Property sales hit highest level since 2004

Throughout the 2021 boom, we've seen a common theme of stock on the market being low while buyer demand has been persistently high.

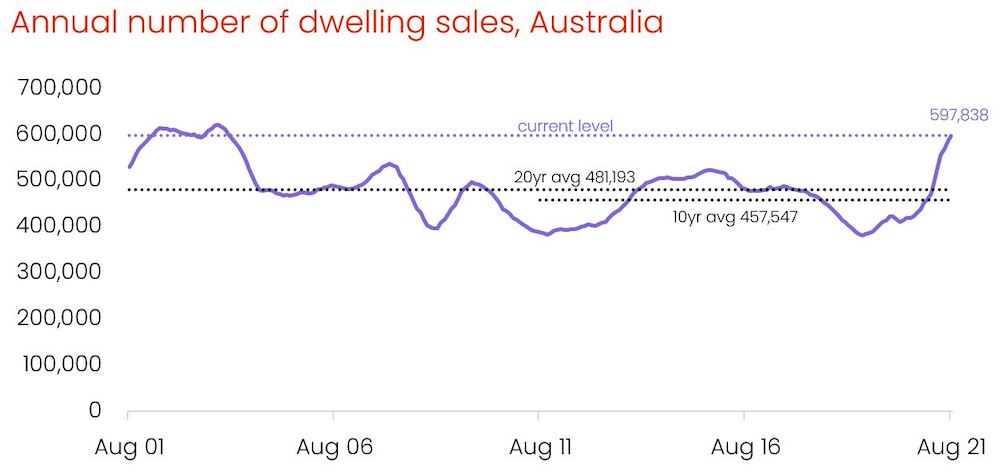

Now, some of CoreLogic's latest figures show just how big an impact that buyer appetite has had, as they reveal the year to August 2021 saw the highest number of annual sales in nearly two decades.

It's clear that people are buying up whatever property they can still get their hands on, effectively creating a supercharged seller's market, but can that dynamic last much longer?

Just how significant is this peak?

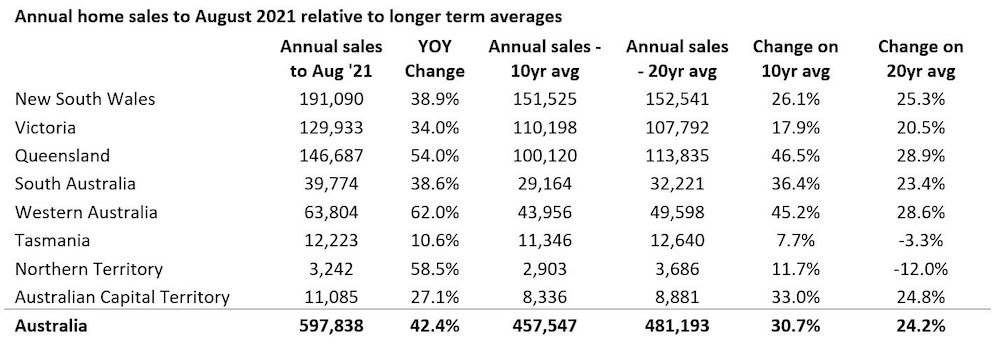

Home sales in the year to August 2021 were up a staggering +42.2 per cent annually, and looking longer-term, they're also up +30.7 per cent on the ten-year average.

The trend is relatively broad-based, too. WA and the NT have led the way with annual increases of +62.0 and +58.5 per cent respectively, while QLD, NSW and Victoria have also seen very strong bumps in those figures.

With close to 598,000 houses and units selling over the past 12 months alone, it's a sign that buyers have been, and still are, in a frenzy to snap up whatever's on the market.

That's made clear by the stat that, in the three months to July, for every new listing coming to the market there were 1.4 properties sold. That means old stock has been purchased much faster than new stock can come online.

As we've explored throughout 2021, that's all come about from a perfect storm of record-low interest rates, built-up savings while travel is limited in the pandemic, bucketloads of government stimulus and an enduring sense of FOMO pressuring buyers to get into the booming market before they miss out for good.

Investors have picked up where some first home buyers left off

First home buyers took centre stage in the first six months of this year's property boom, and their heightened activity has played a big part in keeping those sales numbers so high.

But, as affordability constraints have continued to mount and some new owner-occupiers have been priced out of the market, investors have moved in to pick up the slack.

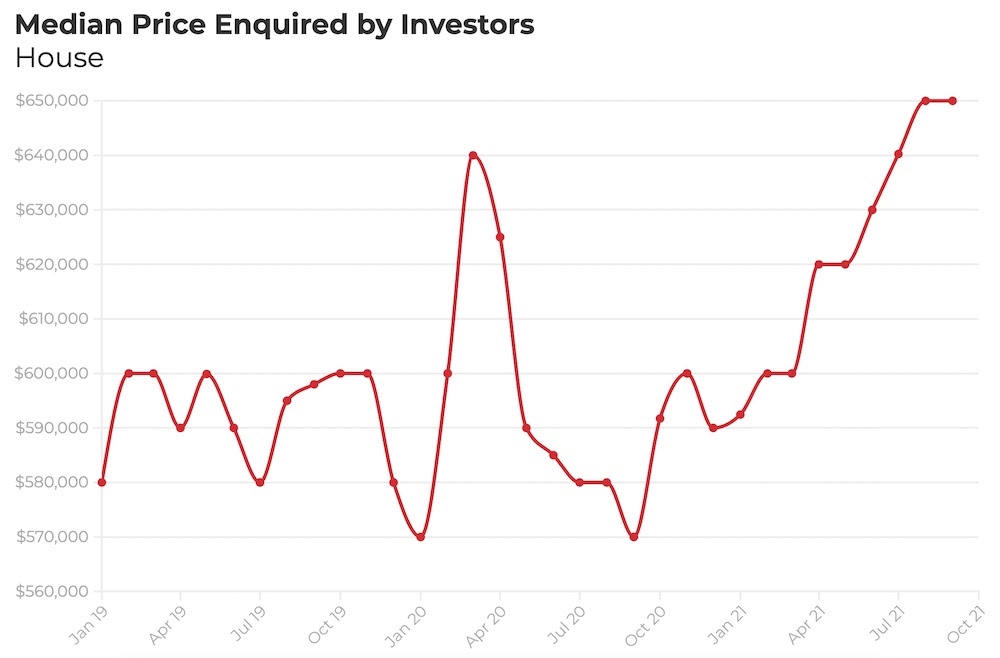

According to the latest ABS data from July, investors make up 29.1 per cent of new loan commitments. The $9.35 billion they borrowed for the month was close to double what they borrowed in July 2020.

Judging by numbers gathered by REA Insights, investors also seem willing to pay a substantial amount more for property than they were even two years ago, so they've adjusted their expectations to the new market peaks.

The question now is, with a flood of new listings expected to arrive this spring, can this trend continue?

What's likely to happen as summer approaches?

CoreLogic points out that, while it's forecast there will be plenty of activity as the weather warms up—especially as locked down states begin to open up again—it's likely that home sales will reduce over the medium term.

They put this down to a few key reasons:

Housing prices are growing at a far more rapid rate than household incomes in most markets, meaning affordability issues will become too great for more buyers.

Lending standards could be under the microscope as a way of cooling the market, so securing a loan would become more difficult for those with smaller deposits or lower incomes.

An increase of stock on the market, including new developments, will likely reduce the rate of turnover.

Immigration is still at minimal levels, which has hurt the rental market in the shorter term but may have a knock-on effect as new migrants looking to buy remain at historic lows.

While interest rates are still close to zero and there's an expectation that the economy will again rebound as lockdowns ease, it still looks as though the market conditions that have been so favourable to sellers aren't going to be around for too much longer.