October brings more growth but headwinds are blowing

Recently it's felt a bit like the property market has switched into cruise control, as October delivered national growth of +1.5 per cent for the third consecutive month, according to CoreLogic's latest data.

That statistic doesn't tell the full picture, though, as we're now seeing different cities and states pulling further out in different directions—some ahead, others behind.

With annual growth now sitting at an astonishing +21.6 per cent across Australia, how will 2021 close out and what's on the cards for the new year?

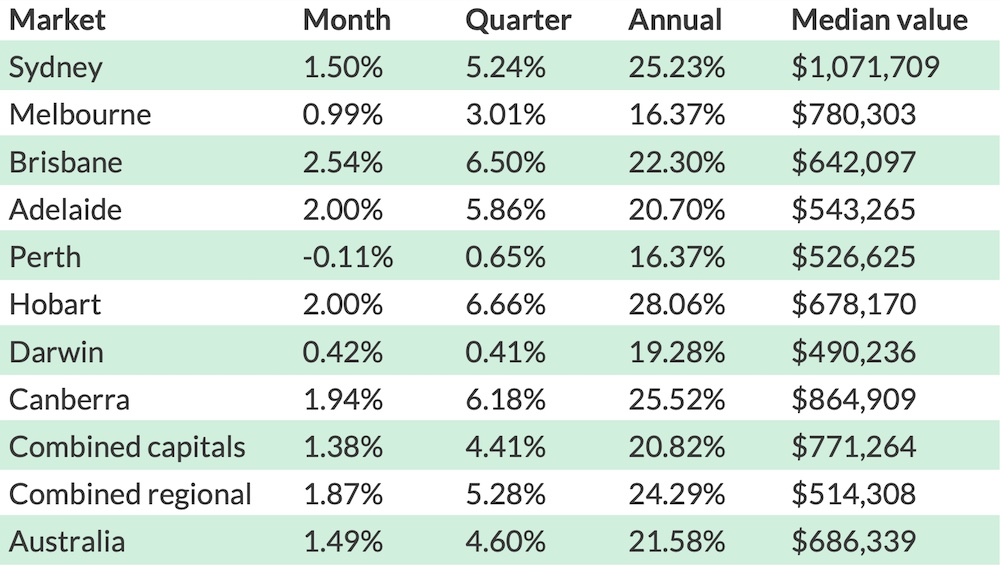

National property values: October 2021

| Houses | Units |

|---|---|

| $733,533 | $593,430 |

| Monthly change: +1.6% | Monthly change: +1.2% |

October's +1.5 per cent national rise brings Australia's median home price to $686,399, a jump of around $12,000 since September.

Looking deeper into CoreLogic's numbers for the month shows that there's been more variation between markets this time around.

Brisbane has shot ahead to achieve the biggest gains in October, up more than +2.5 per cent, while Adelaide and Hobart have also powered along with +2.0 per cent gains.

Canberra and Sydney have both eased off slightly, while Melbourne remains steady at +1.0 per cent and Perth's one-surging gains have fallen into the negative.

The regional markets saw more consistent growth in October, with regional NSW and Victoria both substantially outperforming their capital city counterparts.

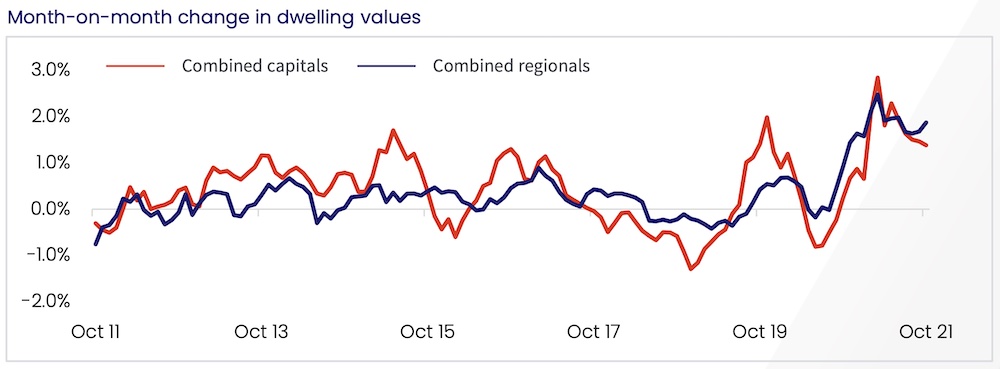

Overall there's been a gentle yet clear dip down from the peak of the boom back in March, although this month's data shows a small jump back up for regional Australia while the capitals continue to slow down on the whole.

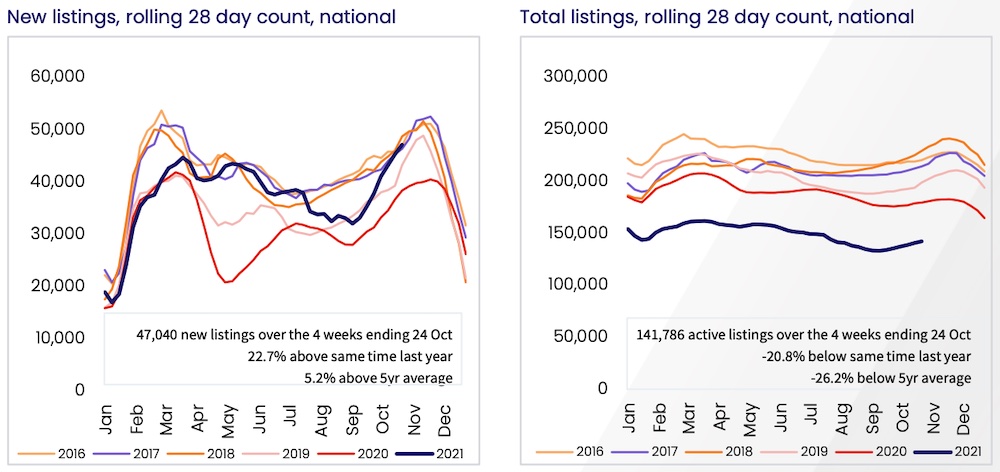

Spring listings are rising fast, but total stock remains well down

Many have been wondering just when market supply will finally match buyer demand again, and the long-awaited surge of new listings coming to the market this spring could be the beginning of the answer.

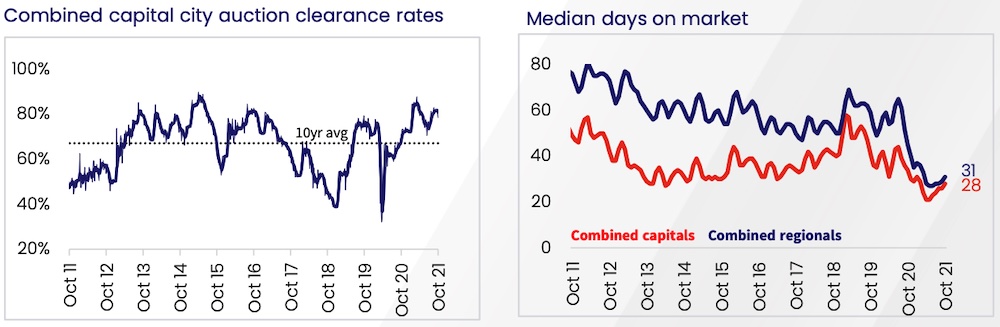

CoreLogic's report notes that the "persistently low levels of housing inventory" have created an extended period of "extremely strong selling conditions," and that's evident in the high auction clearance rates and minimal days on market being seen at present.

Those dynamics may finally be about to wind back, though. Mr Lawless explains that "more listings mean more choice for buyers and less urgency in their purchasing decisions."

He adds that, while FOMO will remain as long as total stock is low, it's likely that "advertised supply will rise further through spring and early summer which, due to worsening housing affordability and a subtle tightening in credit availability, may not be met by a commensurate lift in demand."

Affordability constraints are changing buyer behaviours

Affordability has become one of the hottest topics in Australian property as a result of this year's boom, and it's only getting more pressing.

CoreLogic's research director Tim Lawless explains that "housing prices continue to outpace wages by a ratio of about 12:1. This is one of the reasons why first home buyers are becoming a progressively smaller component of housing demand."

That stunning statistic is part of the reason Mr Lawless expects to see a shift towards units as buyers adjust their goalposts.

"As housing becomes less affordable, we expect to see more demand deflected towards the higher density sectors of the market, especially in Sydney where the gap between the median house and unit value is now close to $500,000," he says.

He also points out that, with international borders now opening, it's likely investor activity will continue to rise, a move that would further help struggling inner-city unit precincts.

APRA may further restrict lending and interest rates tipped to rise early

The new lending restrictions announced by APRA have come into effect this month, and although it's reduced buyers' maximum borrowing power by only a small amount, there's been a lot of talk about whether it's only the first step they'll take to cool the market.

CoreLogic's report suggests they don't expect the new changes to "have a remarkable impact on mortgage demand or housing activity," they do say that additional credit restrictions could be on the cards for next year.

BuyersBuyers co-founder Pete Wargent predicts the next move could be more heavy-handed, targeting high debt to income borrowing which would have a major impact on curbing growth.

"It could reduce borrowing capacity by 10 or 20 per cent," he says.

The Reserve Bank of Australia has also conceded that it may lift interest rates sooner than 2024 after many months of sticking to that message.

Rising from the current record-low cash rate of 0.1 per cent isn't going to set the market into reverse overnight, but it's a sign that the days of ultra-cheap mortgages may be on the way out and so might the frenzied rush to take advantage of them.

What's next for the Australian property market?

While growth has been coasting along around the +1.5 per cent mark on a monthly national level, there are a number of factors that CoreLogic says point to the market being on track to cool off in the coming months.

Among those factors are an influx of listings, worsening affordability and tighter credit conditions which they say are likely to diminish buyer demand.

Although talk of interest rates rising sooner than expected won't have an immediate impact on mortgages, it may also dampen buyer sentiment.

Pete Wargent says that "demand can outstrip supply for a period, but eventually always comes back in.

"Buyers get a bit wary about overpaying as prices go up and more vendors come into the market looking to lock in their gains, so eventually, it will balance out."

In the short-term, though, CoreLogic forecasts further price growth, just at a slower rate than we've seen so far in 2021.

Ultimately, if you're considering selling or buying, it's important to get a clearer, more localised picture of what's happening in your particular market.

Speaking to a top agent with a thorough understanding of the market you're in will go a long way to helping you navigate your property decisions.