Regional market prices soar up to $254,000 in the pandemic - but will it last?

Sea and tree changes have been among the biggest real estate trends since Covid first hit Australia, setting off an astonishing regional property boom all across the country.

The median home price in NSW's Richmond-Tweed region, home to coastal destinations like Byron Bay, has shot up more than $254,000 in 18 months, and that's far from an isolated case.

With the vaccine rollout steaming ahead and some version of normal life due to return, though, will that mean the end of the regional property boom?

Which regions have come out on top so far?

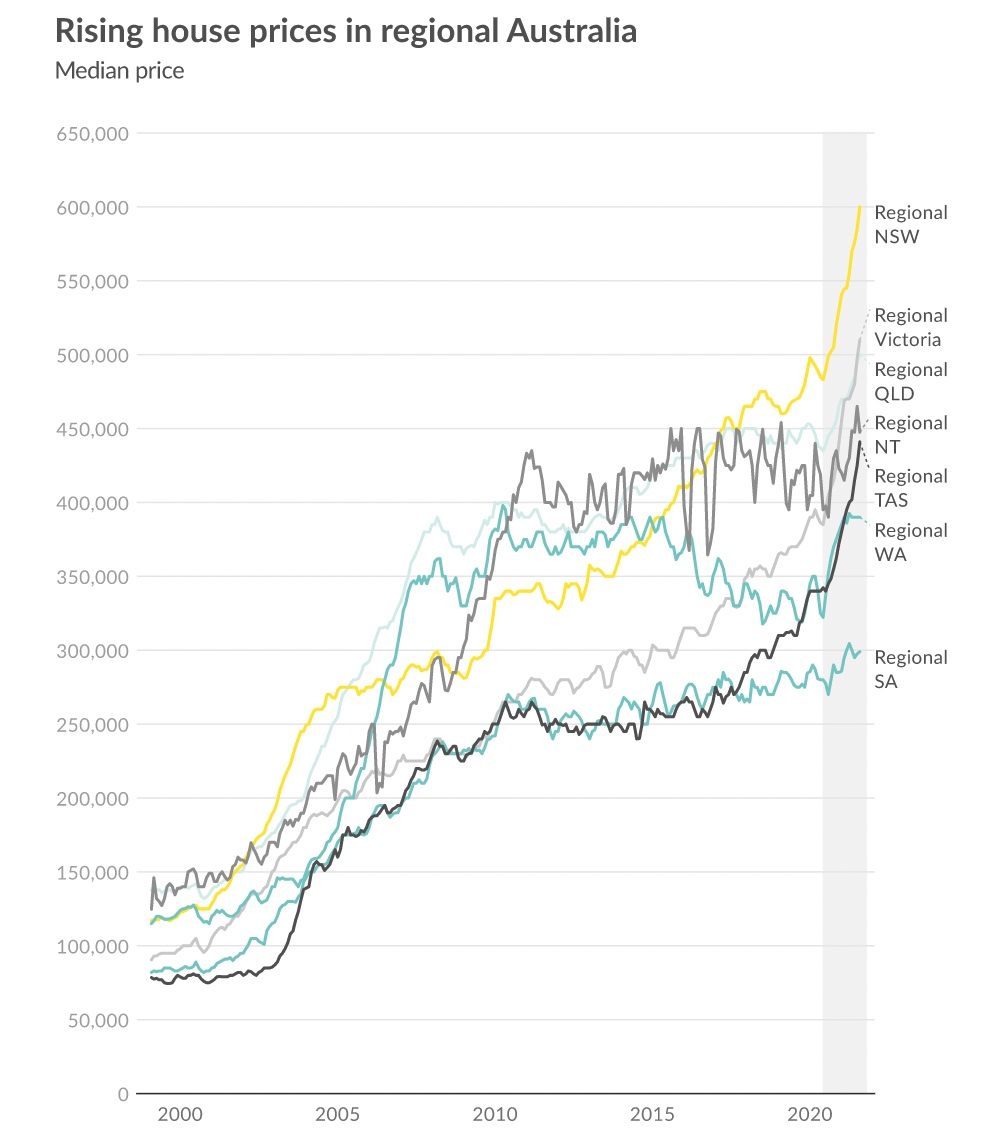

According to numbers sourced by Ray White Now and CoreLogic, property prices in Australia's regional markets have gone up more in the past 18 months than they had in nearly seven years.

That's been driven by factors like a 'race for space' as people look for a lifestyle change during the pandemic and demand for second homes in lieu of overseas travel.

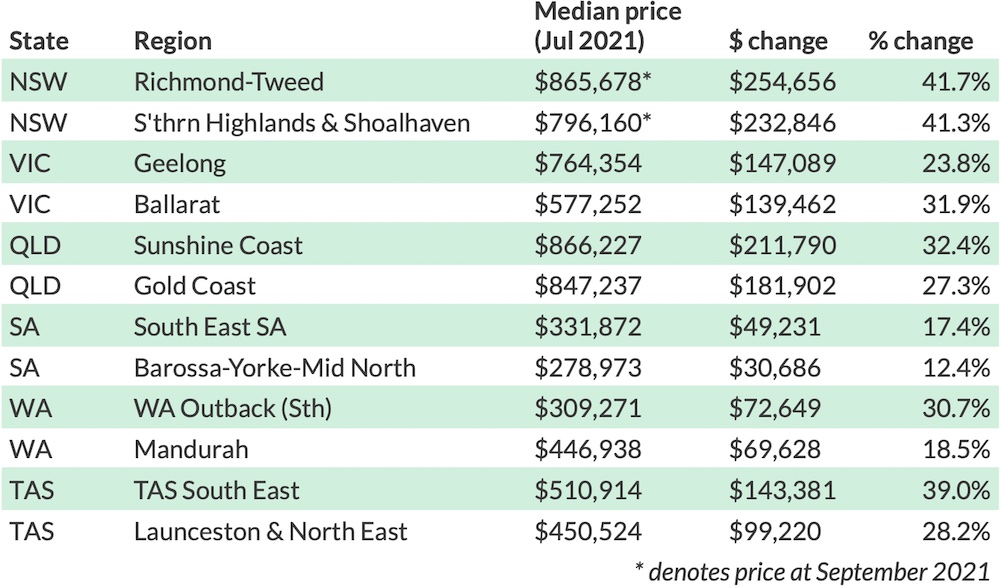

In terms of the top growth markets since March 2020, Richmond-Tweed on the NSW north coast has set an unbeatable pace, with the median home price up $254,656 to $865,678.

The Southern Highlands & Shoalhaven and Illawarra regions in NSW as well as the Sunshine Coast in Queensland have also gained well over $200,000 apiece.

Geelong and Ballarat in Victoria, the Gold Coast in Queensland and Tasmania's South East were among the regions bursting through the $100,000 gains mark.

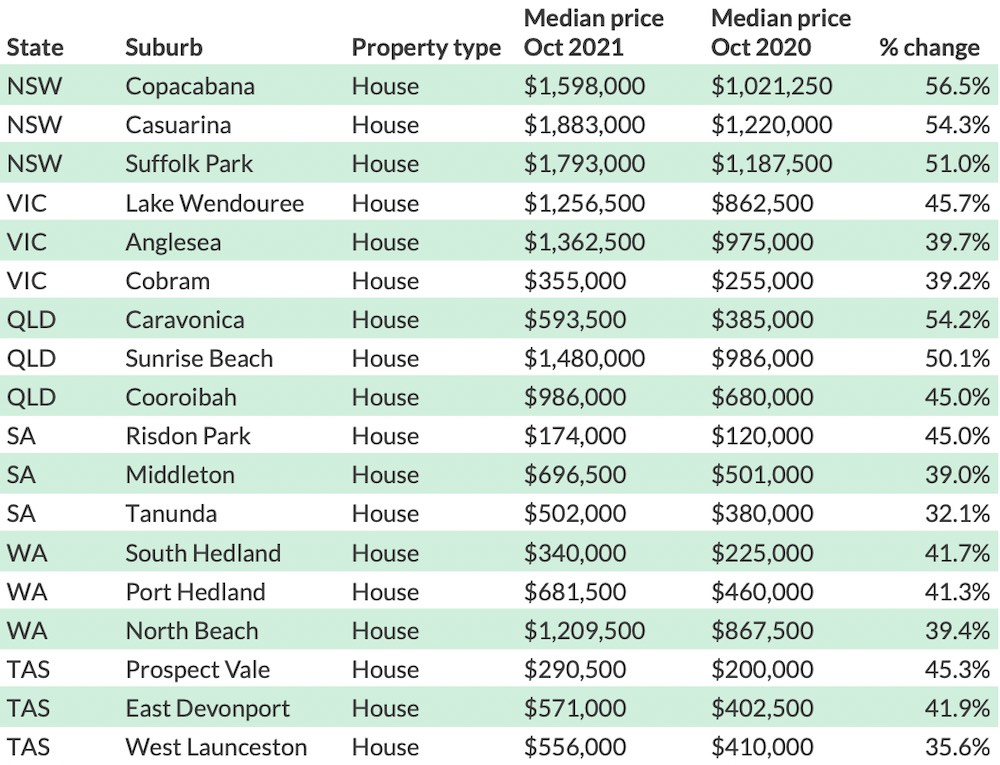

Looking down at the regional suburb level, a number of locations have seen eye-watering growth of more than +50 per cent in the past 12 months alone.

Copacabana on the NSW Central Coast, Sunrise Beach on Queensland's Sunshine Coast and Lake Wendouree in Ballarat, Victoria were among the suburbs that made staggering leaps in median house prices over the last year.

SA, WA and Tasmania also have their fair share of heavy hitters that have delivered annual price increases well above +40 per cent.

This year's lockdowns have propelled the regions even further

Australia's first lockdowns in 2020 kickstarted the trend we've seen of people moving out of densely populated capital cities to find more space and get better bang-for-buck in the typically more affordable regions.

There had been questions around whether that trend would wind down once CBDs kicked back into gear, but the latest round of lockdowns seem to have cemented the new age of remote working and people prioritising lifestyle in where they live.

Cameron Kusher, director of economic research at realestate.com.au, says that "Covid has driven the big push for people to look for properties in regional Australia.

"The demand for outer capital city and regional property is the highest it’s ever been."

He explains that REA is seeing significantly higher volumes of searches for properties with three or more bedrooms as well as houses over units.

That's all led to regional markets on average outpacing capital city gains over the past 12 months, even though cities like Sydney, Brisbane, Canberra and Hobart have seen explosive price growth.

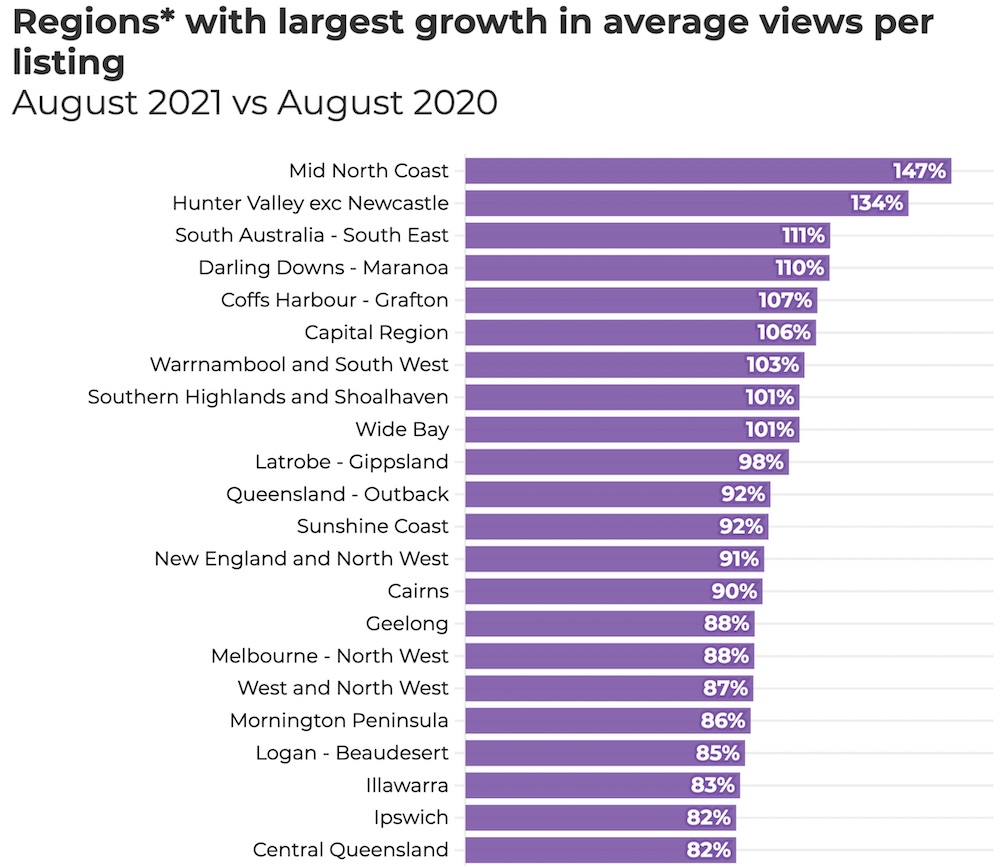

Mr Kusher notes that, while "in-vogue" destinations like Byron Bay and the Gold Coast have drawn plenty of buyers, people are now also casting a wider net.

"Initially it was areas pretty close to the capital cities and now we’re starting to see some of the demand move into areas a little bit further afield," he says.

"They’re places where you probably can't commute back to the office in the capital city if you were living there."

Will the regional boom continue?

With lockdowns due to end and vaccination rates rising rapidly across the country, it's likely some significant changes are on the horizon.

Cities will begin to open up again and the international border will soften at some point, allowing overseas students and migrants to once again flow into the country.

These factors will favour growth in the capitals, but does that mean growth will grind to a halt in the regions or can it carry on?

QBE's latest Australian Housing Outlook 2021-2024 report broadly forecasts prices will continue to rise in the regions, though generally at a slower rate than in their respective capital cities.

They flag the Gold Coast and Sunshine Coast as some of the areas that should still see strong price increases into next year as interstate migration to Queensland remains high.

They also tip values in NSW's Newcastle and the Illawarra regions to grow by around +7 per cent in 2021/22, while they say Geelong in Victoria should gain another +19 per cent by 2024.

Overall, though, it seems that the historic rates of growth seen over the past 18 months are likely to ease along with the Australian property market as a whole.

For those considering selling in a regional market, it looks like the bulk of the gains we've seen throughout the pandemic are now behind us.