Australian property reaches 32-year annual growth peak in September

It's no secret that Australian real estate has been going gangbusters this year, but CoreLogic's latest findings really help just how big this boom has been.

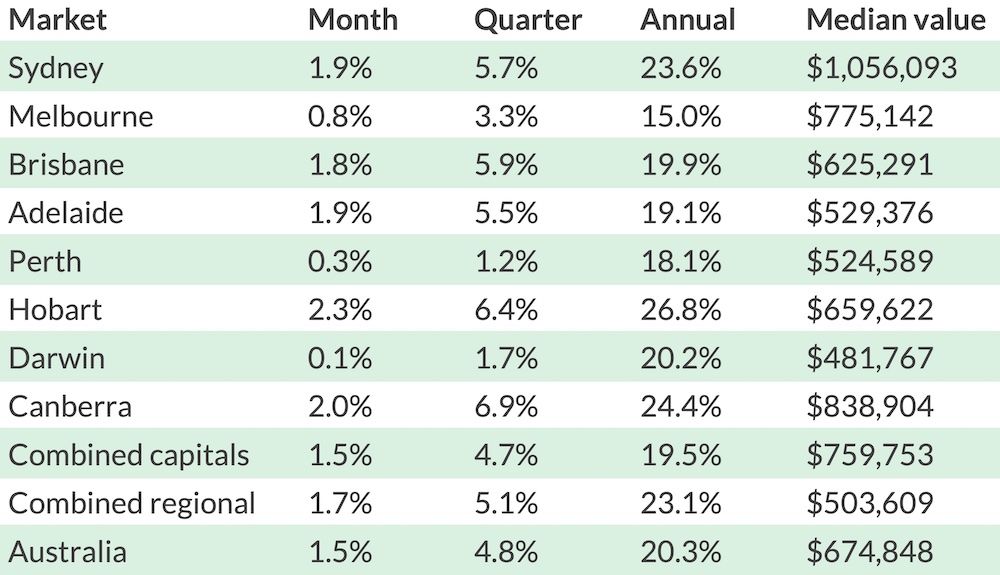

Property prices grew another +1.5 per cent in September, pushing the median Australian home price up +20.3 per cent over 12 months. That's the highest rate of annual growth since June 1989.

This truly is a once in a generation event and a major opportunity for sellers. But, with gains slowly reducing and a rush of stock expected to come to the market, are things about to change?

National property values: September 2021

| Houses | Units |

|---|---|

| $719,209 | $586,993 |

| Monthly change: +1.6% | Monthly change: +1.1% |

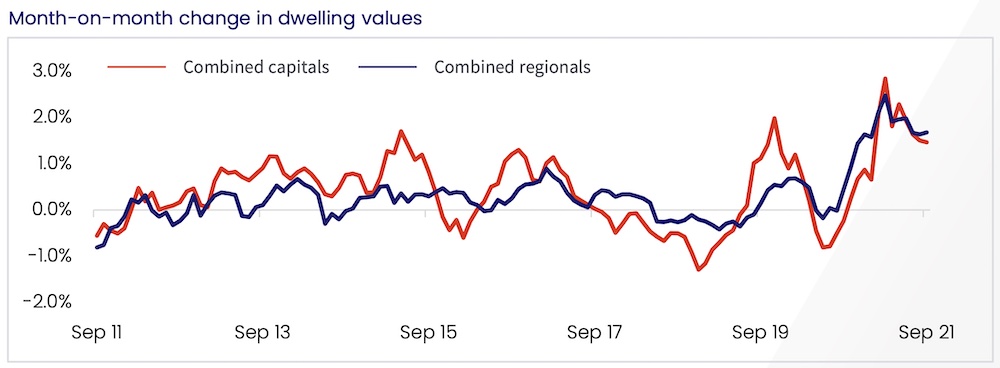

While the overall sentiment is that the market has been cooling off since the +2.8 per cent monthly peak in March, a +1.5 per cent jump in September is still well above the decade average (+0.4 per cent).

Australia's median property price is now $674,848, almost exactly $100,000 more than it was at the beginning of January 2021.

Houses in Sydney, Brisbane, Adelaide, Hobart and Canberra all gained at least another +2.0 per cent in September, with Melbourne up +1.1 per cent.

Regional markets had another strong month and on the whole outperformed the capitals. Among the biggest movers were NSW (+2.0 per cent), QLD and Tasmania (+1.7 per cent) and units in WA (+2.4 per cent).

Even though we're still looking at big monthly numbers in many cities and regions, the bigger picture does show that growth is easing off.

As the CoreLogic report states, "although growth conditions remain positive, it is becoming increasingly clear the housing market moved past its peak rate of growth."

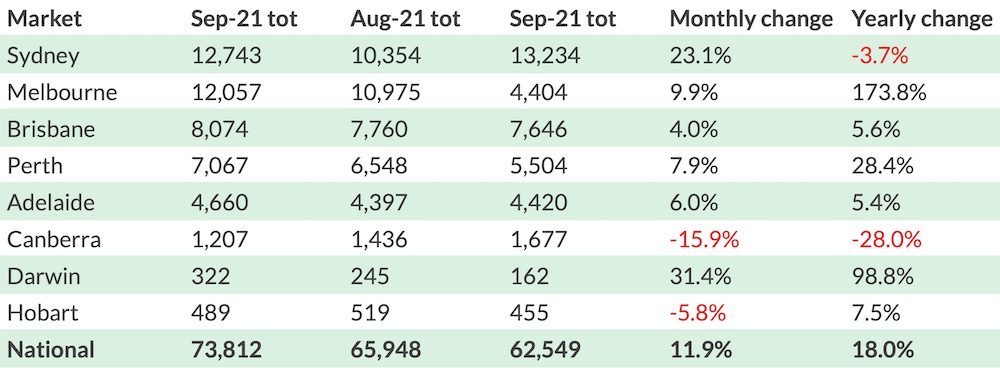

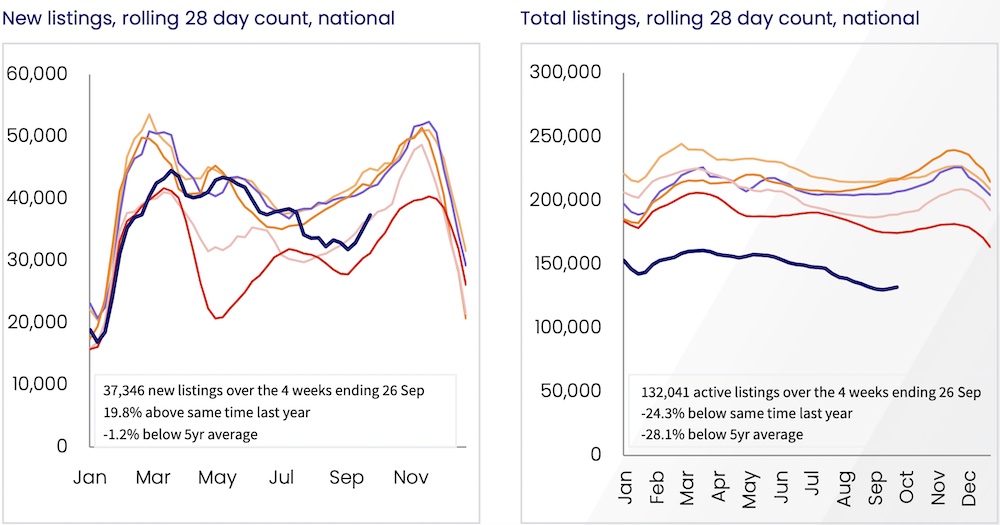

New spring listings hit the market but total stock is still well down

With lockdowns pushing the start of the spring selling season back, there's been plenty of anticipation around fresh listings coming to the market—and they're finally arriving.

Sydney in particular has seen a huge surge of new properties coming online, +23.1 per cent up from August according to SQM Research.

Melbourne listings are up a healthy +9.9 per cent, with plenty more expected to come once restrictions ease further, while Brisbane, Perth and Adelaide have also seen a bump up in their numbers.

Canberra, which entered lockdown later than Sydney and Melbourne, seems further from returning to 'normal' again, and the drop in listings reflects that. But Sydney's path through could foreshadow what's to come in the other locked-down markets.

Even with new listings coming online, CoreLogic says the total amount of stock on the market is still "extremely low" (-25.5 per cent below the five-year average) and with demand remaining so high, desperate buyers are snapping up whatever they can.

"Nationally, homes are selling in 35 days, up from 29 days in April, and vendor discounting levels remain around record lows at - 2.8 per cent," Mr Lawless says.

It's also worth noting that, even with total listings so low, the total number of monthly sales are well beyond the five-year average, suggesting that most of anything that's making it to the market is being bought up.

With days on market and vendor discounting so low, auction clearance rates back up to their highest levels since March and available stock on the market way below average, all the indicators point to very strong selling conditions as spring moves on.

Affordability issues continue to cool the market

Even though we're still seeing well-above-average monthly growth, the overall trend since March 2021 has been towards easing gains.

CoreLogic's research director Tim Lawless believes this has in part been driven by first home buyers being squeezed out of the market thanks to soaring prices and fewer government incentives.

"With housing values rising substantially faster than household incomes, raising a deposit has become more challenging for most cohorts of the market, especially first home buyers," he says.

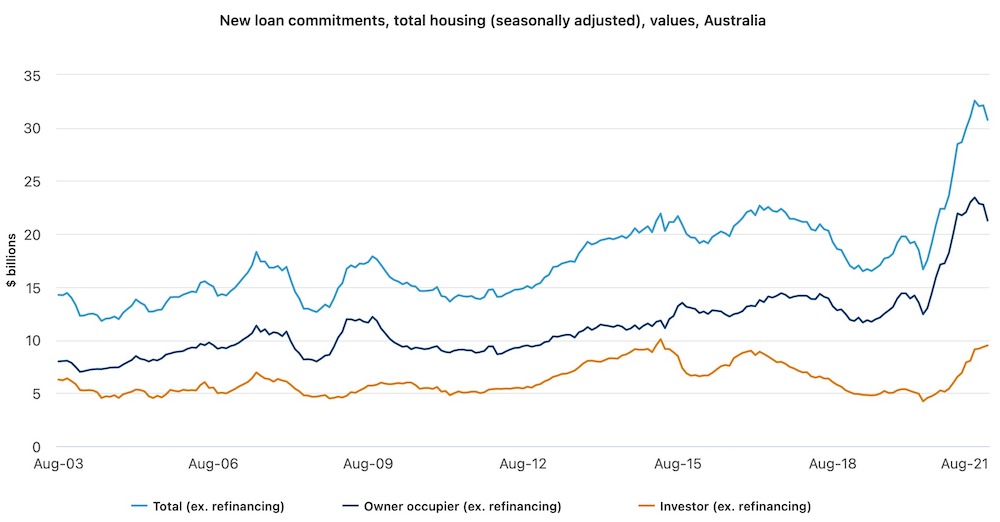

He points to ABS lending data, which shows that the number of first home buyer loans fell -20.5 per cent between January and July, suggesting that those buyers may have changed their tactics to 'rentvest'—seeking an investment property in cheaper markets while renting where they live.

It's widely forecast by the big banks and pundits alike that growth will continue to slow into 2022 as more buyers are priced out of the market, so it's unlikely that sellers will be able to gain too much more out of this cycle.

Houses are still outperforming units despite high prices, but that could change

It may seem contradictory to the above, but house prices continue to increase at a more rapid rate than units even though detached housing is becoming less and less accessible to buyers.

In most capital cities, houses have outpaced units this year by double or more.

Thanks to the prevalence of remote working now, the 'race for space' mentality is still driving people to seek lifestyle improvements during the pandemic, and that means houses have been in hot demand.

There's a chance that could change in some of the country's most expensive markets, though, and houses may cool off while units make up some ground.

As BuyersBuyers co-founder Pete Wargent told OpenAgent, affordability constraints have meant a number of buyers—particularly in markets like Sydney—have had to adjust their new home search.

"My guess is that, the way the median house price has gone in Sydney, there will be a shift towards units," he said. "Prices are so high now that affordability will start to bite for the detached house market."

What's next for the Australian property market?

There's been a lot of talk about if and when APRA may tighten home loan lending conditions, and that's now been announced.

From November it will become more difficult for borrowers to be approved for a mortgage, a move that is widely tipped to slow down the already cooling market as buyers may end up with less purchasing power.

CoreLogic also predicts that, once lockdowns have ended and people return to more normal spending habits, the conditions that have helped many save considerable amounts of money during the pandemic may shift and demand for housing could ease.

They also suggest the influx of stock expected as the spring selling season continues to unfold will start to give buyers more choice and dilute some of the frenzied demand we've seen, which could take more heat out of the market.

So, in the medium term, there are a number of factors that look set to reduce growth. But for now, with stock low and demand high, interest rates remaining at record lows and pent-up pressure ready to release from lockdowns, it's very much a seller's market right now.