Buyer demand hits 'all-time high' while supply remains well down

It's been a recurring theme throughout the 2021 boom, but a shortage of housing stock and insatiable buyer appetite continues to drive prices higher despite lockdowns in some of Australia's biggest markets.

REA Insights' latest Housing Market Indicators Report shows that buyer demand has reached record levels while listings remain heavily limited even as spring begins.

Will the imbalance last? Or are things about to take a turn now that the traditional selling season is underway and there's light at the end of the lockdown tunnel?

Diving into the numbers

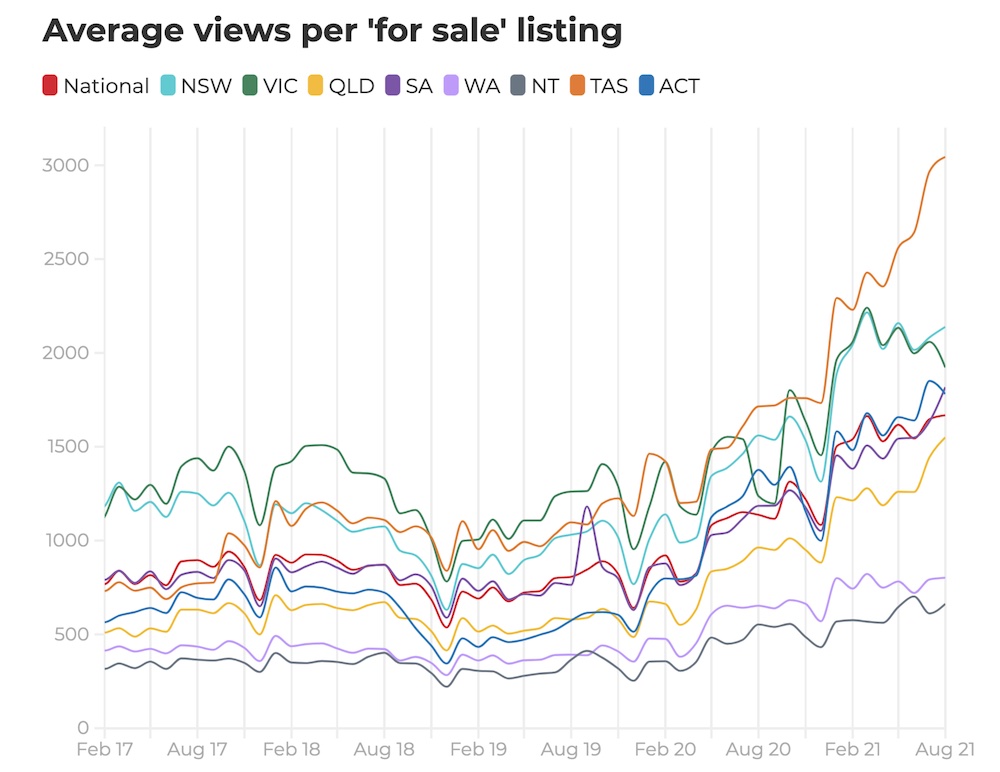

According to the report, "demand, based on the number of views per listing of properties for sale on realestate.com.au, hit an all-time high in August."

There was a +1.2 per cent rise in views per listing for the month which is now a full +46.7 per cent up from where it was 12 months ago.

That means for the limited number of properties currently listed on the market there is a record level of interest from buyers.

The number of email enquiries sent to agents via the site also rose +12.2 per cent in August, a result of many buyers not being able to attend open homes in locked down cities and states.

Property search volumes were also up +1.8 per cent in the first week of September, a +17.6 per cent increase since the same week in 2020.

NSW saw the largest bump in searches for the week of +5.2 per cent, while Queensland, South Australia and the NT hit record highs.

REA's director of economic research Cameron Kusher explained that, "with lockdowns expected to continue in the ACT, NSW and Victoria, we may not see this demand pressure alleviated until seller confidence returns and the volume of new supply increases once lockdowns end."

For now, the substantial gap between supply and demand means properties that are currently listed are being met with fierce buyer competition, pushing sale prices higher.

What does this mean for the spring selling season?

The beginning of September typically brings an influx of listings, but this year's Covid disruptions have thrown a major spanner in the works.

NSW, Victoria and the ACT have now all released roadmaps for the path out of lockdown, and it's looking like inspections will be back on the cards soon for all states. This is likely to revive some of the diminished seller sentiment.

"It is likely pent-up supply and demand will be released once lockdowns ease and the typical increase in new listings that comes with spring could help provide buyers with more choice and reduce some of the competition for individual properties," Mr Kusher said.

BuyersBuyers co-founder Pete Wargent says "this time of year we should have loads of properties coming onto the market, especially in September. They're down by about one third from what we would normally expect to see, and there's just not very much stock on the market."

His prediction is that the spring selling season will get off to a late start once the East Coast reopens and that a flurry of fresh activity could cool the market to a degree.

"My best guess is that it will be compressed into a shorter period and auctions will go on right the way through until close to Christmas instead of tapering off," he says.

"Generally speaking, more supply tends to spread buyers out and dampen price growth or send it into reverse."

Where are prices expected to go from here?

Put simply, Mr Kusher said, "this disconnect between the supply of stock for sale and buyer demand is likely to create upwards price pressures."

CoreLogic data shows price growth has eased off since the national monthly peak of +2.8 per cent in March, but gains have remained strong through to August's +1.5 per cent rise.

If the current rate of buyer demand is met with an influx of new listings as spring unfolds, further cooling of the market may be on the cards.

"As we shift into 2022 it is likely that, assuming everything goes right, people will have other options with regard to spending, such as more travel, and many people who were going to buy have done so and it should lead to slowing price growth," Mr Kusher explained.

The big four banks' forecasts reflect similar expectations, with 2022 growth projections ranging from +3.6 per cent to +7 per cent, so it's likely we've already seen the majority of this boom's price impact.

Whatever happens next, with lockdown markets set to gradually open back up and fresh listings due to hit the market fast, the gap between supply and demand—and the high sale price opportunities that come with it—look like it may be about to start closing.