Melbourne property market news - key takeaways

- Price growth accelerates: Melbourne's home values climbed by +0.9 per cent in October, the biggest monthly increase since May 2023. Over the year, prices have risen by +3.3 per cent. Cotality's data shows the middle market experienced the strongest gains.

- Supply remains constrained: Melbourne's property market is facing a shortage of listings, with stock levels nearly 15 per cent lower than last year. This scarcity is putting upward pressure on prices.

- Auction clearance rates stable: Domain data reveals Melbourne's auction clearance rate was 63 per cent for the week of November 23, 2025. This indicates steady buyer interest despite broader market uncertainties.

- Rental market stabilises: According to SQM Research, Melbourne's vacancy rate stayed at 1.8 per cent in October. Weekly rents have increased by +2.3 per cent year-on-year, pointing to a relatively balanced rental market.

- Interest rates on hold: The Reserve Bank of Australia kept the cash rate at 3.60 per cent in November 2025, offering stability in lending conditions. This decision aids a gradual recovery in the Melbourne property market, though affordability remains a challenge.

Get a free property value estimate

Find out how much your property is worth in today’s market.

Melbourne property price movements

The Melbourne property market is on the rise, with home values climbing at their fastest rate since mid-2023. While this is a positive trend, affordability remains a challenge. The city's growth hasn't yet reached its peak levels, and the number of listings is still well below average.

Melbourne property prices - October 2025

In October, Melbourne's property prices jumped by +0.9 per cent, marking the largest monthly gain since May 2023. This increase has contributed to a +3.3 per cent rise over the year.

| Property type | Month change | Quarter change | Annual change | Current median price |

|---|---|---|---|---|

| All Melbourne dwellings | 0.9% | 1.6% | 3.3% | $818,975 |

Source: Cotality

The median value for Melbourne properties in October 2025 was $818,975, continuing its upward trend. The quarterly change was +1.6 per cent, and the annual change was +3.3 per cent. Historically, Melbourne's property market has shown resilience, although current growth remains below the record highs of previous years.

House prices in Melbourne

The Melbourne housing market saw a +0.9 per cent increase in house prices last month, leading to a +4.0 per cent rise over the past year.

| Property type | Month change | Quarter change | Annual change | Current median price |

|---|---|---|---|---|

| Melbourne houses | 0.9% | 1.6% | 4.0% | $973,994 |

Source: Cotality

The median value for Melbourne houses reached $973,994 in October 2025. The Melbourne housing market continues to be shaped by a limited supply, with listings significantly below the five-year average. This scarcity supports the upward pressure on Melbourne house prices.

Unit prices in Melbourne

Melbourne unit prices rose by +0.9 per cent in October, contributing to a +1.5 per cent increase over the past year.

| Property type | Month change | Quarter change | Annual change | Current median price |

|---|---|---|---|---|

| Melbourne units | 0.9% | 1.5% | 1.5% | $636,605 |

Source: Cotality

The median value for Melbourne units was $636,605 in October 2025. Melbourne unit prices have been steadily climbing, driven by strong demand and limited supply, which continues to fuel growth in this segment of the market.

Melbourne property market forecasts 2026

Australia’s big four banks regularly release house price forecasts to guide mortgage-lending decisions, manage risk, and demonstrate their market knowledge. Here's what they expect for 2026.

| Market | CBA forecast 2026 | Westpac forecast 2026 | NAB forecast 2026 | ANZ forecast 2026 |

|---|---|---|---|---|

| National | 4.0% | 4.0% | 4.1% | 5.8%* |

| Sydney | 3.0% | 5.0% | 4.2% | 5.3% |

| Melbourne | 2.0% | 3.5% | 3.9% | 6.2% |

| Brisbane | 5.0% | 4.5% | 4.6% | 4.3% |

| Adelaide | 5.0% | 3.0% | 4.1% | 2.5% |

| Perth | 6.0% | 4.0% | 3.7% | 4.3% |

| Hobart | 2.0% | 2.0% | 3.6% | 1.8% |

| Darwin | 5.0% | NA | 3.7% | 2.4% |

| Canberra | 3.0% | NA | 2.8% | 1.6% |

Source: Westpac Housing Pulse, NAB Residential Property Survey, CBA Economic Update, ANZ Housing Outlook.

* ANZ estimate for Capital Cities, not national

Melbourne is expected to see moderate growth compared to other major cities, with predictions pointing to a steady rise in house prices. These Melbourne property market predictions suggest a gradual increase, driven by limited supply and ongoing demand.

Melbourne home price forecasts 2026

Westpac forecasts a +3.5 per cent increase in Melbourne property prices in 2026, while NAB predicts a +3.9 per cent rise. ANZ is more optimistic, expecting a +6.2 per cent growth. These forecasts are shaped by current economic conditions, including the RBA's decision to keep the cash rate steady, which stabilises borrowing costs and supports buyer confidence. However, affordability constraints and slower population growth compared to other capitals might slow the pace of price increases.

RBA cash rate forecast 2026

The Reserve Bank of Australia (RBA) kept its cash rate unchanged at 3.60 per cent on 5 November 2025, after three 0.25-per-cent cuts earlier in the year. This decision followed a surprise uptick in inflation, with the RBA’s preferred trimmed-mean measure hitting 3.0 per cent, the top of its 2–3 per cent target band, and headline CPI running at 3.5 per cent annually, leaving no room for another rate cut in 2025. Major bank economists initially expected a November cut but changed their predictions when inflation figures rose, correctly anticipating the RBA would hold steady.

Here’s where the major banks see the cash rate heading next:

- Commonwealth Bank (CBA): Expects no further cash rate cuts in this cycle, keeping the rate at 3.60 per cent into 2026.

- Westpac: Also sees no cuts for the rest of 2025, but forecasts a 0.25-per-cent cut in May 2026 and another in August 2026, bringing the cash rate down to 3.10 per cent by late next year.

- National Australia Bank (NAB): Predicts no additional 2025 cuts, with one 25-basis-point cut in May 2026, lowering the cash rate to 3.35 per cent by mid-2026.

- ANZ: Similarly anticipates no more cuts in 2025, with the next move a 0.25-per-cent cut in February 2026, taking the cash rate to 3.35 per cent at the start of 2026.

What this means for the Melbourne market

Melbourne’s recovery has been slower, with values up just over +3 per cent year-on-year and still below their peak. The rate pause has helped stabilise sentiment and prompted a return to monthly price gains, but growth is likely to remain limited. Affordability remains tight, and Melbourne’s post-pandemic population increase has been softer than in other capitals. The hold should keep the market on a gradual upward track but isn’t a strong growth trigger on its own.

Melbourne house prices graphs and charts

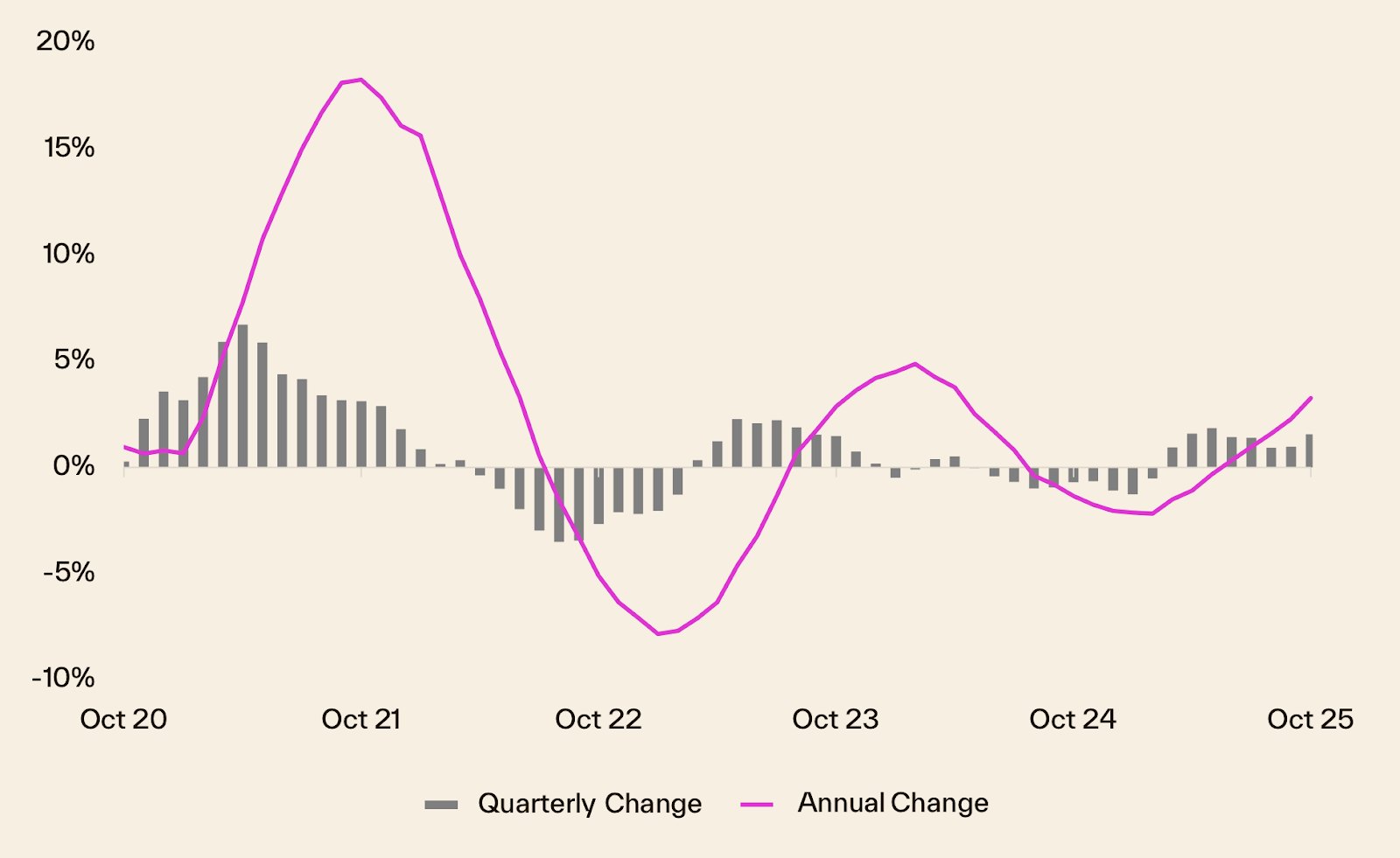

Melbourne house price growth over the last 5 years has been a rollercoaster, shaped by various economic influences. As of October 2025, Melbourne's dwelling values rose by +0.9 per cent for the month, +1.6 per cent over the quarter, and are +3.3 per cent higher than a year ago. Despite these gains, prices are still slightly below their peak in early 2022.

The five-year chart shows that Melbourne's market took a hit during the COVID-19 pandemic, with a noticeable correction after a rise in 2021. According to Cotality’s analysis, the city's extended lockdowns and population decline during the pandemic resulted in a more subdued market compared to other capitals.

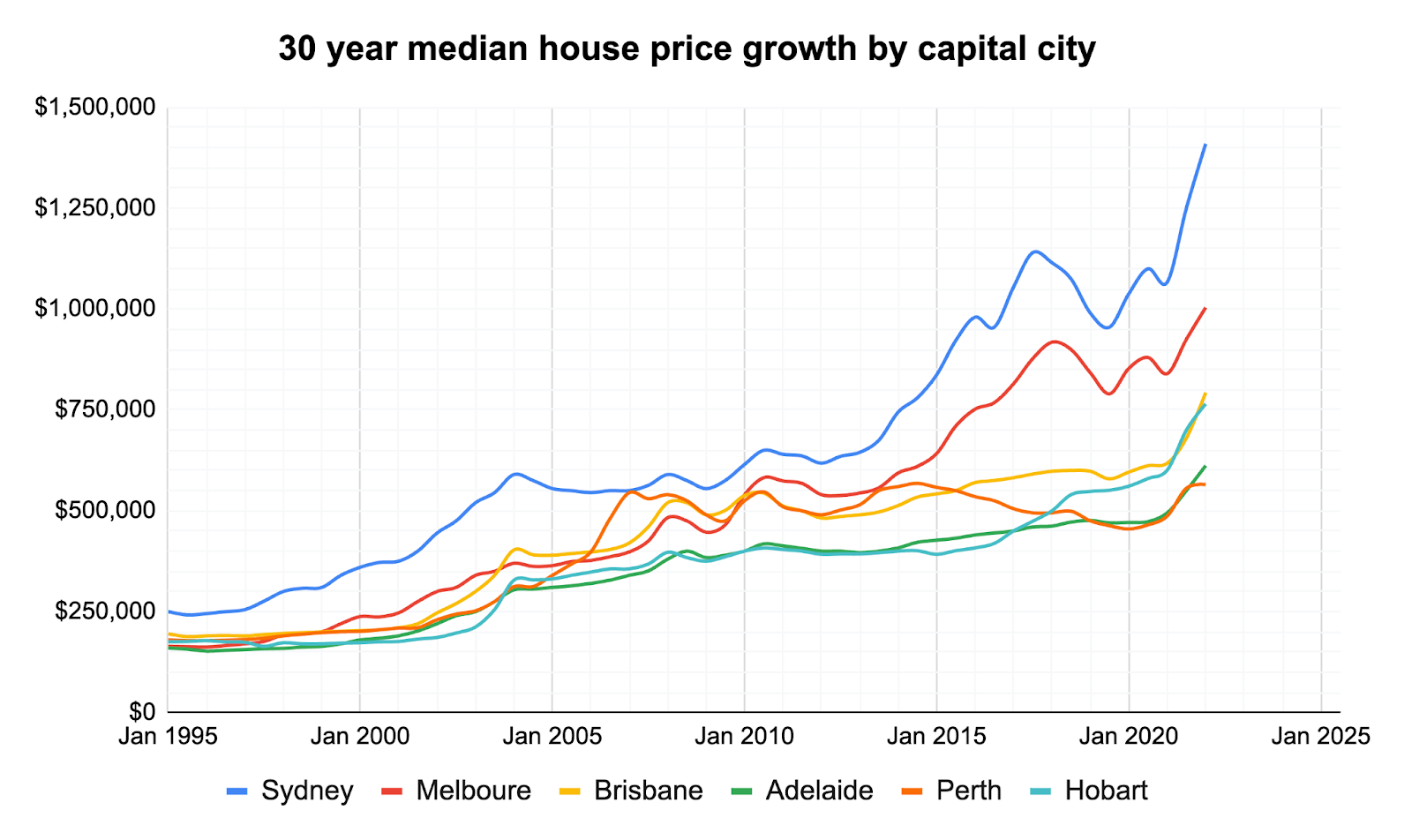

Melbourne property prices graph over 30 years

Melbourne property growth over the last 10 years has been marked by periods of rapid growth and subsequent corrections. The city saw a significant boom in 2020-2021, fuelled by low interest rates and government incentives, followed by a correction in 2022 as interest rates climbed. This mirrors past cycles where Melbourne's property market has shown resilience and a tendency to bounce back over time.

Over the past 30 years, Melbourne's property market has experienced several booms and busts, but the long-term trend has been upward. Homeowners today are cautiously optimistic, as inflation is easing and interest rates are stabilising. History suggests that while short-term fluctuations are inevitable, the overall trajectory remains positive, bolstered by strong population growth and economic fundamentals.

Melbourne selling statistics

Melbourne's property market in November 2025 is showing resilience, with sales volumes on the rise compared to last year. The market is competitive, with properties selling quickly and vendor discounts shrinking, indicating strong buyer interest.

Melbourne sales volume and days on market

In October 2025, Melbourne saw an +8.8 per cent rise in sales volumes from the previous year. Properties in Melbourne had a median of 30 days on the market, a slight improvement from 31 days in October 2024.

| Melbourne sales volume | Melbourne days on market |

|---|---|

| 8.8% Change from 12mo ago | 30 days 31 days 12 mo ago |

Source: Cotality

This uptick in sales volumes and reduced days on market highlight strong demand in Melbourne's property market. Compared to other capitals, Melbourne is performing well, with properties selling faster than the national average of 29 days. This suggests active buyer engagement, possibly driven by favourable economic conditions or attractive property prices.

Melbourne new and total listings

Melbourne experienced a +9.2 per cent increase in new listings from October 2024 to October 2025, while total listings fell by -12.5 per cent.

| Melbourne new listings | Melbourne total listings |

|---|---|

| 9.2% Change from 12mo ago | -12.5% Change from 12mo ago |

Source: Cotality

The rise in new listings indicates more sellers are entering the market, likely to take advantage of strong buyer demand. However, the drop in total listings shows that properties are being snapped up quickly, maintaining a competitive market. This trend aligns with the national decrease in total listings, reflecting high buyer activity across the country.

Melbourne vendor discount and auction clearance rates

Vendor discounting measures the gap between the original asking price and the final sale price, while auction clearance rates show the percentage of scheduled auctions that sell under the hammer or shortly after. Together, they reveal buyer negotiating power and seller confidence.

Melbourne vendor discount

| Oct 2025 | Sep 2025 | Aug 2025 | Jul 2025 | |

|---|---|---|---|---|

| Melbourne median vendor discount | -2.8% | -3.0% | -3.1% | -3.2% |

Source: Cotality

Melbourne's vendor discount rate over the past three months was -2.8 per cent, a slight tightening compared to the national median of -3.1 per cent. This reduction suggests sellers are getting closer to their asking prices, reflecting strong demand and limited supply.

Melbourne auction clearance rates

| Melbourne | November 23 | November 16 | November 9 | November 2 |

|---|---|---|---|---|

| Clearance Rate | 63% | 63% | 63% | 67% |

| Auctions Scheduled | 1597 | 1316 | 1505 | 1356 |

| Auctions Reported | 1364 | 1142 | 1263 | 1175 |

| Sold | 860 | 722 | 791 | 786 |

| Withdrawn | 115 | 125 | 117 | 85 |

| Passed in | 389 | 295 | 355 | 304 |

Source: Domain

In November 2025, Melbourne's auction clearance rates were stable, ranging from 63 to 67 per cent. These figures indicate a healthy auction market, with most properties selling successfully under the hammer. The consistent clearance rates suggest buyers are confident and willing to compete for available properties, keeping the market dynamic and active.

Get a deeper insight into how Melbourne sellers are faring in 2025 and what could be on the horizon for the year ahead with some of our latest articles.

Melbourne property investing

Melbourne's rental market is currently experiencing a period of stability, with signs of easing pressures after previous surges. This section will delve into the specifics of rental rates, yields, and vacancy trends to provide a comprehensive view of the current market conditions in Melbourne.

Melbourne rental market

Rental rates in Melbourne have seen a slight increase over the past year, indicating a more balanced market compared to other capitals. The city's rental yields remain steady, showing a consistent relationship between property values and rental income. Below, you will find detailed metrics on rental rates, yields, and annual changes in rents for both houses and units.

| Location | Rental rates | Rental yield | Annual change in rents, houses | Annual change in rents, units |

|---|---|---|---|---|

| National | 4.6% | 3.60% | NA | NA |

| Combined Capitals | 4.0% | 3.40% | NA | NA |

| Combined Regional | 6.1% | 4.30% | NA | NA |

| Sydney | 4.0% | 3.00% | 3.40% | 5.00% |

| Melbourne | 1.8% | 3.60% | 1.60% | 2.20% |

| Brisbane | 5.8% | 3.50% | 5.60% | 6.50% |

| Adelaide | 3.6% | 3.60% | 3.70% | 3.10% |

| Perth | 5.8% | 4.00% | 5.70% | 6.90% |

| Hobart | 6.9% | 4.40% | 6.80% | 7.70% |

| Darwin | 8.5% | 6.40% | 7.60% | 10.00% |

| Canberra | 2.9% | 4.00% | 2.80% | 3.40% |

Source: Cotality

Despite the increase in rental rates, Melbourne's market remains tight. The annual change in rents for houses is +1.6 per cent, while units have seen a +2.2 per cent increase. This reflects stable demand, with the rental yield holding at 3.6 per cent. The city's vacancy rate has remained at 1.8 per cent, suggesting that while there is more stock available than a year ago, the market is still not fully balanced.

Melbourne vacancy rates

Vacancy rates are crucial for understanding the balance between supply and demand in the rental market. They indicate how easily tenants can find properties and negotiate rents. Nationally, vacancy rates have shown some easing, but most capitals, including Melbourne, remain tight. This indicates a market where demand is still strong, and supply is not keeping pace.

| Location | Oct 2025 vacancy rates | Oct 2025 vacancies | Oct 2024 vacancy rates | Oct 2024 vacancies |

|---|---|---|---|---|

| National | 1.20% | 36152 | 1.20% | 36486 |

| Sydney | 1.30% | 9553 | 1.50% | 10874 |

| Melbourne | 1.80% | 9713 | 1.70% | 9052 |

| Brisbane | 1.00% | 3391 | 1.00% | 3580 |

| Adelaide | 0.80% | 1215 | 0.60% | 915 |

| Perth | 0.70% | 1304 | 0.50% | 998 |

| Hobart | 0.40% | 107 | 0.60% | 179 |

| Darwin | 0.70% | 181 | 1.40% | 349 |

| Canberra | 1.40% | 860 | 1.70% | 1059 |

Source: SQM Research

In Melbourne, the vacancy rate has held steady at 1.8 per cent, which is slightly below the level typically associated with a balanced market. This stability suggests that while there is more stock than a year ago, the market remains tight. Without a significant increase in new rental constructions or investor activity, rents are likely to remain steady rather than fall.

Louis Christopher, Managing Director of SQM Research said in his latest rental market report

“The national vacancy rate holding at 1.2% suggests the rental market remains very tight, with little sign of meaningful supply increases. While some capitals are showing temporary easing in rent growth, underlying conditions remain undersupplied, particularly in cities such as Perth, Adelaide, and Hobart. Brisbane continues to attract strong demand from interstate migration, while Melbourne and Canberra appear to be stabilising following recent surges in new rental listings. Overall, we expect rental conditions to remain tight through the summer months, with only a modest increase in vacancies likely in early 2026.”

Melbourne appears to be stabilising after earlier surges in new rental listings, and the vacancy data supports that view, with the rate holding at 1.8 per cent between September and October 2025. Vacancies have increased from 9,052 in October 2024 to 9,713 in October 2025, indicating more stock than a year ago but no fresh wave of supply in recent months.

At 1.8 per cent, Melbourne’s vacancy rate is still below the level generally associated with a comfortably balanced market, so conditions remain relatively tight even with the extra stock on offer. Unless there is another step-up in new rental construction or investor activity, this stabilisation is more likely to translate into steady rather than falling rents over the coming quarters.

Highest growth areas in Melbourne

| Rank | SA3 Name | SA4 Name | Median Value | Annual % Change |

|---|---|---|---|---|

| 1 | Frankston | Mornington Peninsula | $832,769 | 11.7% |

| 2 | Brimbank | West | $719,099 | 8.9% |

| 3 | Tullamarine - Broadmeadows | North West | $724,420 | 8.0% |

| 4 | Knox | Outer East | $985,290 | 7.7% |

| 5 | Dandenong | Outer South East | $793,467 | 7.0% |

| 6 | Kingston | Inner South | $1,065,054 | 6.2% |

| 7 | Cardinia | South East | $777,291 | 6.0% |

| 8 | Keilor | North West | $1,025,062 | 6.0% |

| 9 | Whittlesea - Wallan | North East | $767,997 | 5.8% |

| 10 | Monash | South East | $1,254,041 | 5.4% |

Source: Cotality

Highlights for Melbourne’s high growth areas

- Frankston is leading the pack, holding the top spot in October 2025. With a median value of $832,769, it boasts an impressive annual growth of +11.7 per cent. The area's coastal lifestyle and ongoing infrastructure projects, like the Frankston Hospital redevelopment, are key drivers of demand. (Suburbs to watch: Seaford, Frankston, Frankston South, Frankston North, Carrum Downs, Langwarrin, Skye)

- Brimbank takes the #2 spot in October 2025, maintaining its strong presence with a median value of $719,099 and annual growth of +8.8 per cent. Improvements in accessibility, such as the new Metro Tunnel, are likely contributing to its consistent growth. (Suburbs to watch: Deer Park, Taylors Lakes, Keilor Downs, St Albans, Sydenham)

- Tullamarine - Broadmeadows ranks #3, showing annual growth of +8 per cent and a median house value of $724,420. Its proximity to Melbourne Airport and planned infrastructure projects like the Melbourne Airport Rail link are attracting first-home buyers and investors. (Suburbs to watch: Craigieburn, Mickleham, Kalkallo)

- Knox and Dandenong both recorded annual growth of +7.1 per cent, with median values of $985,290 and $793,467, respectively. These areas have shown steady growth, driven by their well-connected locations and ongoing revitalisation projects. (Suburbs to watch: The Basin, Bayswater, Ferntree Gully, Rowville, Noble Park, Dandenong North, Dandenong, Springvale)

- Kingston is ranked #6 with a median value of $1,065,054 and annual growth of +6.2 per cent. Its desirable bayside location and recent transport upgrades continue to make it a sought-after area for buyers. (Suburbs to watch: Cheltenham)