QLD property powers ahead as investors target the state

Unlike some of its East Coast neighbours, Queensland has been spared much of the Delta outbreak devastation in recent months, and that's paved the way for a strong launch into the spring selling season.

Houses in Brisbane have soared so far this year, up nearly $115,000 since the beginning of January according to CoreLogic—an increase of more than $3,300 per week over eight months—and there are few signs of slowing.

Houses in regional Queensland have also shot up +15.6 per cent in 2021, and units are following close behind at +14.6 per cent.

So what does all of this mean for what's to come in the warmer months?

Brisbane market update

| Houses | Units |

|---|---|

| $691,214 | $425,777 |

| Monthly change: +2.1% | Monthly change: +1.4% |

Brisbane's median home value jumped up an even +2.0 per cent in August to $612,377, making it one of the strongest performing capital markets.

Houses in the capital are edging towards the $700,000 median barrier, while units, which have performed more modestly so far this year, are now picking up the pace too.

According to SQM Research, new listings fell -9.5 per cent for the month, likely due to Covid-related hesitation from sellers, yet total stock on the market fell by an even larger -10.3 per cent, indicating that buyer demand is still outstripping supply.

Auction clearance rates also sat comfortably above 70 per cent throughout August, when 12 months ago they were suffering below 50 per cent, so things are looking particularly healthy in terms of sales.

Westpac's latest Housing Pulse report points out that "the recent announcement that Brisbane will host the 2032 Olympic gains may well be creating a 'halo effect' for what is already a strong market."

As long as Queensland manages to keep Covid at bay, it looks like it should be a positive spring selling season ahead.

Regional QLD market update

| Houses | Units |

|---|---|

| $466,575 | $445,845 |

| Monthly change: +1.4% | Monthly change: +1.7% |

August has seen another strong performance from Queensland's regional destinations, especially the Sunshine Coast and Gold Coast, as more out of towners flock to brighter shores.

The median home value in regional Queensland jumped up another +1.5 per cent to $461,073, demonstrating a staggering +20.8 per cent gain over the past 12 months.

Units have continued to slightly outperform houses for the quarter, and the two property types are now almost neck and neck in terms of value.

According to REA Insights, new listings in the regions have seen a far less substantial drop than Brisbane of -0.5 per cent, suggesting that vendors are still looking to take advantage of the strong selling conditions while Covid disruptions are minimal.

It's also worth noting that REA found the number of views per listing has risen significantly, up +12.9 per cent in July across the state. That's +69.1 per cent higher than 12 months prior, so interest in Queensland property continues to gather steam.

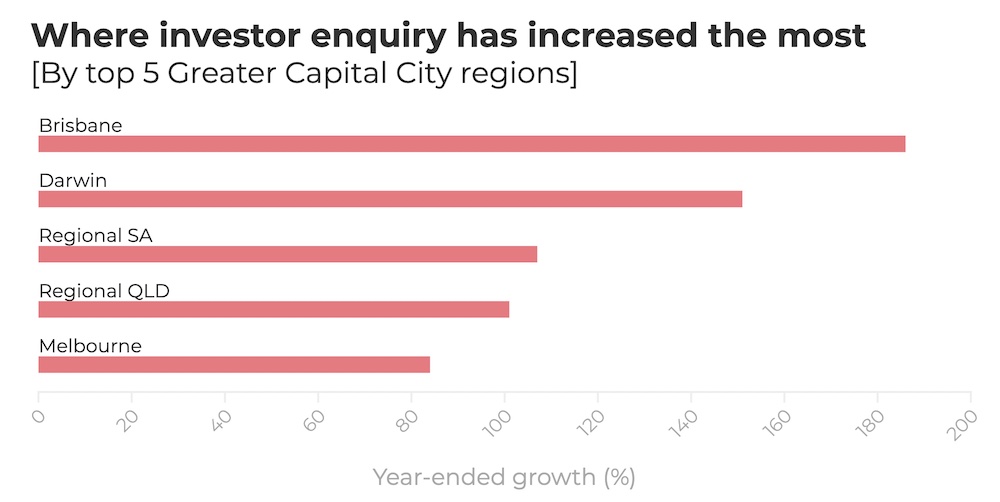

Investor activity is surging across the state

Owner-occupiers aren't the only ones jumping into action, and much of the country's recent investor resurgence is being focused within the Sunshine State.

According to REA Insights, Greater Brisbane and nearby regional destinations are seeing very strong levels of interest from investors.

Specifically, Logan, Moreton Bay, Ipswich and North Brisbane are the highest growth regions for investor enquiry, and it's not just houses that are being sought after either.

While pockets of Brisbane have been stigmatised by oversupply issues in the past, units now seem to be back in favour. Enquiries on North Brisbane units are up +400 per cent year on year, with south and inner Brisbane also surging up +200 per cent.

That's backed up by ABS data that shows new investor lending has more than doubled in the state since March 2020.

Along with interstate buyers looking to migrate north for a lifestyle improvement and Queenslanders themselves upgrading within the state, the soaring rates of investor activity indicate there's more strong growth to come.

What's next for the Brisbane and QLD markets?

Covid outbreaks of the past few months have brought uncertainty to Australia's property markets, but as we enter spring CoreLogic says there's already evidence that listing numbers are beginning to ramp up in Queensland.

The Reserve Bank of Australia confirmed for another month that interest rates won't be moving up from their record lows any time soon, so buyers continue to operate with confidence knowing that money's cheap.

Affordability constraints have been identified as one of the key reasons this year's boom has eased in recent months, however, this issue is mostly affecting the Sydney, Melbourne and Canberra markets. In fact, this may be assisting the Queensland market, as those priced out of the other major cities seek more affordable options elsewhere.

Between the typical seasonal uplift, low interest rates, burgeoning investor activity and continually strong interstate interest in Queensland property, there are few signs that growth will be curbed.

It's looking like more prosperous times are ahead for sellers in the Sunshine State.