VIC market set to rise after easing restrictions in spring

Victoria is once again doing it tough as the latest lockdown enters its second month, but so far not much has hampered property price growth in the state.

On its ongoing creep towards the $1 million mark, Melbourne's median house price has jumped up by more than $154,000 in 2021 alone, or close to $4,500 per week, according to CoreLogic's latest home value index.

Houses in regional Victoria have soared even higher proportionally. The median regional house has grown in value by +15.9 per cent this year—a bump of around $91,000—and units are even stronger at +17.3 per cent.

Let's look into the current state of the market.

Melbourne market update

| Houses | Units |

|---|---|

| $954,496 | $615,909 |

| Monthly change: +1.4% | Monthly change: +0.5% |

Melbourne's median property value now stands at $769,968, a bump of +1.2 per cent throughout August.

While Melbourne has typically seen more modest price growth than some of the other capitals this year, it's still built up strong and consistent momentum that's proved to be hard for lockdowns to stop.

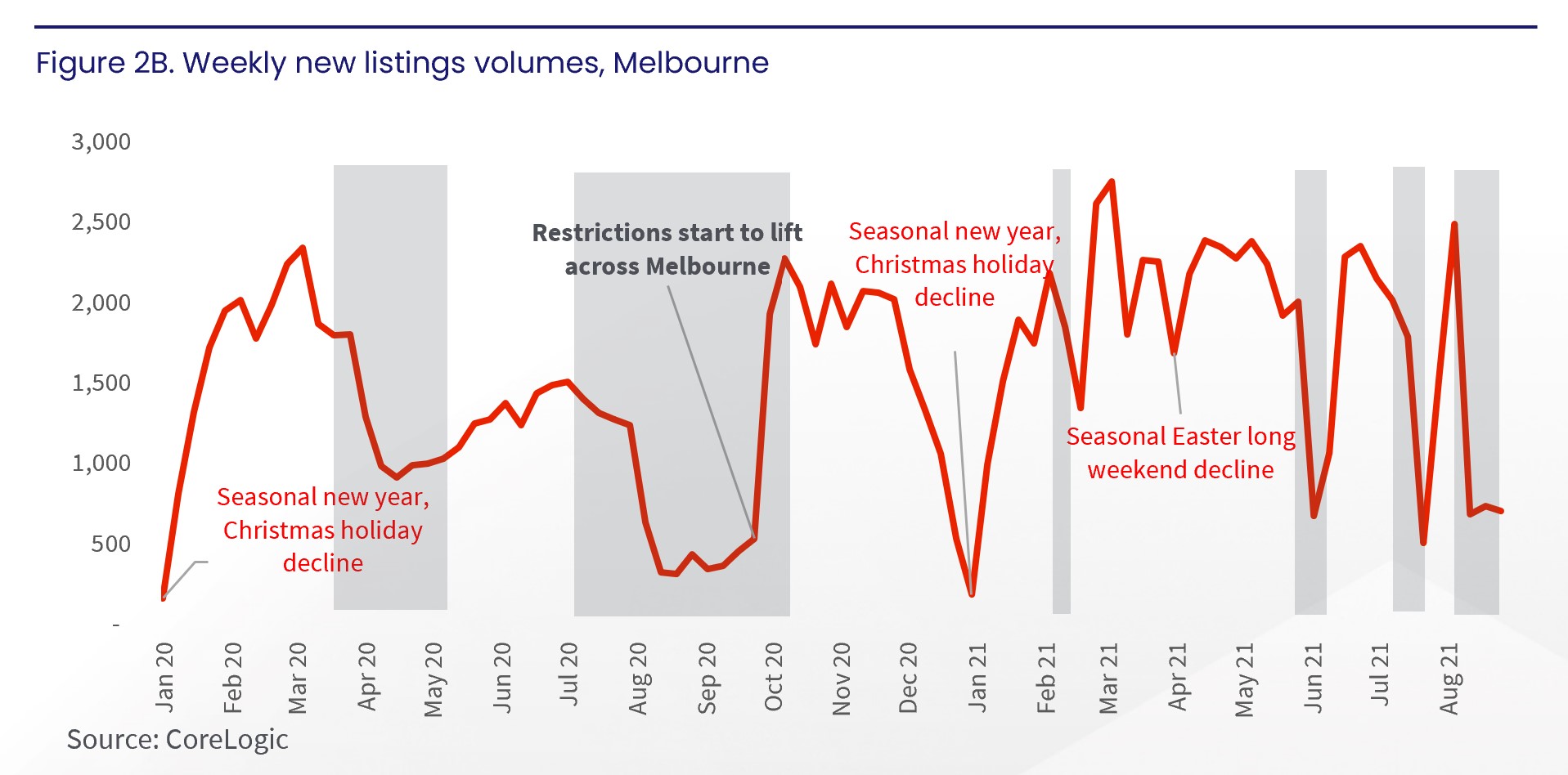

The most significant impact of the current restrictions has been on new listings, which have taken a heavy fall—a drop of -31.2 per cent in August, according to SQM Research—as many sellers look to wait things out and come to market once the city opens back up.

CoreLogic's research director Tim Lawless explains that auction clearance rates have also been dragged down as a result of vendors withdrawing their properties.

"Where properties have proceeded to market, the large majority are recording a successful result, albeit with a large proportion selling prior to the auction," he says.

Effectively, with such little stock on the market at the moment, competition amongst buyers still looking to secure a home remains high and prices are continuing their upward trend despite the restrictions.

Inner-city units are still struggling as the pandemic continues to push demand towards lower density housing and both interstate and international migration remains virtually flat.

Regional Victoria market update

| Houses | Units |

|---|---|

| $534,809 | $363,679 |

| Monthly change: +1.3% | Monthly change: +1.4% |

As has been the case for much of 2021, regional Victoria has again slightly outperformed the capital in August, posting a +1.3 per cent increase in the median dwelling value.

The median regional home has now broken through the $500,000 price barrier, and that +16.0 per cent growth seen this year puts Victoria ahead of even Queensland, which has seen regional destinations like the Gold Coast and Sunshine Coast soaring.

Listings have also dropped in regional Victoria, but not to the same degree as Melbourne. The latest REA Insights Listings Report found a -12.6 per cent decline in new listings in July, leaving buyers with fewer properties to compete over.

That increased competition is especially being seen in regional markets closest to Melbourne like Geelong, which REA reports having the lowest days listed on the site for the regions. On average, they were lasting on average just 29 days online before selling in July.

Inspections are due to resume in most of regional Victoria as of this week, so there should be a flurry of activity as sellers look to beat the spring rush and buyers jump back into their property hunt.

Restrictions remain tight but the market is still moving

Unlike in Sydney, where in-person inspections are still able to go ahead, the Victorian lockdown means much of the usual real estate process is being hampered.

As we discovered late last month from speaking with top Melbourne agent Paul Fenech of McGrath Croydon, that hasn't necessarily brought sales to a halt.

Online marketing is still effective for eager buyers, and in many cases they're putting down deposits on their desired homes while in lockdown on the proviso that, once they're able to see the property after restrictions ease, they can go ahead with the purchase.

"We're saying to people, if they want to sell, there's no time like the present. As in, at least get your home listed, and then we can bound into action once the lockdown's over," Mr Fenech explains.

"The buyers that are really keen to buy property have maybe sold a property and they have to buy a property. So they're paying good dollars.

"Stock is low, so that's always going to drive prices up as well. I would certainly say the [properties] we've sold we've got some really good dollars for, and even the online auctions have been well received as well."

What's next for the Melbourne and Victorian markets?

While control of the latest Delta outbreak in Melbourne hangs in the balance, there have been some positive announcements made this month.

Regional Victoria is being released from lockdown, allowing the property market to resume business as usual, and private inspections in Melbourne will be able to go ahead once 70 per cent of the state has had its first vaccine dose, likely later in September.

CoreLogic states that "there is likely to be an element of pent-up supply that is unleashed when restrictions ease which should see inventory levels rise," although they question whether buyer demand will return at matching levels.

Ultimately, they point out that "housing market activity bounced back quite quickly following previous spot lockdowns and after Melbourne's extended lockdown late last year, and we are expecting a similar turn of events once restrictions are eventually lifted."

It's likely that those vendors with a head start on listing and marketing will benefit most from the easing of restrictions as those looking to purchase a new home make a quick move back to the market.