High-octane January sees market activity soar while growth stabilises

January tends to be the slowest month of the year for home sales, but 2022 has kicked off with a bang as large volumes of buyers made their moves early.

CoreLogic's latest figures once again show very strong growth in some markets while others have stabilised and softened.

The year is still young, but what can January's results tell us about what's ahead?

National property values: January 2022

Houses | Units |

|---|---|

$778,225 | $606,584 |

Monthly change: +1.3% | Monthly change: +0.3% |

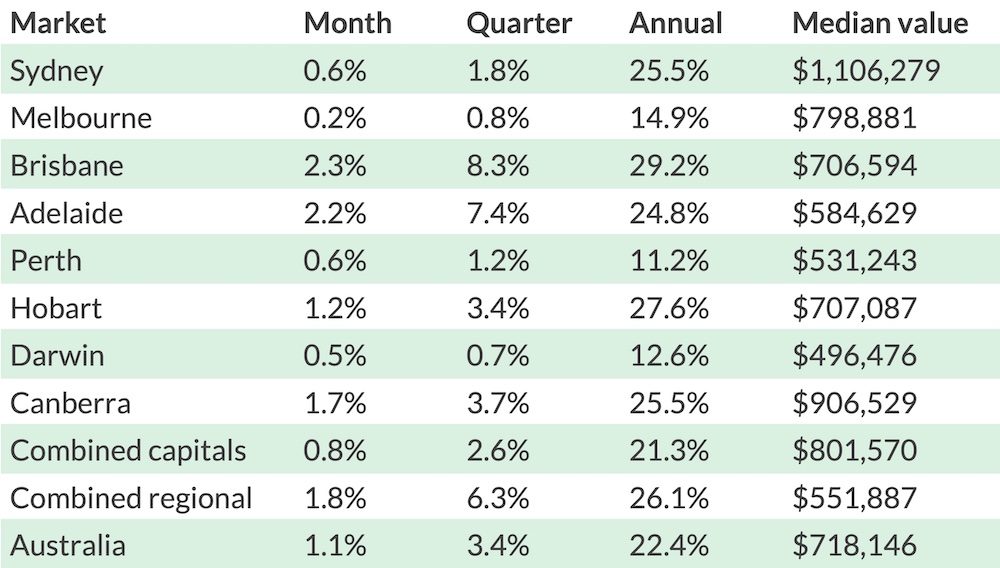

The median Australian home value increased by another +1.1 per cent in January, pushing annual growth up to +22.4 per cent—the highest rate seen since 1989.

That means the median Australian property has grown in value by a remarkable $131,236 over the past 12 months alone.

If we zoom in a bit, though, CoreLogic's figures now show a broad range of market conditions across the country, with some cities easing while others surge.

Brisbane and Adelaide prices shot up once again by more than +2 per cent for the month, stacking up huge quarters for both cities.

Sydney and Melbourne, meanwhile, continued to experience easing conditions well below +1 per cent growth, although Melbourne houses hit a major milestone, surpassing the $1 million median price for the first time.

Canberra bounced back after showing signs of slowing last month, hitting a strong +1.7 per cent increase in prices for January. Hobart also saw a modest nudge up from December.

Perth and Darwin, where growth has been relatively stagnant in recent months, both experienced price bumps around half a per cent.

Regional markets, meanwhile, continue to buck the capital city trend, delivering strong growth across the board to the tune of +1.8 per cent combined.

Transactions surged in January despite below-average new listings

It's generally expected that January will bring the biggest lull in sales for the year as people slowly reemerge from the holiday period.

Home sales in the first month of 2022 have been well above average, though.

On a national level, sales volumes were up +39.4 per cent on the previous five-year average.

That suggests that there is still a great deal of buyer demand out there, especially in regional markets where sales were up a massive +57.9 per cent on the five-year average.

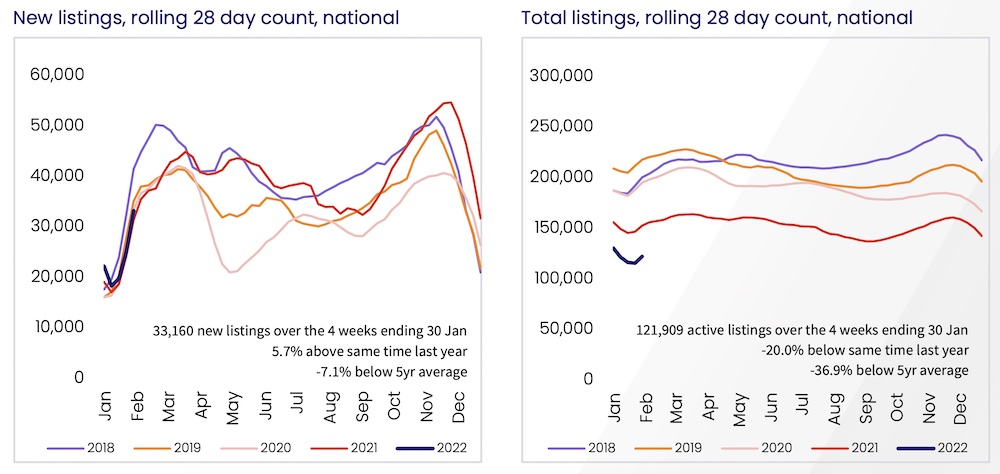

By contrast, new listings remain somewhat on the low side. Following a burst of new stock coming onto the market in the final months of 2021, January saw -7.1 per cent fewer new listings than the five-year average for that month.

Without a further influx of new listings, total stock on the market is still very low, especially in Brisbane and Adelaide which are both in the realm of -50 per cent down on the five-year average.

Melbourne is the only capital city where total stock levels sit around that average mark. That normalised supply speaks to the slow rate of growth the city is now experiencing.

For the majority of markets, though, it looks like the supply and demand dynamic is still favouring sellers.

Multi-speed market dynamics play out across the capitals

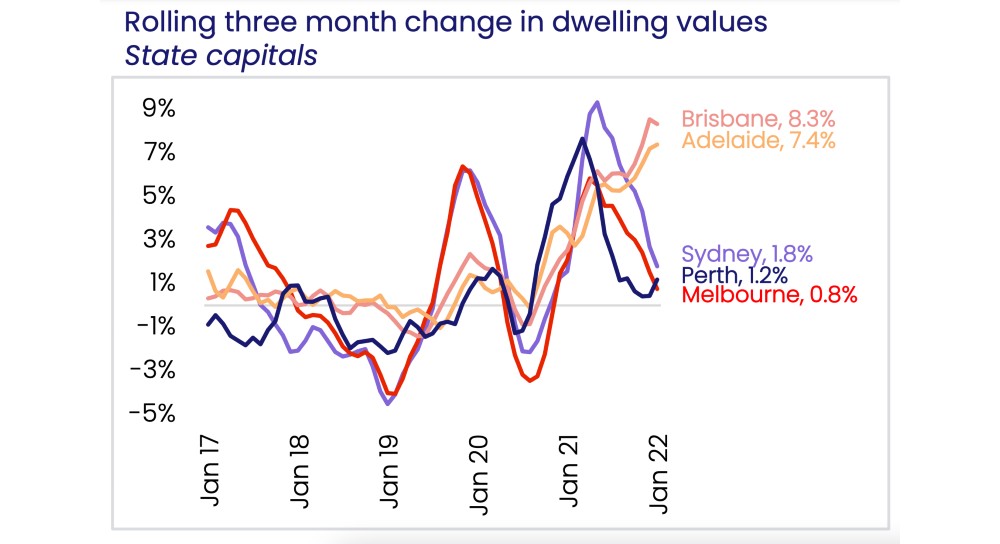

Over the past few months, there has been a clear divergence between capital city markets.

Growth in Sydney and Melbourne, in particular, has slowed substantially, while Brisbane and Adelaide have turned in remarkably strong quarters after experiencing a second wind this cycle.

CoreLogic's research director Tim Lawless explains that "a softening in growth conditions has been influenced by less government stimulus, worsening affordability, rising fixed-term mortgage rates and, more recently, a slight tightening in credit conditions, and a surge in new listings through the final quarter of last year."

The theme of worsening affordability applies especially to Sydney and Melbourne, where the hurdle to save a deposit has become increasingly difficult for many while wage growth remains relatively low.

CoreLogic's report notes that affordability is less of a challenge in Brisbane and Adelaide, two markets that also continue to demonstrate "remarkably low" levels of stock on the market.

The two-speed dynamic between houses and units has also pushed the gap between the two housing types to record levels. The median Australian house now costs +28.3 per cent more than the median unit.

That huge difference may begin to push interest more towards "the more affordable medium-to-high density sector of the market."

Regional markets maintain run of strong growth

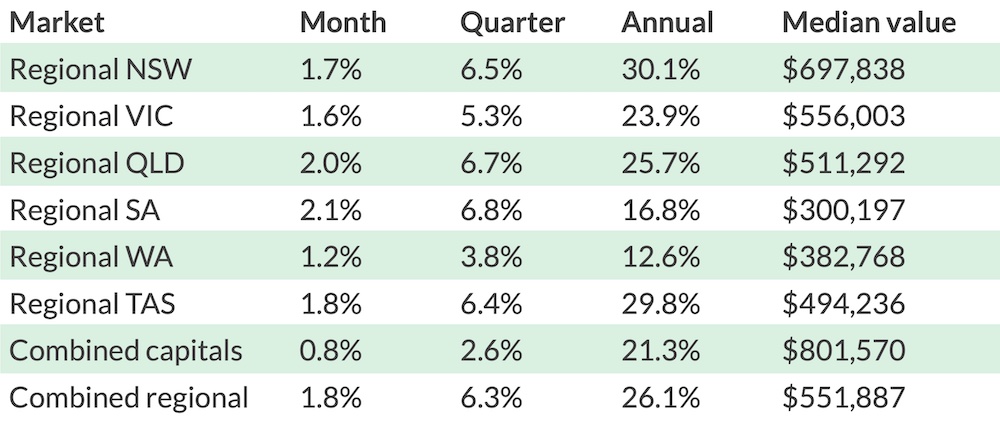

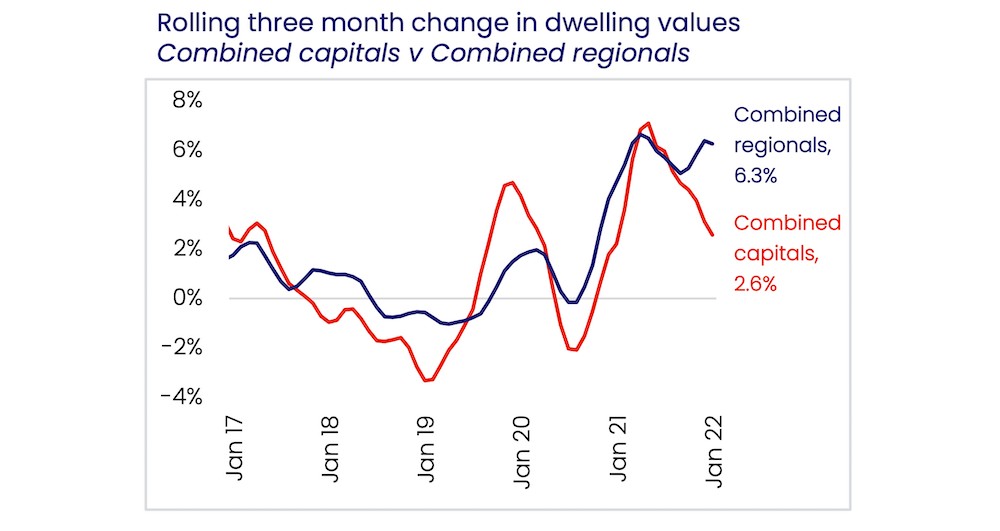

While it remains a mixed bag for the capitals in terms of growth, regional markets have delivered more strong increases across the board.

Like their capital city counterparts, regional QLD and SA have both taken the lead when it comes to monthly growth, but Tasmania, NSW, Victoria and even WA are still delivering big results too.

Looking at annual growth, regional NSW has incredibly seen prices rise +30 per cent in 12 months, with Tasmania right on its heels.

CoreLogic notes that the same low-stock, high-demand dynamic that has been seen since early on in the pandemic remains very much in place for Australia's regional markets.

As capital city growth softens further, the regional boom is maintaining its breakaway streak as the 'race for space' mentality, superior affordability and general lifestyle appeal of regional areas keeps metropolitan buyers fixated.

What's next for the Australian property market?

Looking at the January numbers, the CoreLogic report concludes, "although the housing market is still moving out of the seasonal festive period slowdown, early indicators are showing housing market conditions are starting the year similar to where they finished in 2021."

Essentially, that means property prices are still generally increasing around the country, but at a significantly slower rate than they were at the peak of the boom last year.

The rate of new listings should continue to pick up while affordability pressures in some areas may put a dampener on demand.

"If inventory levels rise and demand reduces, we should start to see vendors and buyers becoming more evenly balanced in the market, reducing the sense of FOMO that has been a key factor in pushing up prices through the pandemic," Mr Lawless explains.

It's expected that there will be further diversity in the market—particularly as Brisbane, Adelaide and some key regional areas continue to surge while others like Sydney and Melbourne experience a substantial slowdown.

Rising inflation may also cause the Reserve Bank of Australia to lift interest rates before the end of the year. If and when that happens, it's forecasted that the housing market will be slowed considerably as a result.

With potential headwinds like rising interest rates, increased stock on the market and ever-worsening affordability, the seller's market conditions we saw throughout 2021 may not last much longer in many parts of the country.

Ultimately, every market and every property is unique. To get a clear picture of what the future might look like as a seller, it's important to speak to a top local agent who fully understands the market you're in.