Another rate cut brings more good news for sellers

The Reserve Bank of Australia delivered its next highly anticipated interest rate cut this past Tuesday, and it's the result home sellers have been waiting for.

With the cash rate now sitting -0.75 per cent below its peak, buyers have deeper pockets and increased confidence, pushing property prices higher.

Spring is just around the corner — so what's the next move for those who are thinking of listing?

Get a free property value estimate

Find out how much your property is worth in today’s market.

February and May cuts have already boosted home values

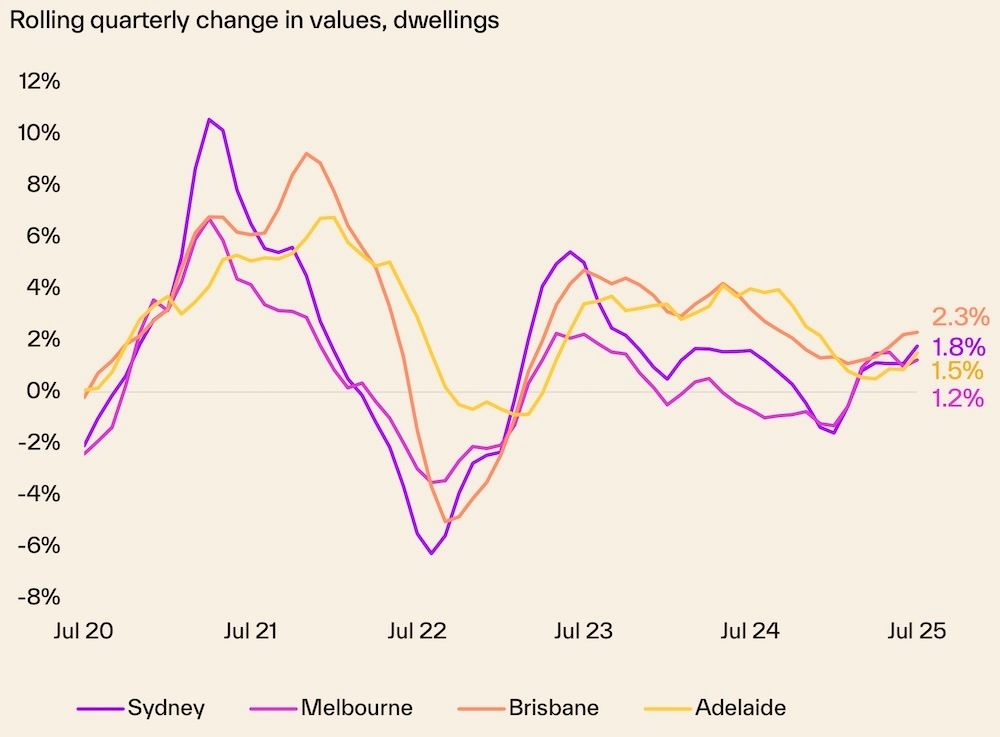

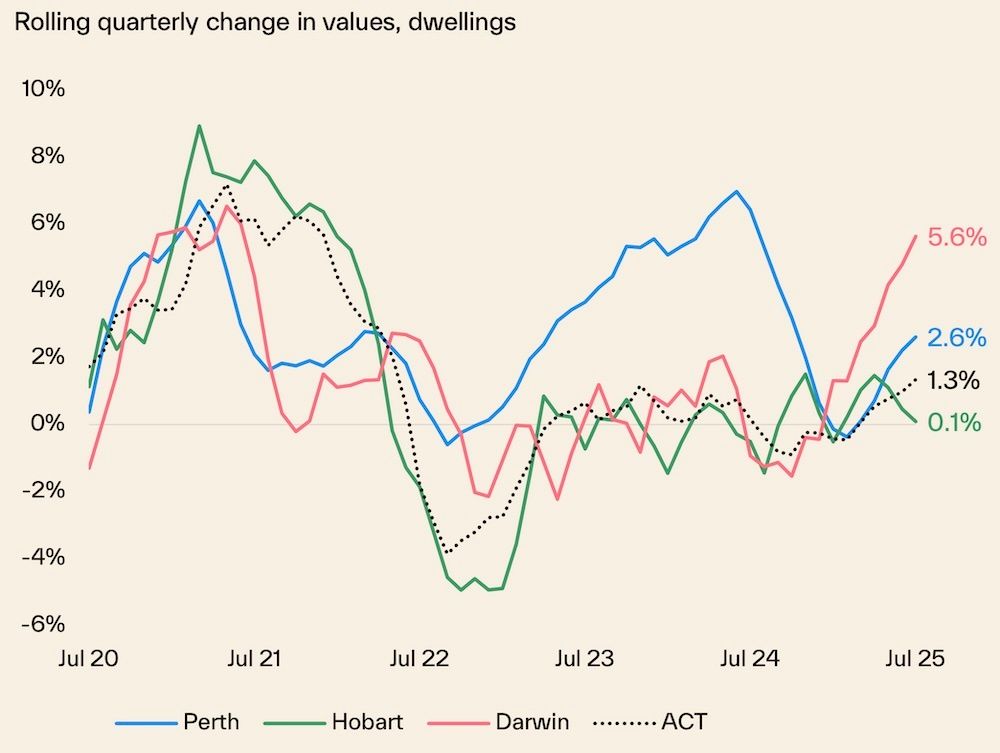

As we moved into 2025, things looked sluggish in many markets around Australia. Prices in Sydney and Melbourne were falling, and the runaway growth seen in cities like Perth, Brisbane and Adelaide was also easing.

Things took a sharp turn for the better in February when the Reserve Bank of Australia (RBA) delivered its first rate cut, and the upward trend has been solidifying ever since.

Since January, property prices have risen in every capital city, with the national median uplift being a solid +3.1 per cent.

Following May's rate cut, SQM Research's Louis Christopher said that rising auction clearance rates and sales volumes "indicate the housing market is at present, recording more home buyers in the marketplace.

"This, combined with ongoing low levels of dwelling completions, are all fuelling the conditions for a short-term surge in dwelling prices."

That surge has turned into a consistent trend, and growth has set in for most markets. So can we expect the same kind of impact from the third rate cut of 2025?

The RBA's August decision will likely push prices higher

A rate cut means relief for both homeowners with a mortgage and buyers looking to secure a loan and make a purchase.

Melissa Gielnik, mortgage broker and director at Smart Lending, told Property Buzz that, “For would-be buyers, a 0.25 per cent cut usually translates to a $20,000 boost to their borrowing capacity.”

Now with three such injections to their budgets, buyers have been able to increase their offers and compete harder in the market.

As a result, Cotality's Tim Lawless explained that "The rate cut is a net positive for housing markets, supporting demand through increased borrowing capacity and loan serviceability.

"Overall, we expect housing markets to respond positively to the rate drop, which is occurring against a backdrop of low supply."

The issue of low supply is key, too. Cotality's data shows that, nationally, listings are tracking -19 per cent lower than the five-year average, meaning there's a clear shortage of properties available to buy.

At the same time, the annual volume of sales is +1.9 per cent higher than the five-year average. Clearly, demand is far outweighing supply, putting further upward pressure on prices.

But the upcoming spring could bring a surge of new listings. Affordability remains a pressing issue, too. So just how far can the market push?

Further rate cuts and price growth are expected

Looking first to the future of rate cuts, it's clear that most experts are predicting there's more to come. How many and when is up for debate, though.

The big four banks are forecasting between one and two more rate cuts by early 2026, landing the cash rate between 3.35 per cent and 3.10 per cent by February.

AMP chief economist Shane Oliver sees the RBA going further, slashing rates to 2.85 per cent by May 2026. But HSBC's own chief economist, Paul Bloxham, told the AFR "I don’t think we should expect very many more cuts from here, and I think they’re going to be quite spread out."

In any case, further rate cuts would likely drive home prices higher still in the coming months.

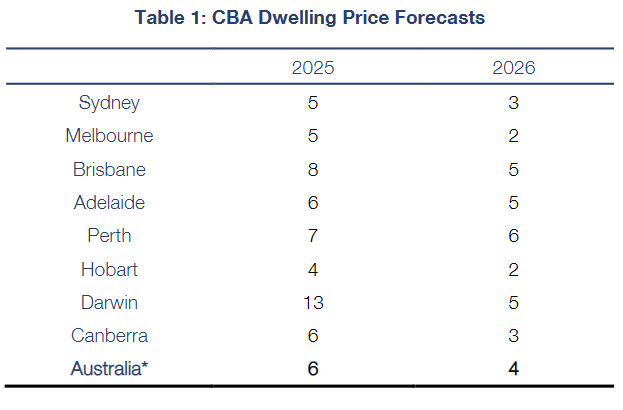

CBA recently lifted their forecasts for home values over the next 18 months, suggesting that the bulk of gains will be seen this side of the new year thanks to recent interest rate movements.

"The upward revision this year reflects current market momentum, a still sound labour market and strong real household disposable incomes," the bank's chief economist, Luke Yeaman, wrote.

"However, given our forecast for a relatively shallow interest rate cycle, easing population growth and continued headwinds in the construction sector, this home price upswing is still expected to be relatively modest and taper out in 2026."

What does it all mean for sellers?

Selling conditions are strong in most markets right now. Prices are rising, buyer budgets have lifted with lower rates, and confidence is improving across the country.

Auction clearance rates have been rising and listings remain relatively scarce, so well-presented homes are drawing attention quickly.

Forecasts suggest growth should continue, but the pace may moderate in 2026 as affordability bites and the rate-cutting cycle nears its end.

That makes the current window — low stock, improving sentiment, and more active buyers — particularly favourable for vendors weighing up a move.

But the right timing still depends on local dynamics. Speaking with experienced local agents can clarify suburb-level demand, likely buyer depth, and the best strategy to maximise price.

For sellers with flexibility, bringing a campaign forward rather than waiting could mean meeting the market at its most receptive. A well-informed plan around pricing, presentation and agent selection will do the rest.

Thinking of selling?

If you're looking to get in on the action in 2025, it's important to be as prepared as possible in order to cut through the competition and achieve a standout result.

Step 1: Understanding how your market is performing

Every market is different, and understanding your local market is fundamental to making the right selling decisions. Our guide to tracking market trends and data will help you to get a clear picture of how your market is performing and how that impacts you as a seller.

Step 2: Know what your property might be worth

Getting a free home value estimate is a great way to set a foundation for your selling expectations and begin planning the path forward.

Step 3: Get a no-obligation market appraisal from a top real estate agent

Understand what your property could sell for in the current market by speaking to the top-performing agents in your suburb. Comparing top agents in your area will help you find the perfect partner for your selling journey and move towards a successful result.

Step 4: Finally, get your property listing ready

Taking a thorough approach to preparing your home for sale is another critical step. From cleaning, decluttering, painting and performing other cosmetic renovations to home staging, photography and marketing, getting your property to sale-ready condition is a must.