The lowest risk suburb picks for property investors

At a time when so many parts of the Australian property market are heating up, it can be difficult to know where to find value.

BuyersBuyers.com.au have released exclusive research via Riskwise Property Research which identifies the lowest risk suburbs for investors.

They are currently finding houses to be, on average, considered to be lower-risk investments than units.

The suburbs below, which cover both capital city and regional markets, are some examples of suburbs where BuyersBuyers.com.au are in the process of assisting investors to buy detached houses.

They've been selected based on factors like low risk of imminent oversupply from overbuilding, proven track records and capital growth potential, and low median prices within their respective price brackets.

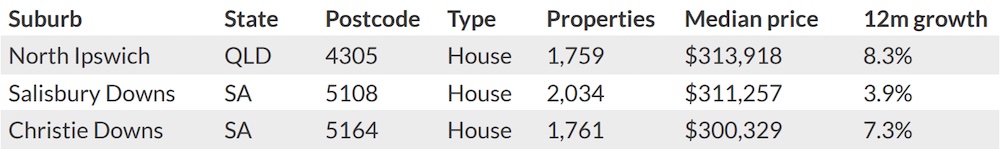

Under $500,000 budget

Speaking about North Ipswich, BuyersBuyers.com.au co-founder Pete Wargent says "south-east Queensland is benefitting from the highest net interstate migration in 15 years, with more than 30,000 people per annum moving to Queensland, largely from Victoria and Queensland.

"New arrivals often seek family-appropriate housing in relatively affordable locations and Ipswich is a popular choice."

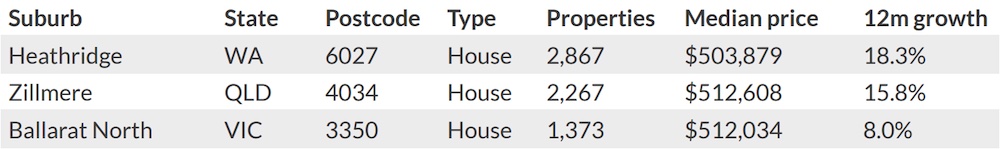

$500,000 to $750,000 budget

Some of the top picks look to be in the Sunshine State, which has seen some big movements over the past six months.

"Brisbane's detached housing market has been hot this year," explains Mr Wargent.

"Zillmere is a suburb with strong transport links for the city where relatively affordable options for detached housing still exist."

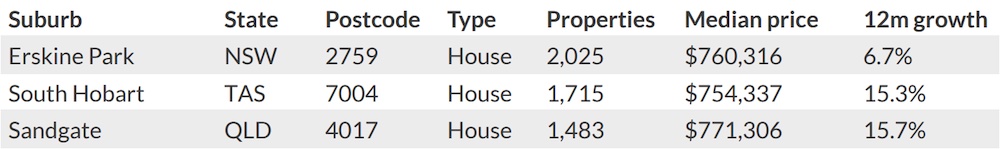

$750,000 to $1m budget

Moving up into the next price bracket, Mr Wargent again notes the recent strength of houses in Brisbane.

"Sandgate is another suburb with strong transport links for the city where relatively affordable options for detached housing still exist," he says.

"Although located some distance from the CBD, Sandgate has train links and a strong suburb character in its own right."

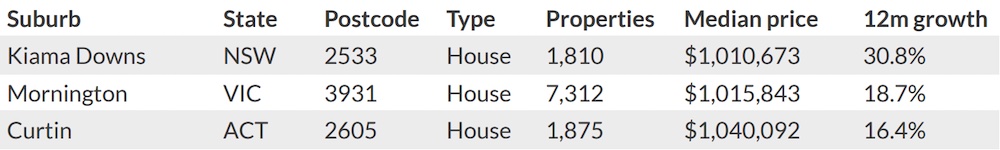

$1m+ budget

Looking down to Mornington in Victoria, Mr Wargent says "demand for property on the peninsula has never been higher and rents and prices are surging.

"There has generally been a shift away from CBD apartments towards lifestyle locations over the past year, and Mornington has been a prime beneficiary.

"Stock levels are very tight at present, so buyer's agent assistance to find off-market or pre-market stock is advised."

Other considerations

Of course, the report says, even within suburbs there are superior locations and streets to avoid, such as busy main roads, blocks with a poor outlook or aspect, or low-lying areas at risk of flooding, for example.

And whenever you buy a property as an investment it’s important to undertake a full due diligence.

Strategic market expertise and local knowledge matters, and the BuyersBuyers.com.au national panel of buyer’s agents can help you to buy the right property at the right price every time.

For more information on BuyersBuyers.com.au and how they can help property investors sourcing their ideal property, see here.