Sydney, Melbourne prices dip while growth gets a bump elsewhere

With the first quarter of 2022 now wrapped up, some interesting property market trends are emerging.

According to CoreLogic's latest report, price growth in Australia's two biggest cities has come to a standstill, suggesting both markets have well and truly peaked. Elsewhere, gains have seen a surprising boost in March, and there may be more left in the tank.

Find out how all of this will impact sellers this year in our March 2022 national market update.

National property values: March 2022

Houses$805,621Monthly change: +0.8%

Units$614,449Monthly change: +0.3%

The median Australian house price broke through the $800,000 barrier for the first time last month, and nationally the median property rose in value by +0.7 per cent.

While that indicates there's still some serious steam in the market, it's far from being broad-based.

| Market | Month | Quarter | Annual | Median value |

|---|---|---|---|---|

| Sydney | -0.2% | 0.3% | 17.7% | $1,116,889 |

| Melbourne | -0.1% | 0.1% | 9.8% | $805,232 |

| Brisbane | 2.0% | 6.4% | 29.3% | $749,493 |

| Adelaide | 1.9% | 5.7% | 26.3% | $602,717 |

| Perth | 1.0% | 1.9% | 7.0% | $542,338 |

| Hobart | 0.3% | 2.7% | 22.3% | $731,849 |

| Darwin | 0.8% | 1.7% | 10.6% | $494,635 |

| Canberra | 1.0% | 3.1% | 21.6% | $932,704 |

| Combined capitals | 0.3% | 1.5% | 16.3% | $818,307 |

| Combined regional | 1.7% | 5.1% | 24.5% | $577,987 |

| Australia | 0.7% | 2.4% | 18.3% | $738,975 |

Growth in Sydney in Melbourne has ground to a halt in 2022, with both cities recording slight falls in median property prices for March.

Hobart also experienced only modest gains of +0.3 per cent for the month after what was a relatively strong start to the year for the Tasmanian capital.

Every other capital city saw a boost in monthly growth, though. Brisbane and Adelaide, which have both been experiencing a strong second wind, achieved impressive gains of around +2.0 per cent.

The recently reopened Perth is on the rise again, delivering +1.0 per cent growth for March, and Canberra also hit the +1.0 per cent mark to finish a steady and solid quarter.

The regional markets maintained their strong momentum too, turning in another +1.7 per cent increase, with regional SA, Queensland and NSW still the top performers.

Overall, the median Australian home has risen in value by +2.4 per cent, or around $17,000 so far in 2022. That's half the rate seen in Q1 2021.

Even with March boost, the market peak has passed

Despite another surge in price growth last month, particularly in Brisbane and Adelaide, CoreLogic's research director Tim Lawless is convinced that the market has lost the momentum it had in 2021.

"Virtually every capital city and major rest-of-state region has moved through a peak in the trend of growth some time last year or earlier this year," he said.

He pointed to Sydney as the clearest indicator of the trend due to biting affordability, rising listings and falling sales activity.

"There are a few exceptions to the slowdown, with regional South Australia recording a new cyclical high over the March quarter and some momentum is returning to the Perth market where the rate of growth is once again trending higher since WA opened its borders."

Although peak growth may be in the past for most markets, conditions still look favourable to sellers in a number of cities and regions.

Mr Lawless noted that the volume of housing sales has in fact increased in Brisbane and Adelaide when compared to 12 months ago, suggesting that buyer demand remains very strong.

New listings are still dictating each market's growth

The contrast in performance seen between different cities and regions clearly matches up with how much, or how little, supply is available in those different markets.

On a national level, total available listings remain -30 per cent below the five-year average. While that number continues to shrink as more stock becomes available, it still doesn't tell the whole story.

Over the past 12 months, total advertised supply in Sydney and Melbourne has risen significantly. Melbourne listings are now +8 per cent above the five-year average for the city, while Sydney is just -2.6 per cent below that average.

"With higher inventory levels and less competition, buyers are gradually moving back into the driver's seat," Mr Lawless explained.

"That means more time to deliberate on their purchase decisions and negotiate on price."

On the other hand, listings in Brisbane and Adelaide are both more than -40 per cent below the five-year average, indicating extremely tight markets where new stock can't keep up with buyer demand.

The same dynamic applies in Australia's most sought-after regional markets, and as long as that supply-and-demand imbalance continues, upward pressure on prices should continue.

A tight rental market could reignite investor activity

Another major shift to come out of the last quarter is an ever-tightening rental market.

SQM Research figures show rental vacancy rates have hit a 16-year low, and that number continues to drop.

SQM's managing director Louis Christopher said "Given a dramatic tightening in vacancy rates, we are seeing an ongoing acceleration in weekly market rents across the capital cities. This situation now represents a significant rental crisis across the country."

While this is bad news for renters, it presents a strong opportunity for investors.

Rents are rising fast as a result of inflation and increased rental competition. At the same time, interest rates have remained at record lows, meaning higher overall rental yields.

Unless interest rate hikes keep up with inflation, those yields will continue to rise, and that may entice investors into the market in a big way.

It could also pressure some renters to make the leap and buy property in order to escape the cycle of ever-increasing rental costs. If more investors and first home buyers are becoming active in the market, that's a positive for sellers.

What's next for the Australian property market?

Where in 2021 there was a practically uniform housing boom—the rising tide that lifted all ships—this year we're looking at a more fractured Australian property market.

Even so, there are a number of factors that are set to impact things on a national scale over the coming months.

In terms of those factors pressing against price growth, the prospect of rising interest rates remains one of the biggest.

Inflation is rising, creating cost of living pressures that are hitting across the country, and housing affordability is already a major struggle. With less disposable income and mortgage costs on the up, buyers will be more restricted in what they can offer.

Combining that with steadily increasing supply and worsening consumer sentiment, the overall pressures against price growth look strong.

On the other hand, though, the Australian economy is in a good place. Unemployment is at historic lows, immigration is set to ramp up, and a new offering of first home buyer incentives could entice some fresh faces to the market.

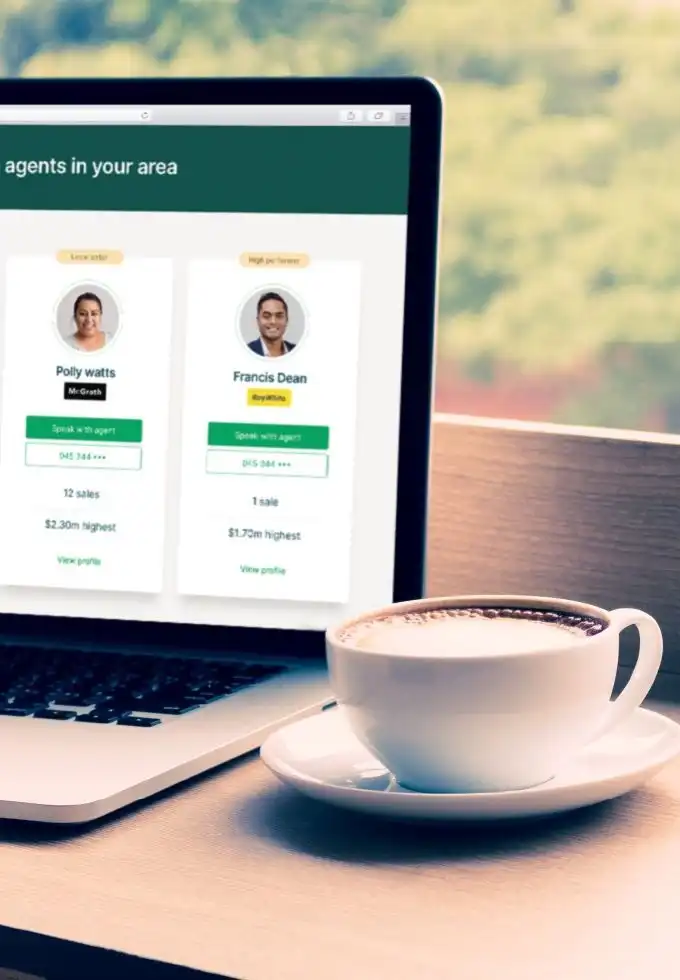

With an uncertain 12 months ahead, there's a lot to consider for sellers. Understanding your local market is critical, and speaking to a top agent in your area is one of the best ways to fully grasp the local dynamic.