarcity of housing stock, which is 19 per cent lower than a year ago and 31 per cent below the five-year average. This shortage of listings is a key factor pushing prices up, alongside strong demand from interstate migration.

House prices in Brisbane

Brisbane house prices rose by +1.8 per cent in October, with a quarterly increase of +4.8 per cent and an annual rise of +10.2 per cent. The median house price in Brisbane is now $1,087,183.

| Property type | Month change | Quarter change | Annual change | Current median price |

|---|---|---|---|---|

| Brisbane houses | 1.8% | 4.8% | 10.2% | $1,087,183 |

Source: Cotality

The Brisbane housing market is thriving due to its relative affordability compared to other major cities like Sydney and Melbourne. The combination of low supply and strong demand continues to drive price growth, making Brisbane an attractive market for both buyers and investors.

Unit prices in Brisbane

Unit prices in Brisbane experienced a notable increase of +1.9 per cent in October, with a quarterly rise of +5.3 per cent and a significant annual growth of +14.0 per cent. The median unit price in Brisbane is $774,498.

| Property type | Month change | Quarter change | Annual change | Current median price |

|---|---|---|---|---|

| Brisbane units | 1.9% | 5.3% | 14.0% | $774,498 |

Source: Cotality

Brisbane unit prices are benefiting from strong demand, particularly from first-home buyers and investors taking advantage of the expanded deposit guarantee scheme. The city's unit market is leading the pace of growth, supported by low supply levels and competitive pricing.

Brisbane property market forecasts 2026

Australia’s big four banks regularly release house price forecasts as part of their economic research. This helps them make informed mortgage-lending decisions, manage risk, and demonstrate their market expertise. Here’s what they expect for 2026.

| Market | CBA forecast 2026 | Westpac forecast 2026 | NAB forecast 2026 | ANZ forecast 2026 |

|---|---|---|---|---|

| National | 4.0% | 4.0% | 4.1% | 5.8%* |

| Sydney | 3.0% | 5.0% | 4.2% | 5.3% |

| Melbourne | 2.0% | 3.5% | 3.9% | 6.2% |

| Brisbane | 5.0% | 4.5% | 4.6% | 4.3% |

| Adelaide | 5.0% | 3.0% | 4.1% | 2.5% |

| Perth | 6.0% | 4.0% | 3.7% | 4.3% |

| Hobart | 2.0% | 2.0% | 3.6% | 1.8% |

| Darwin | 5.0% | NA | 3.7% | 2.4% |

| Canberra | 3.0% | NA | 2.8% | 1.6% |

Source: Westpac Housing Pulse, NAB Residential Property Survey, CBA Economic Update, ANZ Housing Outlook.

* ANZ estimate for Capital Cities, not national

Brisbane is set to see significant growth compared to other capital cities. These Brisbane property market predictions suggest a strong upward trend, fuelled by factors like interstate migration and relative affordability.

Brisbane home price forecasts 2026

Westpac predicts Brisbane property prices will rise by about +4.5 per cent in 2026, while NAB forecasts a +4.6 per cent increase. ANZ expects a slightly lower growth of +4.3 per cent. These forecasts reflect ongoing strong demand in Brisbane, supported by limited housing supply and steady population growth.

The RBA's decision to keep the cash rate steady at 3.60 per cent has also created a stable borrowing environment, encouraging more buyers to enter the market.

RBA cash rate forecast 2025-2026

The Reserve Bank of Australia (RBA) held its cash rate at 3.60 per cent on 5 November 2025, following three 0.25-per-cent cuts earlier in the year. This decision came after inflation showed an unexpected rise, with the RBA’s preferred trimmed-mean measure reaching 3.0 per cent, the top of its 2–3 per cent target band, and headline CPI running at 3.5 per cent annually. This left no room for another rate cut in 2025. Initially, major bank economists expected a November cut, but they changed their predictions when inflation figures rose, correctly anticipating the RBA would hold steady.

Here’s where the major banks see the cash rate heading next:

- Commonwealth Bank (CBA): Expects no further cash rate cuts in this cycle, maintaining the rate at 3.60 per cent into 2026.

- Westpac: Also sees no cuts for the rest of 2025, but forecasts a 0.25-per-cent cut in May 2026 and another in August 2026, lowering the cash rate to 3.10 per cent by late next year.

- National Australia Bank (NAB): Predicts no additional 2025 cuts, with a 25-basis-point cut in May 2026, reducing the cash rate to 3.35 per cent by mid-2026.

- ANZ: Similarly anticipates no more cuts in 2025, with the next move being a 0.25-per-cent cut in February 2026, bringing the cash rate to 3.35 per cent at the start of 2026.

What this means for the Brisbane market

Brisbane is leading the east coast capitals, with prices rising more than +10 per cent annually. The RBA’s rate hold is adding momentum to a market already supported by low supply, interstate migration, and relative affordability. Listings remain well below average, and competition is strong. Historically less volatile than Sydney or Melbourne, Brisbane is now outperforming thanks to local fundamentals—and with the cash rate steady, that outperformance looks set to continue.

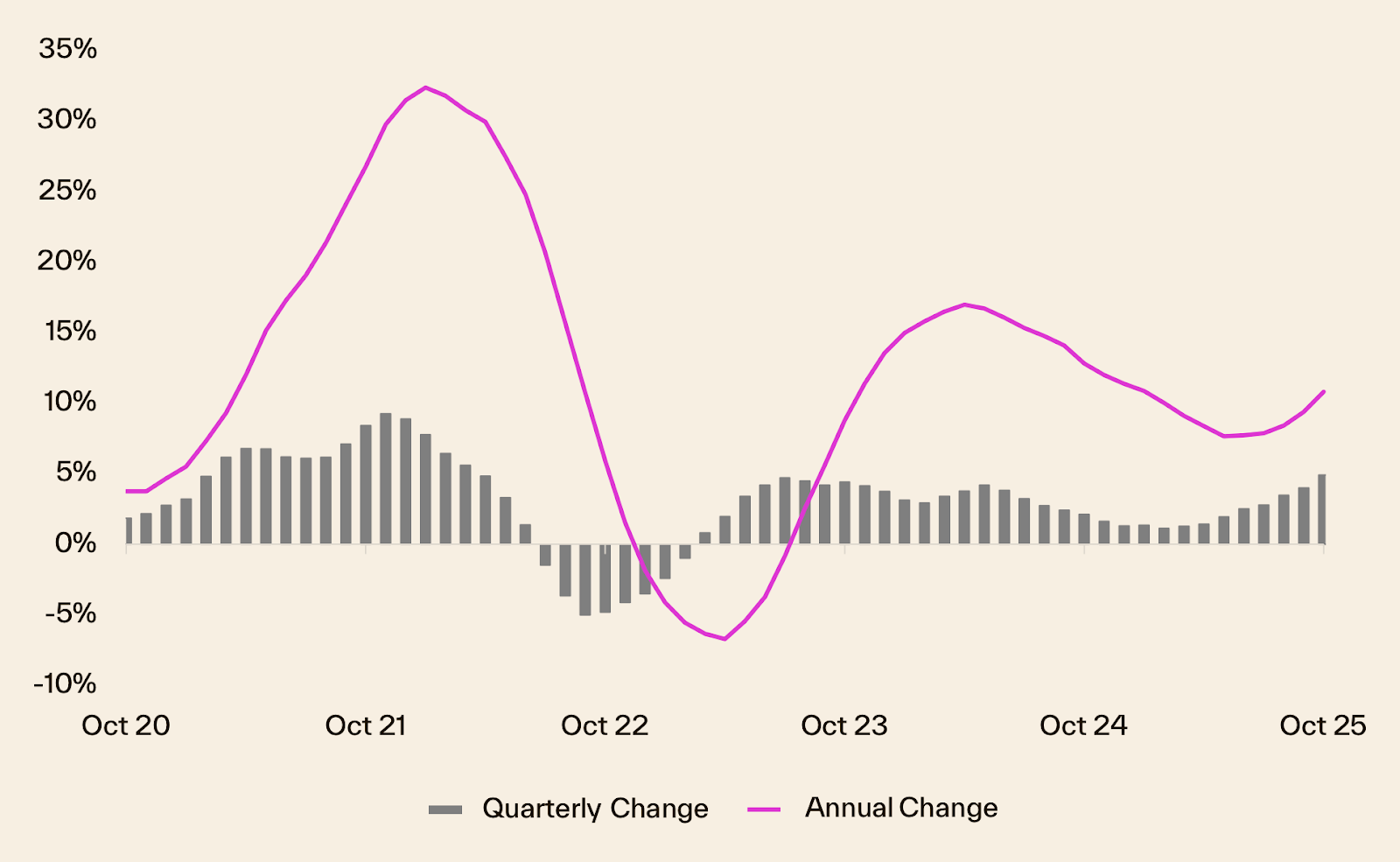

Brisbane house prices graphs and charts

Brisbane house price growth over the last 5 years has been remarkable, with the city seeing significant increases in property values. As of November 2025, Brisbane's home values rose by +1.8 per cent in October, +4.9 per cent over the quarter, and are +10.8 per cent higher than a year ago, reaching all-time highs.

Insights from Cotality show that Brisbane's housing market has been a standout performer, with sustained growth driven by interstate migration and a tight rental market. The limited supply of properties has led to competitive bidding, further pushing up prices.

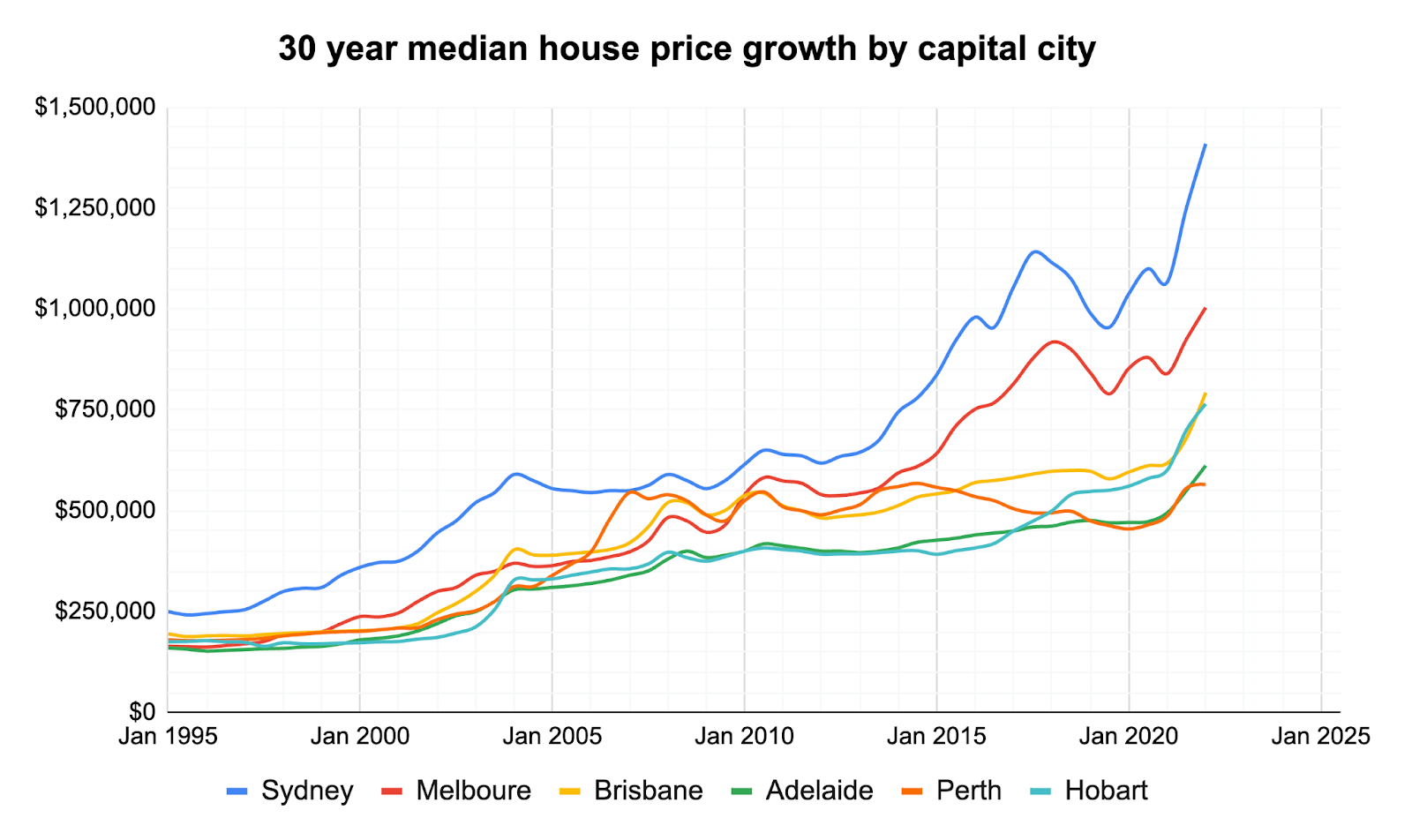

Brisbane property prices graph over 30 years

Brisbane property growth over the 10 years has been substantial, with the city transforming from a relatively affordable market to one of the most expensive in Australia. This growth has been fueled by low interest rates, strong population growth, and a chronic undersupply of housing.

Over the past three decades, Brisbane has experienced cycles of booms and corrections, yet the long-term trajectory has been sharply upward. Today, homeowners are enjoying significant equity gains, though the affordability crisis remains a concern. The market's resilience, despite interest rate hikes, reflects strong underlying demand, but new buyers face high entry costs.

Brisbane selling statistics

Brisbane's property market in November 2025 shows signs of cooling, with sales volumes decreasing compared to the previous year. The market is experiencing longer selling times, indicating a shift in buyer behaviour and possibly a more cautious approach to purchasing.

Brisbane sales volume and days on market

In November 2025, Brisbane's sales volume decreased by 4.2 per cent compared to the previous year, reflecting a broader national trend where sales activity has been relatively stable. The median days on market for Brisbane properties is currently 21 days, which is longer than the previous year but still faster than the national median of 29 days.

| Brisbane sales volume | Brisbane days on market |

|---|---|

| -4.2% Change from 12mo ago | 21 days 17 days 12mo ago |

Source: Cotality

This increase in days on market suggests that buyers are taking more time to make purchasing decisions, possibly due to economic uncertainties or higher interest rates. Compared to other capitals, Brisbane's selling times are still relatively quick, indicating that while the market has slowed, it remains more dynamic than some other cities like Hobart or Darwin, where properties linger longer on the market.

Brisbane new and total listings

Brisbane has seen a significant drop in both new and total listings. New listings have fallen by -8.2 per cent, and total listings have decreased by -19.7 per cent from last year.

| Brisbane new listings | Brisbane total listings |

|---|---|

| -8.2% Change from 12mo ago | -19.7% Change from 12mo ago |

Source: Cotality

This reduction might be because sellers are hesitant to list in a less favourable market. With fewer properties available, competition among buyers could increase, potentially stabilising or even boosting property prices if demand holds steady.

Brisbane vendor discount and auction clearance rates

Vendor discounting and auction clearance rates are key indicators of market health. Vendor discounting shows the gap between asking and sale prices, while auction clearance rates reflect the percentage of properties sold at auction, indicating buyer demand and market competitiveness.

Brisbane vendor discount

| Oct 2025 | Sep 2025 | Aug 2025 | Jul 2025 | |

|---|---|---|---|---|

| Brisbane median vendor discount | -2.6% | -2.6% | -2.7% | -3.0% |

Source: Cotality

Brisbane's vendor discount rate has tightened to 2.6 per cent, lower than the national average. This suggests sellers are less willing to negotiate on price, possibly due to confidence in the market's strength.

Brisbane auction clearance rates

| Brisbane | November 23 | November 16 | November 9 | November 2 |

|---|---|---|---|---|

| Clearance Rate | 55% | 46% | 52% | 49% |

| Auctions Scheduled | 196 | 175 | 211 | 208 |

| Auctions Reported | 175 | 156 | 181 | 177 |

| Sold | 97 | 71 | 94 | 86 |

| Withdrawn | 25 | 12 | 21 | 20 |

| Passed in | 53 | 73 | 66 | 71 |

Source: Domain

In the past four weeks, Brisbane's auction clearance rates have varied, starting at 49 per cent in early November and rising to 55 per cent by the end of the month. This fluctuation points to a market in transition, where buyer interest is present but inconsistent, possibly due to differences in property quality or economic conditions affecting buyer confidence.

Get a deeper insight into how Brisbane sellers are faring in 2025 and what could be on the horizon for the year ahead with some of our latest articles.

Brisbane property investing

Brisbane's rental market is buzzing with high demand. This surge is largely due to strong interstate migration and a limited supply of new properties. As a result, rental prices are on the rise. Let's dive into the statistics on rental rates, yields, and vacancy trends to get a clearer picture of the current conditions in Brisbane.

Brisbane rental market

Rental rates in Brisbane have seen notable growth, with the city ranking among the top for annual increases among the capitals. This is a reflection of ongoing demand pressures and limited supply, keeping the market competitive. Gross rental yields in Brisbane are slightly above the national average, offering investors a relatively strong return compared to other capitals. These trends provide the backdrop for the detailed metrics below.

| Location | Rental rates | Rental yield | Annual change in rents, houses | Annual change in rents, units |

|---|---|---|---|---|

| National | 4.6% | 3.60% | NA | NA |

| Combined Capitals | 4.0% | 3.40% | NA | NA |

| Combined Regional | 6.1% | 4.30% | NA | NA |

| Sydney | 4.0% | 3.00% | 3.40% | 5.00% |

| Melbourne | 1.8% | 3.60% | 1.60% | 2.20% |

| Brisbane | 5.8% | 3.50% | 5.60% | 6.50% |

| Adelaide | 3.6% | 3.60% | 3.70% | 3.10% |

| Perth | 5.8% | 4.00% | 5.70% | 6.90% |

| Hobart | 6.9% | 4.40% | 6.80% | 7.70% |

| Darwin | 8.5% | 6.40% | 7.60% | 10.00% |

| Canberra | 2.9% | 4.00% | 2.80% | 3.40% |

Source: Cotality

Despite the growth in rental rates, Brisbane faces a persistent shortage of available properties. The annual rent change for houses and units has been significantly high, driven by strong population inflows and limited new stock. This situation is likely to keep rents climbing unless there is a substantial increase in new housing supply.

Brisbane vacancy rates

Vacancy rates are a key indicator of the balance between supply and demand, showing how easily tenants can find properties and negotiate rents. Nationally, vacancy rates remain tight, with little sign of significant supply increases. This trend is especially evident in Brisbane, where strong demand continues to absorb available stock, maintaining a competitive market.

| Location | Oct 2025 vacancy rates | Oct 2025 vacancies | Oct 2024 vacancy rates | Oct 2024 vacancies |

|---|---|---|---|---|

| National | 1.20% | 36152 | 1.20% | 36486 |

| Sydney | 1.30% | 9553 | 1.50% | 10874 |

| Melbourne | 1.80% | 9713 | 1.70% | 9052 |

| Brisbane | 1.00% | 3391 | 1.00% | 3580 |

| Adelaide | 0.80% | 1215 | 0.60% | 915 |

| Perth | 0.70% | 1304 | 0.50% | 998 |

| Hobart | 0.40% | 107 | 0.60% | 179 |

| Darwin | 0.70% | 181 | 1.40% | 349 |

| Canberra | 1.40% | 860 | 1.70% | 1059 |

Source: SQM Research

Brisbane's current vacancy rate is 1.0 per cent, slightly up from the previous month's 0.9 per cent, yet still well below the national average. This indicates a tight market. Compared to other capitals, Brisbane's vacancy rate is among the lowest, highlighting the city's strong demand and limited supply. Historically, Brisbane has maintained low vacancy rates, underscoring the ongoing challenges for tenants in finding available properties.

Louis Christopher, Managing Director of SQM Research said in his latest rental market report

“The national vacancy rate holding at 1.2% suggests the rental market remains very tight, with little sign of meaningful supply increases. While some capitals are showing temporary easing in rent growth, underlying conditions remain undersupplied, particularly in cities such as Perth, Adelaide, and Hobart. Brisbane continues to attract strong demand from interstate migration, while Melbourne and Canberra appear to be stabilising following recent surges in new rental listings. Overall, we expect rental conditions to remain tight through the summer months, with only a modest increase in vacancies likely in early 2026.”

Brisbane’s vacancy rate dropped to just 0.9 per cent, illustrating the “ongoing shortage” Louis describes. Monthly rents dipped -0.2 per cent but remain +3.8 per cent higher year-on-year, aligning with his view that rents stay high while supply is constrained. With vacancies under 1 per cent, Brisbane is among the tightest markets nationally, leaving tenants with few options. Without a surge in new dwellings, even minor rent pull-backs are likely temporary.

Highest growth areas in Brisbane

| Rank | SA3 Name | SA4 Name | Median Value | Annual % Change |

|---|---|---|---|---|

| 1 | Caboolture Hinterland | Moreton Bay - North | $950,265 | 14.0% |

| 2 | Redcliffe | Moreton Bay - North | $973,087 | 14.0% |

| 3 | Chermside | North | $1,217,426 | 13.2% |

| 4 | Sunnybank | South | $1,224,606 | 13.1% |

| 5 | Brisbane Inner | Brisbane Inner City | $906,303 | 13.1% |

| 6 | Nathan | South | $1,305,782 | 13.1% |

| 7 | The Gap - Enoggera | West | $1,290,745 | 12.9% |

| 8 | Nundah | North | $1,018,140 | 12.9% |

| 9 | The Hills District | Moreton Bay - South | $1,205,744 | 12.7% |

| 10 | Capalaba | East | $1,124,416 | 12.7% |

Source: Cotality

Highlights for Brisbane's high growth areas

- Caboolture Hinterland and Redcliffe are shining bright, both ranking #1 in October 2025. They boast an impressive annual growth of 14 per cent, with median values at $950,265 and $973,087, respectively. These areas have been top performers for the past six months, showing strong demand and steady growth. (Suburbs to watch: Burpengary East, Caboolture, Redcliffe, Scarborough)

- Chermside holds the #3 spot with a solid annual growth of 13.2 per cent and a median value of $1,217,426. Its consistent presence in the top 5 underscores its appeal as a sought-after residential area. (Suburbs to watch: Chermside, Aspley)

- Sunnybank and Brisbane Inner both recorded an annual growth of 13.1 per cent. Their median values stand at $1,224,606 and $906,303, respectively. These areas are consistently ranked high, thanks to their proximity to the CBD and vibrant local amenities. (Suburbs to watch: Fortitude Valley, South Brisbane, West End, Kangaroo Point)

- Nathan comes in at #6 with a median value of $1,305,782 and steady annual growth of 13.1 per cent. Its frequent appearance in the top 10 is likely due to its appealing suburban lifestyle and easy accessibility. (Suburbs to watch: Tarragindi)

- The Gap - Enoggera and Nundah both saw an annual growth of 12.9 per cent, with median values of $1,290,745 and $1,018,140, respectively. Their consistent growth over recent months highlights their attractiveness to families and professionals. (Suburbs to watch: The Gap, Keperra, Nundah, Nudgee, Boondall)