What does the return of investors mean for the property market?

Throughout the first half of this year, much of the talk of this property boom has been focused on owner-occupiers and especially first home buyers.

Record-low interest rates, a suite of government incentives and a burst of consumer confidence after last year's dire economic forecasts were proved wrong helped usher in one of the biggest years of growth the Australian housing market has ever seen.

Over the past few months, though, affordability pressures have put the squeeze on those new market entrants, and it's made way for a fresh wave of investor activity.

Will that shift continue to propel the market to greater gains, or is the heat set to die down? We spoke with Michael Yardney, one of the country's leading property experts, to get the state of play.

What are the signs that investor activity is on the rise—and why now?

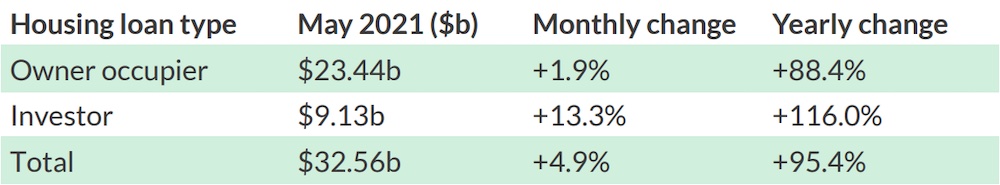

The latest data from the Australian Bureau of Statistics, which tracks new loan commitments for housing, shows a substantial uptick in lending to investors in recent months.

May especially saw a substantial jump in loans to investors of +13.3 per cent, or $9.13 billion for the month. That's +116 per cent more than the same period last year.

Mr Yardney, a best-selling author, founder and director of Metropole Property Strategists and the name behind one of the world's leading real estate blogs, Property Update, says lending indicators are all pointing to a resurgence in investor activity.

"In my close to 50 years in the property market, I've never seen all the markets coordinate and grow as strongly," Mr Yardney explains.

"Throughout Australia, investors are reading in the media that properties are going up in value, they're seeing the value of their home going up, and so they're also getting confidence to take on a commitment and get into the market."

"In fact, more are experiencing FOMO, because they think 'Hey, I'm reading that overall the markets have increased +13.5 per cent this year according to CoreLogic in the last financial year, and most of that's occurred in the last half of that year.'"

In Mr Yardney's view, the smartest investors would have already jumped on the rising market in the months prior, but with his forecast of a further +10 per cent growth nationally for the year, there are still big upsides to making a move now, even while rents are still recovering.

"Informed investors have always invested for capital gains rather than cash flow. They recognise that while cash flow keeps them in the game, it's their capital growth that will get them out of the rat race."

Many investors are also choosing to sell while the market's hot. Is that wise?

While plenty of investors are making a fresh leap into the buoyant property market, others are choosing to list their assets and cash in on this year's staggering growth.

"Yes it's a trend, and it's a silly trend," Mr Yardney says.

"We're seeing that because they're seeing the market's going up and saying 'I'm making a profit, I'm going to sell.' But most investors are in it, or should be in it, for the long term."

As he sees it, acting on emotion rather than being patient and reaping the rewards over the decades is a more sound approach to investing.

"Property investment is the vehicle they're using to get financial independence and choices in life in the future. For most of the investors we deal with at Metropole, they don't ever sell. They're wanting to create intergenerational wealth."

The conditions now, however, present a good opportunity to capitalise on a hot market and offload any investment properties that aren't A-grade.

"If they've got a secondary property, a dud property, one that's not very good, this is a good time to sell and buy something better to see you through because you don't want to be left with a dud property when the cycle finishes," he says.

How will increased investor activity affect the market?

Investors swooping into an already booming market will no doubt have an impact on other buyers and sellers.

The first half of 2021 saw an influx of first home buyers breaking into the market, and the surging rates of growth have stimulated a lot of conversation around the topic of housing affordability.

Mr Yardney feels this concern is overblown to a degree, though, and it's more an issue of desired location.

"First home buyers have always had difficulty with affordability," he says. "I bought my first property for $18,000 in the early 1970s, and I could only go halves with my parents because I couldn't afford it, and I took out a 30-year loan. We got $12 rent and we were excited."

He points out that first homeowner activity has reached record levels in the past year, but many of them "want to live in the sort of property it took their parents 40 years to buy. So they've got to become more realistic.

"Having said that, moving forward first homeowners are going to have difficulty, and it will take a while. It's not the level of the mortgage that's the issue for first homeowners; they don't bring a trade-in to the market like established home buyers do, so it's saving the deposit that's the biggest issue for first home buyers."

Sellers, meanwhile, have been presented with a golden opportunity thanks to huge demand driven in part by record-low interest rates.

"Sellers are able to take advantage of the biggest property boom in a couple of decades," he says. "This sort of property boom is a once in a generation thing where you're going to get all the banks, all the big economists agree this cycle, property values will go up 25 to 30 per cent."

With investors picking up where some first home buyers have left off, unable to keep up with such rapid growth, it looks like sellers will continue to benefit from a thriving property market.

Mr Yardney does caution, though, that high-density units in inner-cities are still an unattractive option.

"Investors are currently shunning CBD high-rise Legoland apartments which are proving to be poor investments and are being very cautious about buying off the plan," he says. They seem to be more informed and not lured by unrealistic promises from developers and project marketers."

So what comes next?

With first home buyers pulling back, investors upping their activity and a fresh coronavirus outbreak throwing the country into varying states of disarray, what could be around the corner for real estate?

"I believe in the second half of 2021, overall property values are going to go up 10 per cent," Mr Yardney predicts.

"The investors and homebuyers have worked their way through Covid. They're used to it now. It's a nuisance, it's a setback, but it's not stopping them."

He notes that, while the economy is likely to take a hit as a result of prolonged lockdowns, "we've seen what happened after Melbourne—once the gates are opened up, people are going to get going again."

He characterises the current market as a "cycle of upgraders," saying tenants are buying their first homes while homeowners are upgrading their properties or moving to better locations, all as a result of low interest rates.

"Why are property values going up? Because people can afford it. Despite people saying it's unaffordable—if it wasn't, there wouldn't be so many people taking loans and buying properties. Because the banks are still very strict with their lending criteria."

Ultimately, it looks like there's plenty more action to come in this year's property boom.