What does the 2020-21 Federal Budget mean for real estate in Australia?

The much anticipated 2020-21 Federal Budget was handed down on October 6th by Treasurer Josh Frydenberg outlining the plan to support Australians from the impact of the pandemic.

Now that we have had some time to analyse the effects and implications of the budget, we take a look at what this means for players in the real estate industry, as well as the response from relevant industry bodies.

First home buyers

First home buyers who are hoping to get into the property market may be able to purchase a property sooner with the extension of the First Home Loan Deposit Scheme (FHLDS) which offers an additional 10,000 places from the 6th October to 20th June 2021.

This scheme allows first home buyers to purchase a new property with a deposit as low as 5 per cent, with the other 15 per cent of the loan guaranteed by the Government.

This benefits buyers with low deposits as they can potentially save thousands of dollars in lenders mortgage insurance which would normally be required for a deposit of less than 20 per cent.

The extension of the First Home Loan Deposit Scheme (FHLDS) offers an additional 10,000 places from the 6th October to 20th June 2021.

This extension follows the previous FHLDS introduced at the beginning of the year which proved to be extremely popular. Under the extended scheme, property purchases are restricted to newly built homes which the original scheme did not.

Ken Morrison, Chief Executive of the Property Council of Australia welcomed the extension.

“The previously announced extension of the First Home Loan Deposit Scheme will provide a welcome boost for new apartment and housing construction. This scheme, along with the HomeBuilder grant, have been vital in supporting residential construction,” he said.

Real Estate Institute of Australia President Adrian Kelly, however, has voiced his concerns that the extended scheme directed at new builds is a missed opportunity in helping more Australians into their first homes.

Mr Kelly said the scheme ignores the needs and preferences of Australian first home buyers with over 80 per cent of first home buyers choosing established dwellings due to affordability.

“It would have been far better not to limit the additional places to new builds in terms of the economic impacts and first home buyer preferences.

"The First Home Buyer Deposit Scheme should be extended to all eligible buyers of all homes, not just new builds. This will be a priority for REIA moving into 2021," he said.

Find out more about eligibility and property price thresholds here.

Homeowners and house hunters

Another big announcement of the Federal Budget was bringing forward the second stage of the Personal Income Tax Plan which will provide tax relief for over 11 million individuals backdated to 1 July 2020.

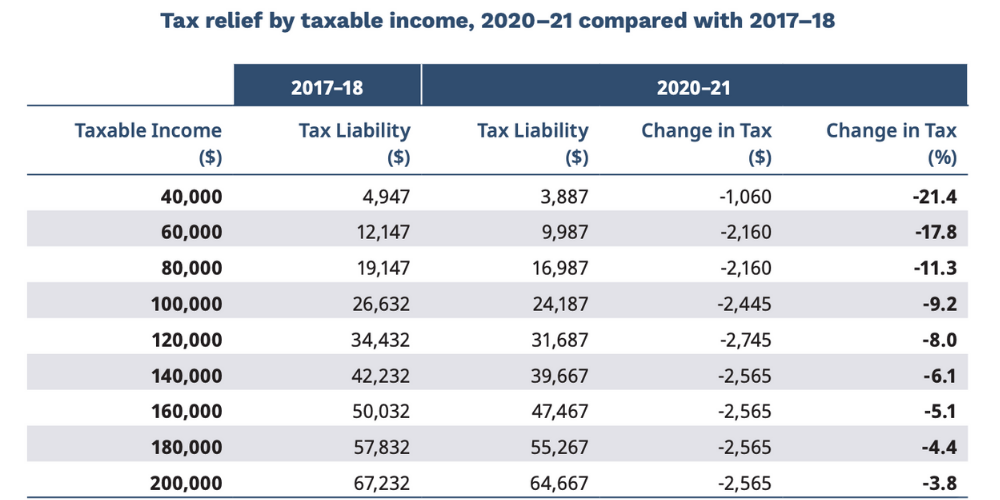

Low and middle income earners to receive tax relief of up to $2,745 for singles or up to $5,490 for dual income families. How much you save will depend on how much you earn.

Those who earn $60,000 will pay 17.8 per cent less tax resulting in an extra $2,160 in their pockets and those who are earning $100,000 will pay 9.2 per cent less and have an extra $2445.

The Government will also provide additional targeted support to low and middle income Australians with a one-off benefit of up to $1,080 per individual and $2,160 for dual income couples from the low and middle income tax offset (LMITO).

Tax relief could allow homeowners to pay back a higher amount on their mortgage repayments, potentially resulting in them paying off their home loan faster.

For those looking to purchase property, extra money in the bank would provide support in saving for a deposit.

Tax relief could allow homeowners to pay back a higher amount on their mortgage repayments, potentially resulting in them paying off their home loan faster.

Since the announcement of tax cuts, the question on everyone’s lips was when Australians would actually receive the tax relief.

Mr Frydenberg told 7news that he expects these changes to be putting money in people’s pockets by Christmas.

It is important to note that while the amount you will be taxed will be reduced by the end of the year and for every month after, the five months that have been backdated (from 1 July 2020) will be received when you put in your tax return next year.

Read more about individual tax cuts here.

Home sellers

If proposed changes to winding back responsible lending obligations pass in parliament, from March 2021 there would be a simplified loan application process making it easier and faster to refinance or obtain a home loan.

Mr Frydenberg has argued that the current lending is too restrictive since lending standards were tightened in the 2018 royal commission.

“It’s critical that this reform … is understood as improving the chances of a consumer, of a mum and dad, to be able to access credit, so that they can buy their home, so that they can spend as they need to across the economy, as part of the economic recovery,” he said.

Mr Kelly said that the changes will boost the housing economy as sellers will be able to list their properties knowing that buyers will be out there.

“By improving demand, the government is giving prices less chance to fall, meaning the doomsday forecasts can be archived.

“It’s important we ensure there are minimal to no obstacles for those wishing to list their properties,” he said.

Property Investors

From the budget, there are no direct impacts such as changes to negative gearing or investment property taxes that will impact investors.

There are no direct impacts from the budget that would affect investors as there is no change to negative gearing or investment property taxes.

An indirect impact however will be the JobMaker program, where eligible employers will receive $200 per week for new employees aged between 16 and 35 years old.

With 40 per cent of job losses between March and August affecting those under 24 years old, many young Australians moved back home with their parents due to the pandemic.

This program is designed to create jobs and get younger Australians back into the workforce which will have a flow on effect on the rental market.

Find out more about JobMaker here.

Renters

The budget allows the National Housing Finance Investment Corporation (NHFIC) to issue a further $1 billion in bonds for the construction of affordable housing.

Mr Kelly said that this boost to affordable housing was good news for Australia's tenants requiring somewhere to live.

The budget allows the National Housing Finance Investment Corporation (NHFIC) to issue a further $1 billion in bonds for the construction of affordable housing.

“COVID-19 has highlighted that the private sector is carrying most of the load to support our tenants and the government-led affordable housing commitment for NHFIC in the form of $1 billion dollars is most welcomed,” he said.

Help for Indigenous home buyers

The budget provides $150 million to Indigenous Business Australia to help them extend the indigenous Home Ownership Program.

This aims to deliver 360 home loans for new housing construction in regional Australia.

To conclude

The Federal Budget has included many measures that support and provide an encouraging outlook for all the players in the Australian property market.

Moving forward, there may be more support in the future with speculation that interest rates could be further cut in November as well as hints that the HomeBuilder scheme could be extended due to high demand and a backlog of paperwork.