Are property prices back at 2017 boom levels?

There’s no denying that the Australian property market is in the midst of a property boom, as both national property prices and consumer confidence continue to rise.

It’s been three and a half years since the peak of the last housing boom in 2017 — and here we are again. Interest rates are low, home lending is at record highs, and housing markets are heating up.

Over February, national house prices increased by 2.1 per cent off the back of an upward trend that shows no signs of slowing down. It’s got us all thinking — have national home values soared past the 2017 boom? And if they haven’t already, are they on track to?

According to the February figures in CoreLogic’s latest Hedonic Home Value Index, some capitals around the country have already surpassed their 2017 peaks.

In some capital cities, the pace of growth is advancing quite aggressively — with CoreLogic releasing figures on the 11th of March showing that Sydney property values had grown by 1 per cent in the first ten days of March, recovering beyond their earlier 2017 peak.

Why were property prices so high in 2017?

2017 was an interesting year in Australian real estate with the first half of the year posting incredible growth before softening towards the end of the year.

Low interest rates, strong demand from domestic and foreign investors, population increases and lower supply were the primary drivers for the price hikes in the first half of the year.

The CoreLogic Hedonic home Value Index for March 2017 reports that property prices in Sydney had an annual rise of 18.4 per cent and 15.9 per cent in Melbourne.

After property prices peaked around August/September, they started to ease due to affordability constraints and tighter lending policies from APRA which aimed to cool the hot property market. Interest rates increased which drove a downturn in consumer sentiment towards housing.

How is the 2017 boom different to the one we’re experiencing now?

1. The 2017 boom was investor driven

The 2017 property boom was largely driven by strong demand from domestic and international investors.

Australian Bureau of Statistics (ABS) data shows that over the year to January 2017, investor lending grew 27.5 per cent compared to 1.9 per cent for owner-occupiers.

In contrast, the property boom in 2021 has been supported by first home buyers and other owner-occupiers due to strong government support and schemes such as the First Home Loan Deposit Scheme (FHLDS) and HomeBuilder as well as stamp duty concessions combined with record low interest rates.

The latest ABS lending indicators data for January 2021 shows that the value of loans for owner-occupiers grew 52.3 per cent compared to a lower 22.7 per cent for investors.

2. APRA introduced measures to cool the property market

In March 2017, the Australian Prudential Regulation Authority (APRA) clamped down on interest-only loans in order to cool the hot property market. This would limit the number of loans to investors and thus pull back demand.

In contrast, in 2021, as house prices increase at the fastest pace since 2003, APRA are yet to intervene. While all categories of higher-risk lending are on the increase, they are still below the levels that would concern the macroprudential authority to step in and take action.

Buyers and sellers — how do you know if it’s time to pounce?

Whether you’re choosing to buy or sell, it’s essential to understand what’s happening in your local market.

Australia doesn’t have ‘one’ property market, and performance will differ from suburb to suburb and across different property types.

As a general rule of thumb, if prices are soaring rapidly in your area, you’re in a sellers market, where demand is most likely outstripping supply. Selling in a market like this can be advantageous, given that there is strong competition between buyers for property.

If prices are dropping or remain stagnant, this is more likely to be a buyer’s market, where supply is greater than demand.

In any case, it’s important to do your market research. Attend auctions, keep an eye on new listings and recently sold properties, and start talking to local agents. This will give you the best chance of knowing whether it’s the right time for you to take the leap.

What might happen to property prices?

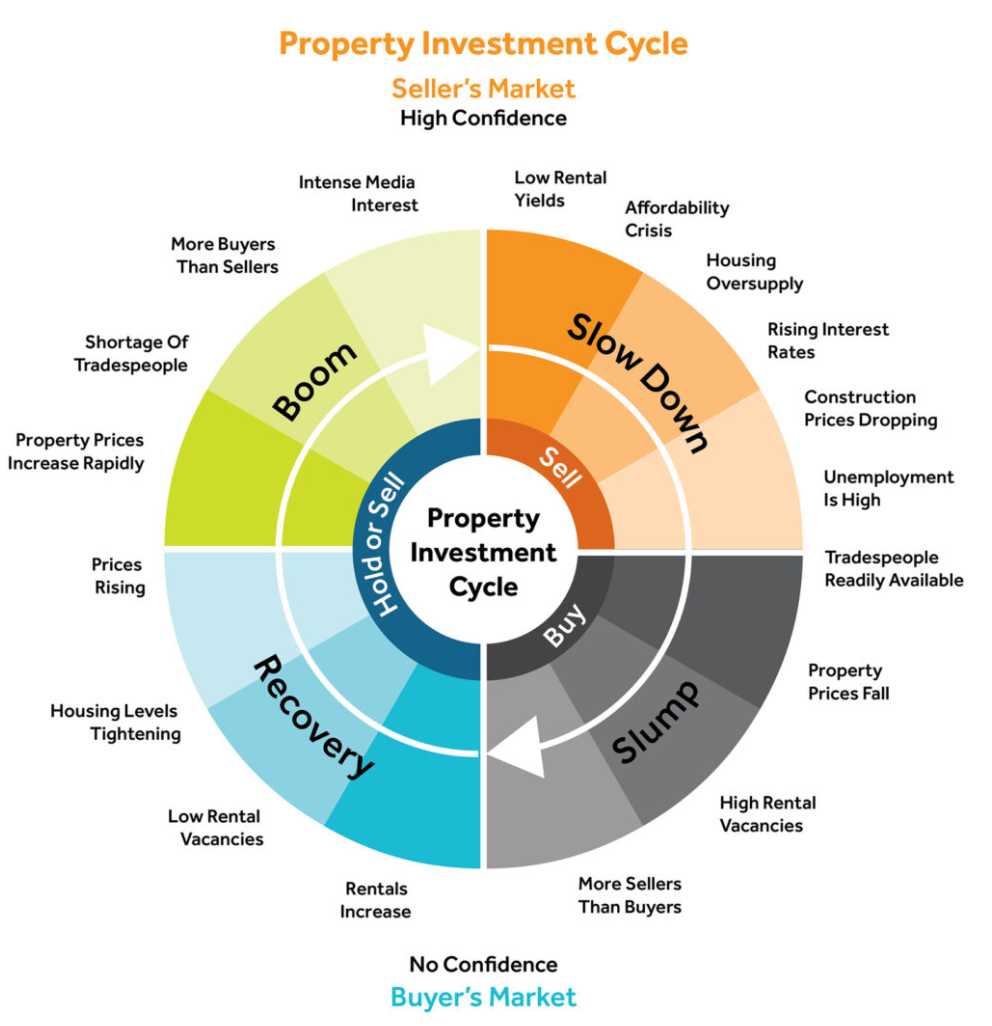

While we are currently in the “boom” period of the property lifecycle, conditions are currently favouring sellers as there are more buyers than there are properties available. This is leading to a sharp increase in property prices, which economists have forecasted to continue into 2022.

As prices continue to rise, there will eventually be a slowdown, once the market hits an “affordability crisis.” While there is a general consensus that affordability is already an issue, we are not yet at a level where APRA is willing to step in.

With prices surging at the current rate, it’s expected that we’ll eventually hit a peak where 1) buyers are priced out, resulting in an eventual oversupply of stock and 2) APRA will intervene to tighten lending standards and the RBA will lift interest rates.

This month JobKeeper stimulus will come to an end. All eyes will be on the property market, waiting to see if the withdrawal of this stimulus will have an effect on listing levels in the market.