Property Clock: Which markets will boom or bust?

Tracking the housing market is anything but straightforward — and calling the next move is tougher still.

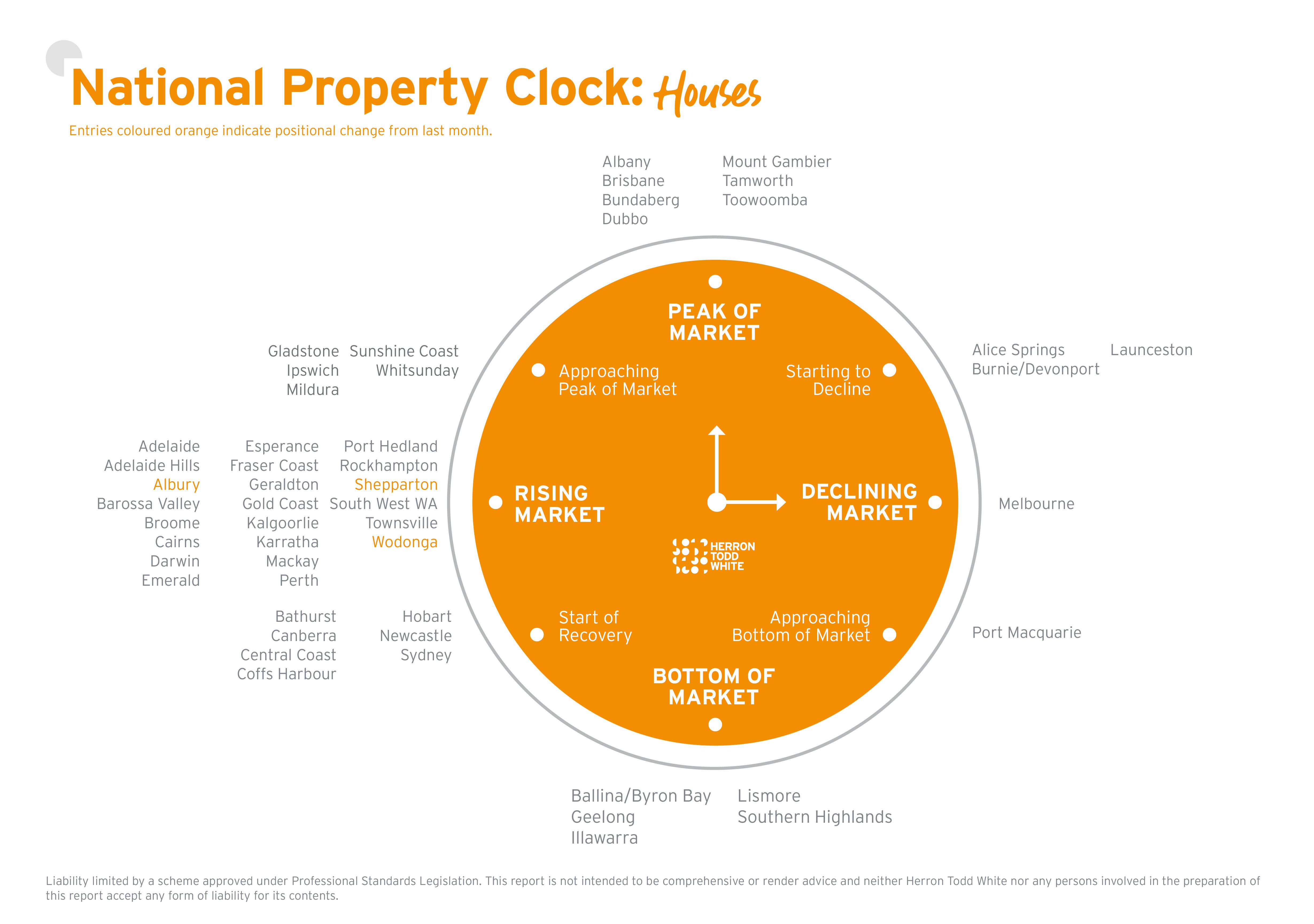

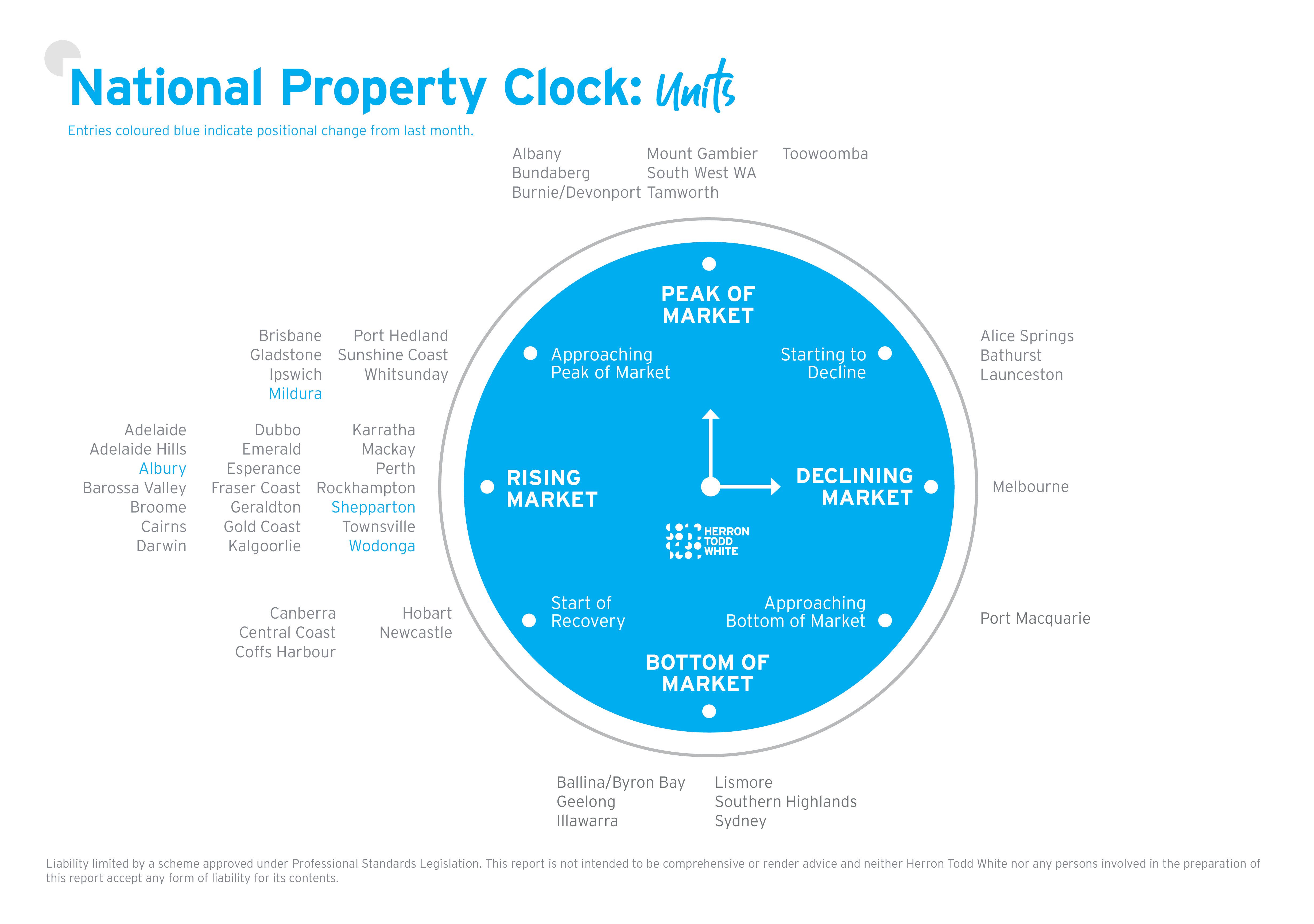

Each month, independent valuer Herron Todd White maps Australia’s 50 biggest markets on its Property Clock, showing who’s rising, peaking, cooling or bottoming out in the cycle.

So where does your market sit right now? Dive into September’s clock to see what the next few months could hold.

Get a free property value estimate

Find out how much your property is worth in today’s market.

Markets on the rise

Australia's median property price is hitting new peaks with each passing month, with falling interest rates, a widespread shortage of listings, and strong buyer demand driving consistent growth.

The favourable selling conditions have led the majority of markets on HTW's Property Clock to sit around the 'rising' segment.

Houses in Sydney and Canberra, along with regional hotspots Newcastle, Bathurst and the NSW Central Coast, are all considered to be at the start of their next upswing with strong performances ahead.

Hobart joins them, indicating that HTW believes the worst is behind the Tasmanian capital after several sluggish years post-pandemic.

The biggest cohort of cities and regions classified as rising markets covers star performers Adelaide and Perth, along with Darwin which has seen explosive growth so far in 2025.

They're joined by plenty of regional hotspots, with strong representation in Queensland that includes the Gold Coast, Cairns, Townsville, Rockhampton and Mackay. Albury, Wodonga and Shepparton are new additions to the rising list.

Markets at or approaching their peak

Moving towards the top end of the clock, we see a few surprises.

Burgeoning Queensland markets like the Sunshine Coast, Ipswich and Whitsunday find themselves classified as approaching the peak of the market.

So do units in Ipswich and Brisbane — calls we would question given Brisbane's reacceleration of growth as the spring approaches.

It's particularly unusual to see Brisbane's house market classified as being at its peak after gains of nearly +3 per cent in the last quarter alone, according to Cotality data.

Other markets that HTW consider to be at peak levels include inland regional areas like Dubbo, Tamworth, Mildura, Toowoomba and Mount Gambier.

Markets declining or at the bottom

The declining segment of the Property Clock is where HTW continues to deliver even more controversy.

Their picks of Launceston, Alice Springs, Shepparton and Port Macquarie as markets on a downswing are reasonable, but there's one selection that stands out.

Both houses and units in Melbourne are considered to be declining markets — a fair assessment to make throughout 2024, but after two rate cuts in 2025, it seems clear that the tides have turned for the Victorian capital.

Melbourne property prices have risen nearly +3 per cent since the start of the year, according to Cotality, indicating a clear shift in momentum for the previously slumping city.

Looking to the bottom of the clock at markets set to begin climbing, Sydney's unit market is joined by a number of NSW coastal spots, including Ballina/Byron Bay, Coffs Harbour, the Illawarra, and Lismore.

A different perspective from Domain

Midway through the year, Domain recently released their Housing Market Forecast Financial Year 2026 report and included a property clock of their own.

The graphic, which only looks at the six most populous capital cities, paints a different picture to HTW's outlook, particularly for Melbourne.

According to Domain, the Victorian capital is firmly in the 'accelerating price rises' region as recent rate cuts fuel a rebound for the city.

Sydney and Brisbane are also considered to be on a solid upswing, with Canberra beginning a bounceback of its own.

Adelaide and Perth, the two runaway stars of Australian property in recent years, look to be experiencing a slowdown in growth as affordability worsens, though both cities are still delivering solid gains each month.

Thinking of selling?

If you're looking to get in on the action in 2025, it's important to be as prepared as possible in order to cut through the competition and achieve a standout result.

Step 1: Understanding how your market is performing

Every market is different, and understanding your local market is fundamental to making the right selling decisions. Our guide to tracking market trends and data will help you to get a clear picture of how your market is performing and how that impacts you as a seller.

Step 2: Know what your property might be worth

Getting a free home value estimate is a great way to set a foundation for your selling expectations and begin planning the path forward.

Step 3: Get a no-obligation market appraisal from a top real estate agent

Understand what your property could sell for in the current market by speaking to the top-performing agents in your suburb. Comparing top agents in your area will help you find the perfect partner for your selling journey and move towards a successful result.

Step 4: Finally, get your property listing ready

Taking a thorough approach to preparing your home for sale is another critical step. From cleaning, decluttering, painting and performing other cosmetic renovations to home staging, photography and marketing, getting your property to sale-ready condition is a must.