Darwin property market news - key takeaways

- Strong price growth: Darwin's dwelling values have surged by 15.4 per cent over the past year, leading the pack among Australian capitals, according to Cotality’s latest figures.

- Demand outstrips supply: The Darwin property market is feeling the squeeze, with listings 50 per cent below average. This supply-demand imbalance is driving up prices, as highlighted by Cotality data.

- Quick sales: Properties in Darwin are flying off the market, with days on market dropping significantly due to high demand and limited supply.

- Rental market strength: Darwin is at the forefront of rental growth. House rents have climbed 7.6 per cent, while unit rents have jumped 10 per cent over the past year. SQM data shows a tight rental market with a low vacancy rate of 0.7 per cent.

- Stable interest rates: The Reserve Bank of Australia has kept the cash rate steady at 3.60 per cent, ensuring stable borrowing costs. This decision bolsters confidence in the Darwin property market, although future rate cuts seem unlikely.

Get a free property value estimate

Find out how much your property is worth in today’s market.

Darwin property price movements

The Darwin property market is on the rise, with dwelling values showing notable increases over the past year. This growth is mainly due to local economic factors, an increase in investor activity due to the city's relative affordability, and a limited supply of available properties, which have pushed prices higher.

Darwin property prices - October 2025

In October 2025, Darwin's property prices continued to climb, with a monthly increase of +1.6 per cent. Over the quarter, values rose by +5.4 per cent, and annually, the growth was an impressive +15.4 per cent. The median value for properties in Darwin reached $564,473.

| Property type | Month change | Quarter change | Annual change | Current median price |

|---|---|---|---|---|

| All Darwin dwellings | 1.6% | 5.4% | 15.4% | $564,473 |

Source: Cotality

The Darwin property market has been supported by a strong local economy and a noticeable supply-demand imbalance. The city's affordability compared to other capitals continues to draw buyers, contributing to the ongoing rise in property values.

House prices in Darwin

Darwin's housing market saw a monthly increase of +1.3 per cent in October 2025. Over the quarter, house values increased by +5.2 per cent, and annually, the growth was +16.7 per cent. The median house price in Darwin was $671,904.

| Property type | Month change | Quarter change | Annual change | Current median price |

|---|---|---|---|---|

| Darwin houses | 1.3% | 5.2% | 16.7% | $671,904 |

Source: Cotality

The Darwin housing market is benefiting from strong investor interest and a shortage of available listings, which has kept upward pressure on prices. The combination of a steady cash rate and local economic factors has bolstered the Darwin housing market, making it an appealing choice for buyers.

Unit prices in Darwin

Unit prices in Darwin saw a significant monthly increase of +2.2 per cent in October 2025. Over the quarter, unit values rose by +5.9 per cent, and the annual growth was +12.7 per cent. The median value for units in Darwin was $412,266.

| Property type | Month change | Quarter change | Annual change | Current median price |

|---|---|---|---|---|

| Darwin units | 2.2% | 5.9% | 12.7% | $412,266 |

Source: Cotality

The Darwin unit market is experiencing strong growth, driven by high rental yields and investor demand. With gross rental yields for units at 7.7 per cent, Darwin unit prices are attracting both investors and first-home buyers looking for more affordable options compared to houses.

Darwin property market forecasts 2026

Australia’s big four banks regularly release house price forecasts to guide mortgage-lending decisions, manage risk, and demonstrate their market expertise. Here's a look at what they expect for 2026.

| Market | CBA forecast 2026 | Westpac forecast 2026 | NAB forecast 2026 | ANZ forecast 2026 |

|---|---|---|---|---|

| National | 4.0% | 4.0% | 4.1% | 5.8%* |

| Sydney | 3.0% | 5.0% | 4.2% | 5.3% |

| Melbourne | 2.0% | 3.5% | 3.9% | 6.2% |

| Brisbane | 5.0% | 4.5% | 4.6% | 4.3% |

| Adelaide | 5.0% | 3.0% | 4.1% | 2.5% |

| Perth | 6.0% | 4.0% | 3.7% | 4.3% |

| Hobart | 2.0% | 2.0% | 3.6% | 1.8% |

| Darwin | 5.0% | NA | 3.7% | 2.4% |

| Canberra | 3.0% | NA | 2.8% | 1.6% |

Source: Westpac Housing Pulse, NAB Residential Property Survey, CBA Economic Update, ANZ Housing Outlook.

* ANZ estimate for Capital Cities, not national

Darwin is set to outpace other capital cities in terms of growth. These Darwin property market predictions suggest a notable price increase, fuelled by strong local economic conditions and a limited housing supply.

Darwin home price forecasts 2026

NAB anticipates Darwin property prices will climb by about +3.7 per cent in 2026, while CBA expects a +5 per cent rise. ANZ, on the other hand, forecasts a more moderate growth of +2.4 per cent. These predictions are shaped by Darwin's unique market factors, including high housing demand and limited supply.

The stable cash rate is also likely to attract investors, further boosting prices. However, potential buyers should be mindful of ongoing supply constraints that could restrict property availability.

RBA cash rate forecast 2025-2026

The Reserve Bank of Australia (RBA) held its cash rate steady at 3.60 per cent on 5 November 2025, following three 0.25-per-cent cuts earlier in the year. This decision came as inflation unexpectedly rose, with the RBA’s preferred trimmed-mean measure reaching 3.0 per cent, the upper limit of its 2–3 per cent target band, and headline CPI running at 3.5 per cent annually. This left no room for another rate cut in 2025. Initially, major bank economists had anticipated a November cut, but revised their expectations when inflation figures increased, accurately predicting the RBA would maintain the current rate.

Here’s where the major banks see the cash rate heading next:

- Commonwealth Bank (CBA): Expects no further cash rate cuts in this cycle, maintaining the rate at 3.60 per cent into 2026.

- Westpac: Also anticipates no cuts for the rest of 2025, but forecasts a 0.25-per-cent cut in May 2026 and another in August 2026, reducing the cash rate to 3.10 per cent by late next year.

- National Australia Bank (NAB): Predicts no additional cuts in 2025, with a 25-basis-point cut in May 2026, lowering the cash rate to 3.35 per cent by mid-2026.

- ANZ: Similarly foresees no more cuts in 2025, with the next move being a 0.25-per-cent cut in February 2026, taking the cash rate to 3.35 per cent at the start of 2026.

What this means for the Darwin market

Darwin has made significant strides in 2025, with prices rising over +15 per cent year-on-year, finally reaching past peaks. The RBA’s steady rate is encouraging investor activity, and severe supply shortages are adding to price pressures. Historically more influenced by local economic cycles than rates, Darwin is currently benefiting from both improved sentiment and stronger fundamentals. The pause provides room for the rally to continue and could support further gains into 2026.

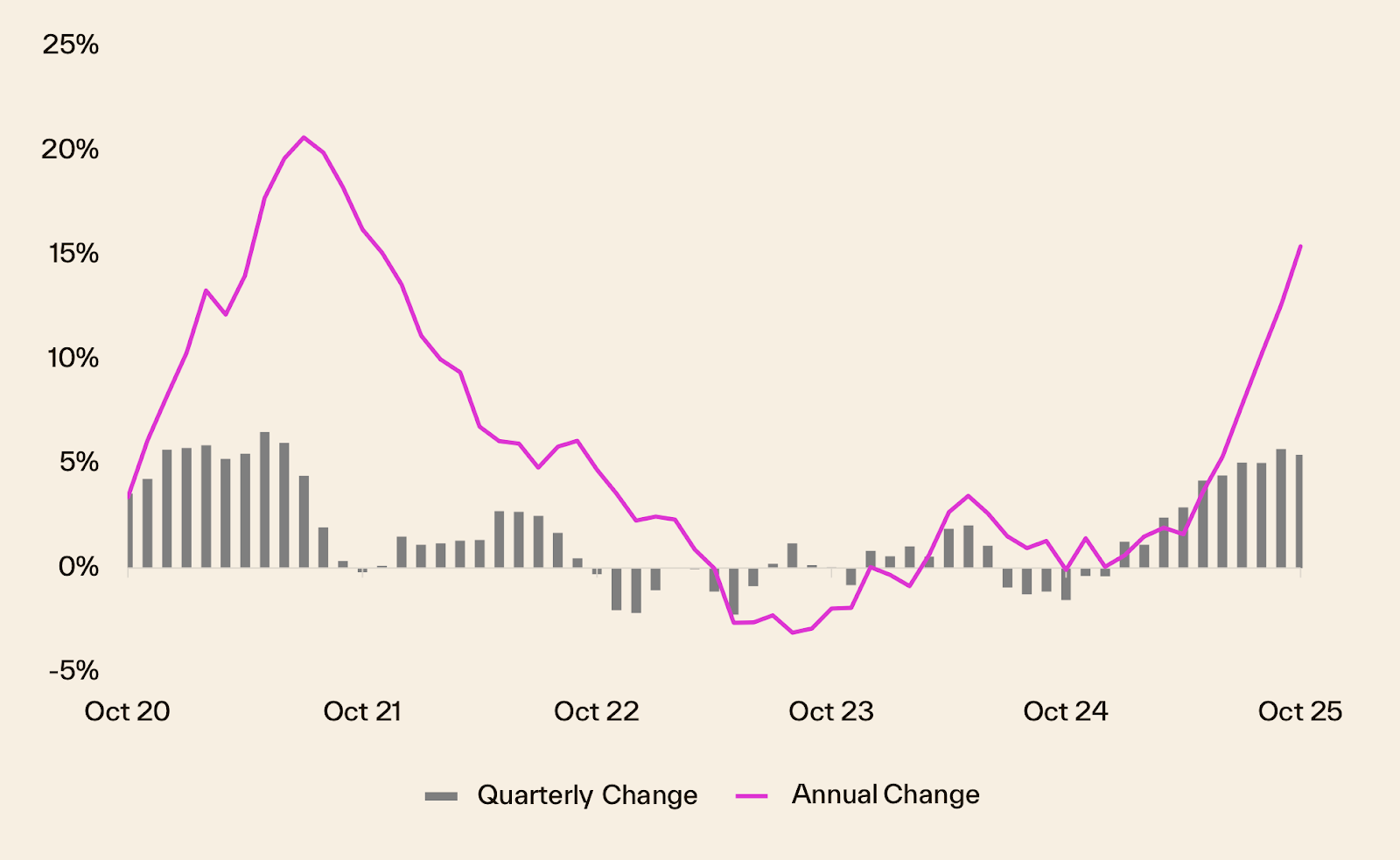

Darwin house prices graphs and charts

Darwin's house price growth over the last 5 years has been remarkable. As of November 2025, dwelling values increased by +1.6 per cent in October 2025, showing ongoing rapid growth. Over the quarter, values jumped +5.4 per cent, and Darwin housing prices are now +15.4 per cent higher than a year ago. This marks the strongest annual growth of any capital city.

The five-year chart highlights Darwin's transition from a period of decline to becoming one of Australia's fastest-growing property markets by 2025. According to Cotality, key drivers of this resurgence include investor interest, spurred by lower entry prices and strong rents, as well as some population gains. The local economy has seen growth, particularly in the resources and defence sectors, while housing supply remains tight.

Darwin property price growth over the last 10 years has been shaped by significant fluctuations. The market faced a prolonged downturn before 2020, but the COVID period triggered a turnaround. Darwin's affordability and high rental yields attracted investors, and the market was less impacted by the 2022 interest rate hikes compared to larger cities. This resilience, along with a tight rental market, supported price growth.

Today, Darwin homeowners are optimistic as their assets gain value, finally recovering from a lost decade. The market has shifted to a seller's market, with not enough homes for everyone who wants one. Renters, however, are feeling the squeeze of higher rents and limited options, motivating some to buy if they can gather a deposit. The expectation of future interest rate cuts by the RBA is likely to further boost buyer demand.

Darwin selling statistics

Darwin's property market is buzzing, with a noticeable jump in sales volume compared to last year. This rise in sales comes alongside a drop in the number of days properties stay on the market, pointing to strong demand and quicker sales in the housing sector.

Darwin sales volume and days on market

Sales in Darwin have soared by +57.7 per cent over the past year, showing incredibly robust market demand. At the same time, the median days on market have fallen from 51 days to 39 days. This indicates a more dynamic market where properties are selling faster than before.

| Darwin sales volume | Darwin days on market |

|---|---|

| 57.7% Change from 12mo ago | 39 days 55 days 12 mo ago |

Source: Cotality

The sharp reduction in days on market suggests buyers are acting quickly, possibly due to competitive pricing or limited stock. Compared to the national median of 30 days, Darwin's faster turnover highlights its unique market conditions. This trend is different from cities like Sydney, where properties take longer to sell, indicating a more balanced or slower market there.

Darwin new and total listings

Darwin has seen a -10.2 per cent drop in new listings and a significant -44.7 per cent decrease in total listings year-on-year.

| Darwin new listings | Darwin total listings |

|---|---|

| -10.2% Change from 12mo ago | -44.7% Change from 12mo ago |

Source: Cotality

The steep decline in total listings could be due to high buyer demand outpacing the supply of new properties entering the market. This scarcity might be driving quicker sales and could lead to increased competition among buyers, potentially pushing prices higher.

Darwin vendor discount

Vendor discount refers to the percentage difference between the initial asking price and the actual sale price, offering insight into the bargaining power buyers enjoy. It’s a key indicator because tighter discounts imply that sellers are standing firm on price, whereas wider discounts suggest a softer market and potentially more aggressive bargaining.

| Oct 2025 | Sep 2025 | Aug 2025 | Jul 2025 | |

|---|---|---|---|---|

| Darwin median vendor discount | -2.7% | -2.9% | -3.5% | -3.3% |

Source: Cotality

In Darwin, the vendor discount is at -2.7 per cent, which is relatively low compared to other capitals like Hobart, where discounts are wider. This narrow discount indicates that sellers in Darwin are achieving closer to their asking prices, reflecting strong buyer interest and possibly limited room for negotiation.

Get a deeper insight into how Darwin sellers are faring in 2025 and what could be on the horizon for the remainder of the year with some of our latest articles.

Darwin property investing

Darwin's rental market is in a dynamic phase, marked by strong demand and limited supply. This has led to significant rent increases over the past year, creating challenges for renters but offering potential gains for investors. Below, we delve into the statistics on rental rates, yields, and vacancy trends to provide a comprehensive view of Darwin's current market conditions.

Darwin rental market

Rental rates in Darwin have surged, with the city recording the highest annual increase in rents among the capitals. House rents have risen by 7.6 per cent, while unit rents have jumped by 10 per cent over the past year.

| Location | Rental rates | Rental yield | Annual change in rents, houses | Annual change in rents, units |

|---|---|---|---|---|

| National | 4.6% | 3.60% | NA | NA |

| Combined Capitals | 4.0% | 3.40% | NA | NA |

| Combined Regional | 6.1% | 4.30% | NA | NA |

| Sydney | 4.0% | 3.00% | 3.40% | 5.00% |

| Melbourne | 1.8% | 3.60% | 1.60% | 2.20% |

| Brisbane | 5.8% | 3.50% | 5.60% | 6.50% |

| Adelaide | 3.6% | 3.60% | 3.70% | 3.10% |

| Perth | 5.8% | 4.00% | 5.70% | 6.90% |

| Hobart | 6.9% | 4.40% | 6.80% | 7.70% |

| Darwin | 8.5% | 6.40% | 7.60% | 10.00% |

| Canberra | 2.9% | 4.00% | 2.80% | 3.40% |

Source: Cotality

Darwin continues to offer attractive rental yields, standing at 7.7 per cent for units, the highest among the capital cities. The rental market is driven by a significant imbalance between supply and demand. Darwin's affordability compared to other capitals has attracted a steady influx of residents, further fueling demand. However, limited new supply has kept vacancy rates low, adding pressure on rents.

Darwin vacancy rates

Vacancy rates are a crucial indicator of the rental market's health, reflecting the balance between supply and demand. Nationally, vacancy rates have remained tight, with the national average holding at 1.2 per cent. This trend indicates a generally undersupplied market, with most capitals experiencing low vacancy levels.

| Location | Oct 2025 vacancy rates | Oct 2025 vacancies | Oct 2024 vacancy rates | Oct 2024 vacancies |

|---|---|---|---|---|

| National | 1.20% | 36152 | 1.20% | 36486 |

| Sydney | 1.30% | 9553 | 1.50% | 10874 |

| Melbourne | 1.80% | 9713 | 1.70% | 9052 |

| Brisbane | 1.00% | 3391 | 1.00% | 3580 |

| Adelaide | 0.80% | 1215 | 0.60% | 915 |

| Perth | 0.70% | 1304 | 0.50% | 998 |

| Hobart | 0.40% | 107 | 0.60% | 179 |

| Darwin | 0.70% | 181 | 1.40% | 349 |

| Canberra | 1.40% | 860 | 1.70% | 1059 |

Source: SQM Research

Darwin's vacancy rate has dropped significantly over the past year, from 1.4 per cent to 0.7 per cent, according to SQM Research. This sharp decline highlights the city's strong demand and limited rental stock. Compared to other capitals, Darwin's vacancy rate remains among the lowest, indicating a highly competitive market for tenants. The city's rental market conditions are expected to remain tight unless there is a substantial increase in new housing supply.

Louis Christopher, Managing Director of SQM Research said in his latest rental market report

“The national vacancy rate holding at 1.2% suggests the rental market remains very tight, with little sign of meaningful supply increases. Sydney and Brisbane continue to see strong tenant demand, while Hobart remains at near record-low vacancy levels. Rents are still rising in most capitals, particularly for houses, despite a slight easing in rental growth rates compared to last year. Overall, we are still seeing an undersupplied rental market, although conditions appear to be stabilising in some cities such as Melbourne and Canberra.”

While Darwin is not mentioned explicitly in Louis’s comments, his broader message about tight national conditions aligns with the city’s vacancy rate of 0.7 per cent in October 2025, down from 1.4 per cent a year earlier. Vacancies have nearly halved over the year, dropping from 349 to 181, even as they have nudged slightly higher since September, suggesting demand has absorbed much of the available stock.

This sharp year-on-year tightening places Darwin firmly in the group of markets where renters have little bargaining power and landlords can still command strong rents. Unless supply steps up meaningfully, any modest seasonal lift in vacancies is likely to be short-lived.

Highest growth areas in Darwin

| Rank | SA3 Name | SA4 Name | Median Value | Annual % Change |

|---|---|---|---|---|

| 1 | Palmerston | Darwin | $581,589 | 22.3% |

| 2 | Darwin Suburbs | Darwin | $587,065 | 11.6% |

| 3 | Darwin City | Darwin | $480,591 | 9.7% |

- Palmerston leads the way in Darwin's growth areas. With a median value of $581,589, it boasts an impressive annual growth of +22.3 per cent as of October 2025. This growth is fuelled by affordable land, proximity to job centres, and major infrastructure projects.

- Darwin Suburbs comes in second, with a median value of $587,085 and an annual growth of +16 per cent. The area is in demand thanks to its coastal amenities, significant infrastructure, and a tight rental market.

- Darwin City ranks third, with a median value of $480,591 and an annual growth of +9.7 per cent. The city's ongoing urban projects and vibrant lifestyle make it attractive to both residents and investors.