Hobart property market news - key takeaways

- Price growth: Hobart home values edged up by +0.3 per cent in October, which is below the national average increase of +1.1 per cent. This suggests a gradual recovery from earlier declines, with the market still 8.9 per cent below the peak levels of March 2022, according to Cotality’s latest data.

- Supply constraints: Cotality’s data shows Hobart is facing a drop in advertised stock levels, with inventory down 31 per cent compared to last year and nearly 15 per cent below the previous five-year average. This limited supply is helping to support price growth.

- Selling conditions: Hobart’s market is marked by low supply, 17 per cent below the five-year average. This scarcity is likely to bolster stronger growth in the future.

- Rental market: Hobart’s rental market remains tight, with a vacancy rate of just 0.4 per cent as of October 2025, down from 0.6 per cent a year earlier. This low vacancy rate suggests limited options for renters, according to SQM Research.

- Interest rates: The RBA has kept the cash rate steady at 3.60 per cent, following earlier cuts this year. This decision, driven by inflation concerns, is expected to maintain current borrowing conditions without further rate reductions in 2025.

Get a free property value estimate

Find out how much your property is worth in today’s market.

Hobart property price movements

The Hobart property market is on the mend, with home values inching up after earlier declines. While the recovery is gradual, the market remains more affordable than its peak in March 2022, offering potential opportunities for buyers.

Hobart property prices - October 2025

In October, Hobart's property values nudged upwards, continuing their slow recovery. The median value for properties in Hobart rose by +0.3 per cent over the month, contributing to a quarterly increase of +0.5 per cent and an annual rise of +2.4 per cent.

| Property type | Month change | Quarter change | Annual change | Current median price |

|---|---|---|---|---|

| All Hobart dwellings | 0.3% | 0.5% | 2.4% | $686,262 |

Source: Cotality

Over the past year, Hobart's property values have shown resilience, with a steady annual increase of +2.4 per cent. The current median property value stands at $686,262, reflecting a positive market sentiment.

House prices in Hobart

Hobart house prices have been on a consistent upward path, with a monthly increase of +0.5 per cent in October. This growth has resulted in a quarterly change of +0.5 per cent and an annual increase of +2.4 per cent.

| Property type | Month change | Quarter change | Annual change | Current median price |

|---|---|---|---|---|

| Hobart houses | 0.5% | 0.5% | 2.4% | $735,326 |

Source: Cotality

The Hobart housing market continues to recover, with house prices now at a median value of $735,326. This reflects a stable market environment, with the Hobart house prices showing resilience despite previous downturns.

Unit prices in Hobart

In contrast to houses, Hobart unit prices saw a slight dip of -0.2 per cent in October. However, the quarterly change remained positive at +0.6 per cent, with an annual increase of +2.6 per cent.

| Property type | Month change | Quarter change | Annual change | Current median price |

|---|---|---|---|---|

| Hobart units | -0.2% | 0.6% | 2.6% | $558,932 |

Source: Cotality

Hobart unit prices are currently at a median value of $558,932. Despite the recent monthly decline, the annual growth indicates a recovering market, with unit prices benefiting from increased rental yields and demand.

Hobart property market forecasts 2026

Australia's major banks regularly release house price forecasts to guide mortgage-lending decisions, manage risk, and demonstrate their market expertise. Here's what they predict for 2026.

| Market | CBA forecast 2026 | Westpac forecast 2026 | NAB forecast 2026 | ANZ forecast 2026 |

|---|---|---|---|---|

| National | 4.0% | 4.0% | 4.1% | 5.8%* |

| Sydney | 3.0% | 5.0% | 4.2% | 5.3% |

| Melbourne | 2.0% | 3.5% | 3.9% | 6.2% |

| Brisbane | 5.0% | 4.5% | 4.6% | 4.3% |

| Adelaide | 5.0% | 3.0% | 4.1% | 2.5% |

| Perth | 6.0% | 4.0% | 3.7% | 4.3% |

| Hobart | 2.0% | 2.0% | 3.6% | 1.8% |

| Darwin | 5.0% | NA | 3.7% | 2.4% |

| Canberra | 3.0% | NA | 2.8% | 1.6% |

Source: Westpac Housing Pulse, NAB Residential Property Survey, CBA Economic Update, ANZ Housing Outlook.

* ANZ estimate for Capital Cities, not national

Hobart's property market predictions suggest slower growth compared to other capital cities. While the national trend points to a moderate increase, Hobart's growth is expected to be more restrained, reflecting its unique market conditions.

Hobart home price forecasts 2026

Westpac anticipates a +2 per cent rise in Hobart property prices for 2026. NAB is slightly more optimistic, predicting a +3.6 per cent increase. ANZ forecasts a smaller growth of +1.8 per cent. These predictions indicate that while Hobart's market is stabilising, it may not see the same growth levels as other capitals. Factors like affordability challenges and slower population growth are likely influencing these forecasts.

RBA cash rate forecast 2025-2026

The Reserve Bank of Australia (RBA) held its cash rate steady at 3.60 per cent on 5 November 2025, following three 0.25-per-cent cuts earlier in the year. This decision came after inflation unexpectedly rose, with the RBA’s preferred trimmed-mean measure reaching 3.0 per cent and headline CPI at 3.5 per cent annually, leaving no room for another rate cut in 2025. Initially, major bank economists expected a November cut, but they revised their predictions when inflation figures increased, correctly anticipating the RBA would maintain the rate.

Here’s where the major banks see the cash rate heading next:

- Commonwealth Bank (CBA): Expects no further cash rate cuts in this cycle, maintaining the rate at 3.60 per cent into 2026.

- Westpac: Predicts no cuts for the rest of 2025, but forecasts a 0.25-per-cent cut in May 2026 and another in August 2026, reducing the cash rate to 3.10 per cent by late next year.

- National Australia Bank (NAB): Foresees no additional cuts in 2025, with a 25-basis-point cut in May 2026, lowering the cash rate to 3.35 per cent by mid-2026.

- ANZ: Also anticipates no more cuts in 2025, with the next move being a 0.25-per-cent cut in February 2026, bringing the cash rate to 3.35 per cent at the start of 2026.

What this means for the Hobart market

Hobart’s market has stabilised after a sharp decline, with prices now inching higher—up just over +2 per cent annually. The RBA's decision to hold the rate has provided a floor under the decline but hasn't sparked a significant resurgence. Affordability remains a challenge, and population growth has slowed. While Hobart historically surged during low-rate periods, it now seems to be in a holding pattern. The pause helps sentiment, but deeper cuts or new demand drivers may be needed to trigger a stronger upswing.

Hobart house prices graphs and charts

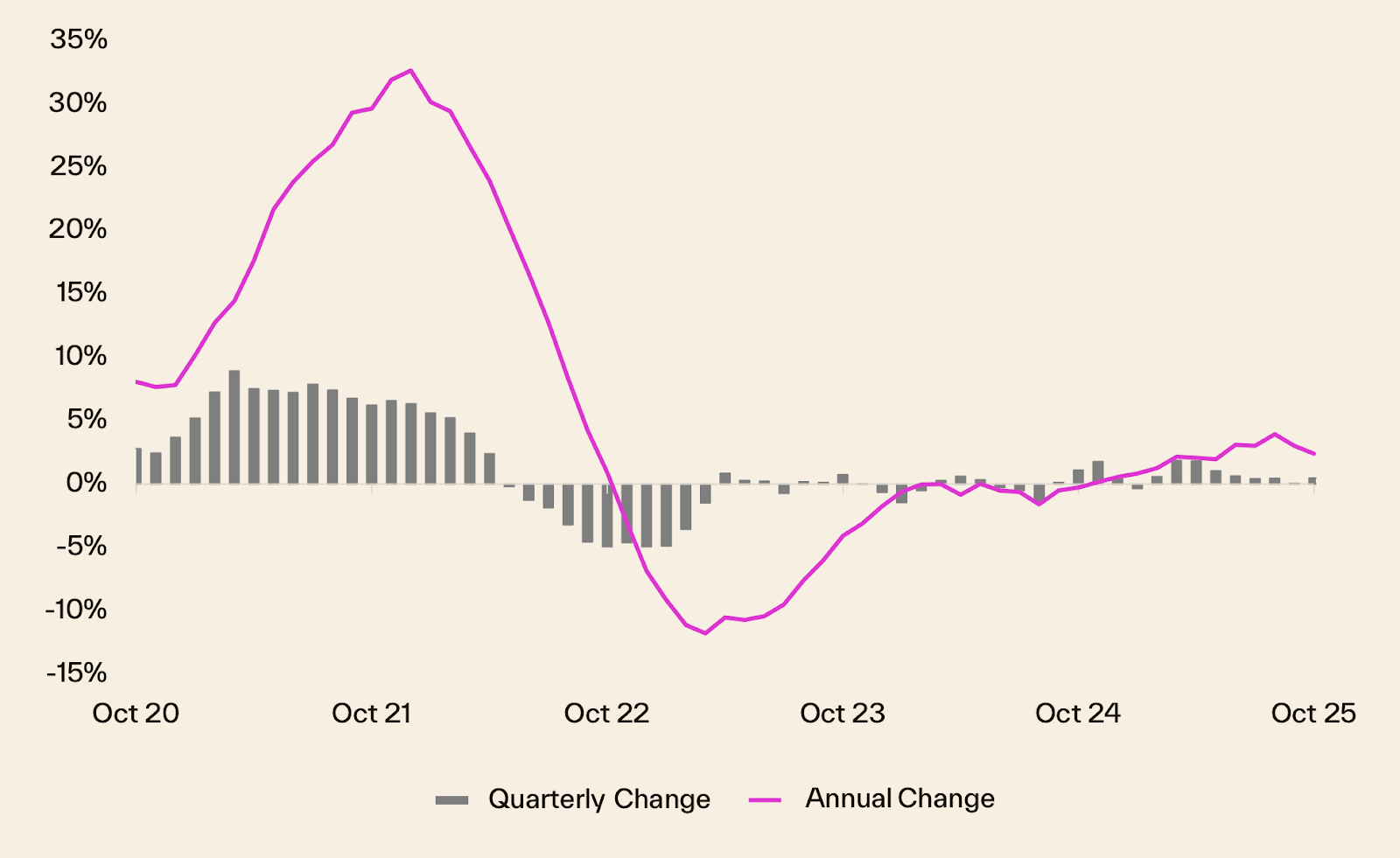

Hobart's house price growth over the last 5 years has seen a significant boom, followed by a correction and a gradual recovery. As of October 2025, dwelling values have risen by +0.3 per cent over the month, +0.5 per cent over the quarter, and are +2.4 per cent higher than a year ago. However, they are still about -8.9 per cent below their March 2022 peak.

The five-year chart shows that after a dramatic rise in 2021, Hobart faced a downturn as interest rates increased, leading to a slow recovery. According to Cotality's data, despite some minor upticks, prices remain well below their peak, unlike other capitals that have reached new highs.

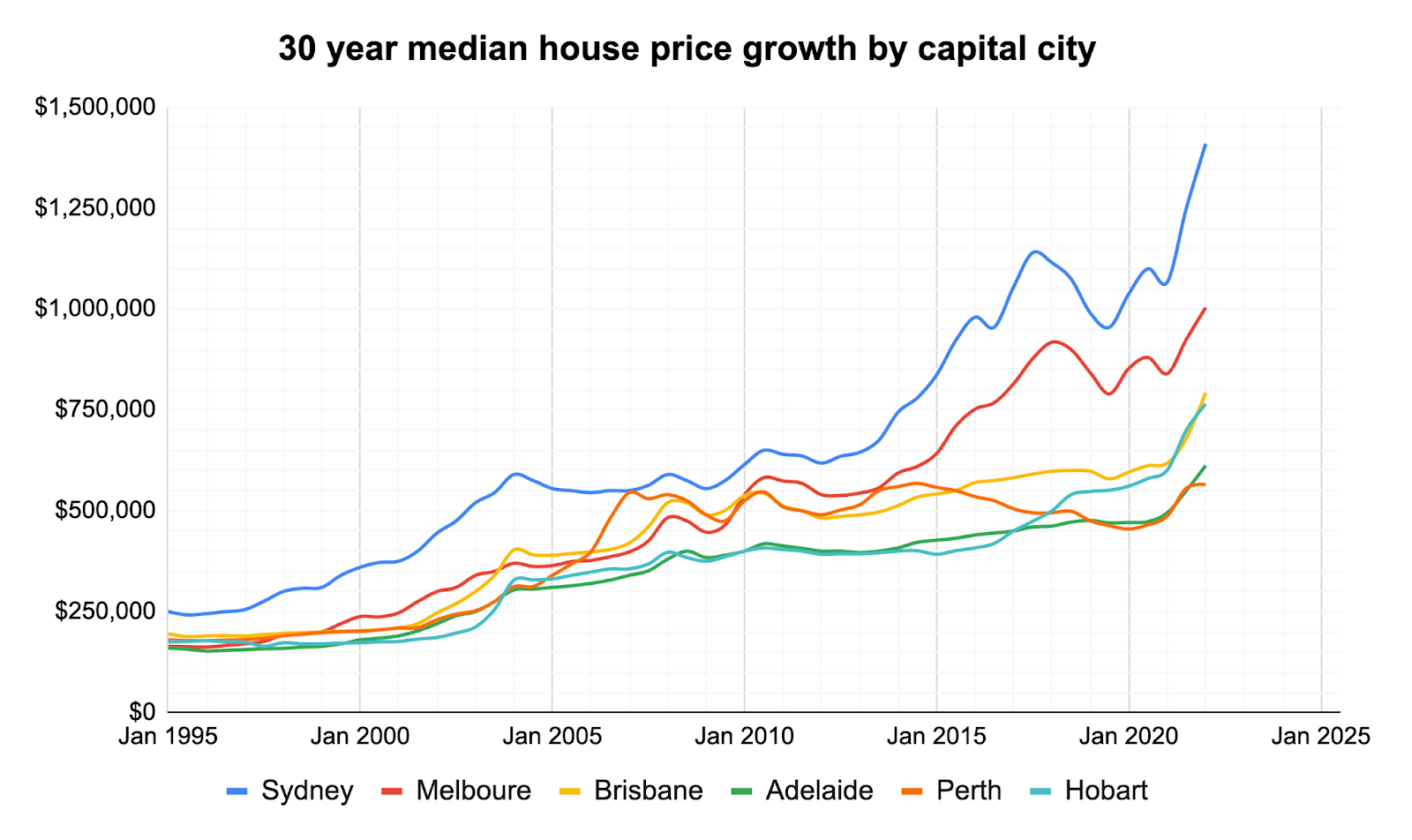

Hobart property prices graph over 30 years

Hobart property prices growth over the last 10 years has been remarkable, with values nearly doubling from 2012 to 2022 due to migration and undersupply. Recent market conditions indicate a shift from the rapid appreciation of the past decade. The market has stabilised, with homeowners feeling cautiously optimistic as interest rates seem to have peaked, and there is potential for future rate cuts.

Over the past 30 years, Hobart's property market has experienced cycles of sharp gains and corrections. The current sentiment among homeowners is cautiously optimistic, as the market searches for a new balance. While the era of double-digit annual gains might be behind us, the fundamentals of limited supply and steady demand continue to support property values.

Hobart selling statistics

Hobart's property market is in a phase of change. Sales volumes have increased compared to last year, but properties are taking a bit longer to sell. This suggests buyers are being more cautious. The market seems balanced between supply and demand, with sellers needing to be competitive with their pricing.

Hobart sales volume and days on market

Sales volumes in Hobart have risen by 6.8 per cent from the same period last year, showing steady interest. Currently, the median days on market for Hobart properties is 31 days, slightly longer than the national average of 29 days.

| Hobart sales volume | Hobart days on market |

|---|---|

| 6.8% Change from 12mo ago | 31 days 27 days 12 mo ago |

Source: Cotality

The rise in sales volume indicates interest in the Hobart market, but the longer days on market suggest buyers are taking their time. This could be due to economic conditions or expectations for better deals. Compared to other capitals, Hobart's longer days on market might reflect a more deliberate buying process or a need for sellers to adjust their pricing to align with market expectations.

Hobart new and total listings

In Hobart, new listings have seen a small increase of 0.3 per cent from last year, while total listings have dropped significantly by 27.3 per cent.

| Hobart new listings | Hobart total listings |

|---|---|

| 0.3% Change from 12mo ago | -27.3% Change from 12mo ago |

Source: Cotality

The slight rise in new listings, alongside a big drop in total listings, suggests that while new properties are entering the market, they are not enough to replace those being sold or withdrawn. This could mean a competitive market where properties are quickly absorbed, or it might show a cautious approach by sellers in listing their properties. The decrease in total listings could also indicate a tighter market, potentially leading to more competition among buyers.

Hobart vendor discount

Vendor discount measures the percentage difference between the initial asking price and the actual sale price, offering insight into buyers' bargaining power. Tighter discounts mean sellers are firm on price, while wider discounts suggest a softer market with more aggressive bargaining.

| Oct 2025 | Sep 2025 | Aug 2025 | Jul 2025 | |

|---|---|---|---|---|

| Hobart median vendor discount | -3.0% | -3.9% | -4.4% | -4.7% |

Source: Cotality

Hobart's vendor discount rate is currently at 3.0 per cent, slightly above the national average. This suggests sellers in Hobart are negotiating more on their asking prices compared to other regions. This could be due to the longer days on market, as sellers may be more willing to adjust prices to speed up sales. The higher discount rate compared to other capitals might also indicate a more buyer-friendly market, where purchasers have more leverage in negotiations.

Get a deeper insight into how Hobart sellers are faring in 2025 and what could be on the horizon for the remainder of the year with some of our latest articles.

Hobart property investing

Hobart’s rental market is one of the most competitive in Australia, marked by low vacancy rates and rising rents. This section delves into the current rental landscape in Hobart, providing insights into rental rates, yields, and vacancy trends.

Hobart rental market

Rental rates in Hobart have seen notable growth, driven by ongoing demand and limited supply. As of November 2025, rental rates in Hobart have increased by +6.9 per cent over the past year, indicating strong upward pressure on rents. The rental yield in Hobart is at 4.4 per cent, which is relatively high compared to other capital cities. This suggests that rental properties in Hobart offer attractive returns for investors.

| Location | Rental rates | Rental yield | Annual change in rents, houses | Annual change in rents, units |

|---|---|---|---|---|

| National | 4.6% | 3.60% | NA | NA |

| Combined Capitals | 4.0% | 3.40% | NA | NA |

| Combined Regional | 6.1% | 4.30% | NA | NA |

| Sydney | 4.0% | 3.00% | 3.40% | 5.00% |

| Melbourne | 1.8% | 3.60% | 1.60% | 2.20% |

| Brisbane | 5.8% | 3.50% | 5.60% | 6.50% |

| Adelaide | 3.6% | 3.60% | 3.70% | 3.10% |

| Perth | 5.8% | 4.00% | 5.70% | 6.90% |

| Hobart | 6.9% | 4.40% | 6.80% | 7.70% |

| Darwin | 8.5% | 6.40% | 7.60% | 10.00% |

| Canberra | 2.9% | 4.00% | 2.80% | 3.40% |

Source: Cotality

Despite high rental yields, the annual change in rents for houses and units continues to rise due to the scarcity of available properties. The limited new supply and strong demand have contributed to this trend, making Hobart a challenging market for renters but potentially rewarding for investors.

Hobart vacancy rates

Vacancy rates are a key indicator of the rental market's health, showing the balance between supply and demand. Nationally, vacancy rates have remained tight, with Hobart recording one of the lowest rates among the capitals. This scarcity of available rental properties suggests a competitive market where tenants have limited bargaining power.

| Location | Oct 2025 vacancy rates | Oct 2025 vacancies | Oct 2024 vacancy rates | Oct 2024 vacancies |

|---|---|---|---|---|

| National | 1.20% | 36152 | 1.20% | 36486 |

| Sydney | 1.30% | 9553 | 1.50% | 10874 |

| Melbourne | 1.80% | 9713 | 1.70% | 9052 |

| Brisbane | 1.00% | 3391 | 1.00% | 3580 |

| Adelaide | 0.80% | 1215 | 0.60% | 915 |

| Perth | 0.70% | 1304 | 0.50% | 998 |

| Hobart | 0.40% | 107 | 0.60% | 179 |

| Darwin | 0.70% | 181 | 1.40% | 349 |

| Canberra | 1.40% | 860 | 1.70% | 1059 |

Source: SQM Research

Hobart's vacancy rate was just 0.4 per cent in October 2025, down from 0.6 per cent a year earlier. This decline highlights the ongoing undersupply of rental properties in the city. Compared to other cities, Hobart's vacancy rate is among the lowest, indicating a market that heavily favours landlords. The lack of new supply or significant changes in population growth suggests that these tight conditions are likely to persist.

Louis Christopher, Managing Director of SQM Research said in his latest rental market report

“The national vacancy rate holding at 1.2% suggests the rental market remains very tight, with little sign of meaningful supply increases. While some capitals are showing temporary easing in rent growth, underlying conditions remain undersupplied, particularly in cities such as Perth, Adelaide, and Hobart. Brisbane continues to attract strong demand from interstate migration, while Melbourne and Canberra appear to be stabilising following recent surges in new rental listings. Overall, we expect rental conditions to remain tight through the summer months, with only a modest increase in vacancies likely in early 2026.”

Hobart’s vacancy rate was steady at 0.6%, reflecting the entrenched shortage Louis highlights. Rents surged +3.6 per cent over the month and +7.6 per cent annually, showing how severe undersupply can push rents higher even when vacancies don’t tighten further. With vacancies barely half a percent, Hobart is Australia’s second-tightest capital market, leaving little room for tenant bargaining. Significant new supply or a population slowdown is needed before meaningful relief emerges.

Top growth areas in Hobart

| Rank | SA3 Name | SA4 Name | Median Value | Annual % Change |

|---|---|---|---|---|

| 1 | Hobart - North West | Hobart | $568,500 | 5.0% |

| 2 | Hobart - North East | Hobart | $724,433 | 3.9% |

| 3 | Hobart - South and West | Hobart | $796,023 | 3.0% |

| 4 | Brighton | Hobart | $568,624 | 2.3% |

| 5 | Hobart Inner | Hobart | $850,161 | 1.9% |

| 6 | Sorell - Dodges Ferry | Hobart | $614,832 | -0.8% |

Source: Cotality

Highlights for Hobart’s top growth areas

- Hobart - North West has consistently held the top spot over the past six months. With a median value of $568,500 and an annual growth of +5 per cent in October 2025, this area is a magnet for young families and migrants. Its affordable housing and easy access to central Hobart jobs make it a popular choice.

- Hobart - North East comes in at #2, boasting a median value of $724,443 and an annual growth of +3.9 per cent. The area’s strong population growth is driven by its proximity to the CBD and ongoing infrastructure investments. (Suburbs to watch: Sandford)

- Hobart - South and West ranks #3, with a median value of $796,023 and an annual growth of +3 per cent. This area attracts professionals and families who are drawn to its lifestyle benefits, including access to the river and bushland.

- Brighton is in the #4 spot, with a median value of $568,624 and an annual growth of +2.3 per cent. Known for its young demographic and affordability, Brighton is a favourite among first-home buyers and young families.

- Hobart Inner takes the #5 position with a median value of $850,161, though it shows no annual growth. Despite limited space for new dwellings, its central location and strong rental demand keep it appealing.