June brings more gains, but signs point to the market easing

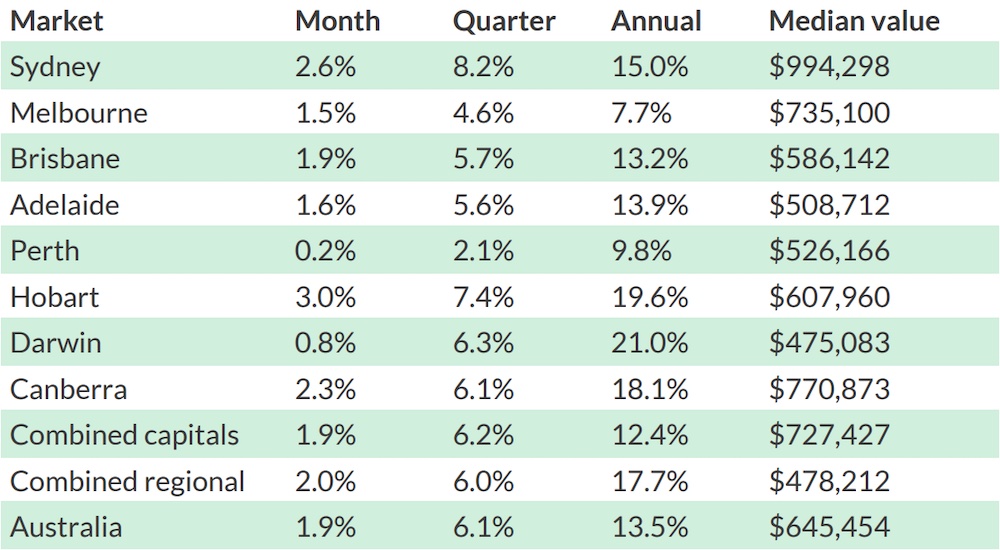

June closed on another strong note as far as Australian property is concerned, with median prices rising +1.9 per cent last month according to CoreLogic's latest national home value index.

It's a slight dip down from May's +2.2 per cent push but still represents a very solid increase in most states.

Even so, CoreLogic says there are emerging signs that the market could be cooling along with the weather. So where does that leave things as we enter a new financial year?

National property values: June 2021

| Median property value | Monthly change | |

| Houses | $682,728 | +2.1% |

| Units | $568,853 | +1.3% |

With a +1.9 per cent national rise clocked for June, that brings the median dwelling value in Australia to $645,454, about an $11,000 bump up from May.

The financial year closes out with a +13.5 per cent annual growth in median values—a huge +15.6 per cent increase for houses versus +6.8 per cent for units.

"This is the highest annual rate of growth seen across the Australian residential property market since April 2004, when the early 2000s housing boom was winding down after a period of exceptional growth" explains Eliza Owen, CoreLogic's Head of Research for Australia.

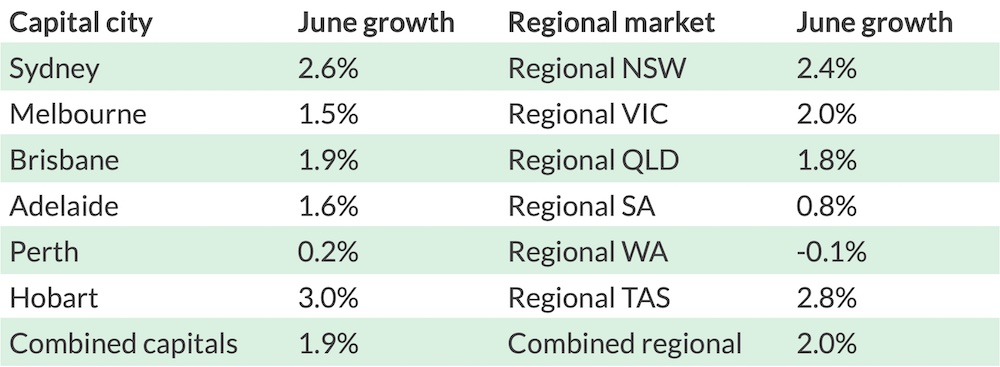

Hobart had the biggest rise for the month, a full +3.0 per cent, finishing off a staggering +19.6 per cent growth for the year.

Sydney inched within just days of reaching the $1 million median property mark, with a +2.6 per cent upswing bringing that number up to $994,298, and Canberra continued its hot streak by jumping +2.3 per cent, or +18.1 per cent over 12 months.

Brisbane and Adelaide both turned in around-average results of +1.9 per cent and +1.6 per cent gains respectively.

Ms Owen points out, though, that "there are some markets where performance is starting to ease more notably."

Melbourne again saw slightly muted growth, +1.5 per cent for the month and +4.6 per cent for the quarter, likely held back by yet another recent lockdown.

Darwin, Australia's fastest-growing capital for the year at an astonishing +21.0 per cent annually, only managed a +0.8 per cent bump in June, and Perth slowed to a crawl with a +0.2 per cent monthly gain, making it the most stunted performer for the quarter.

A booming economy has fueled a booming market

On top of factors like low interest rates and reduced stock on the market, the strength of the country's economic recovery after 2020 is a major contributor to this year's property boom.

Ms Owen points out that "In May, the unemployment rate fell to 5.1 per cent, and the underutilisation rate fell to 12.5 per cent, the lowest level since February 2013. Consumer confidence remained elevated through June, although down from the recent April highs."

It's the same set of circumstances that have driven the big banks to forecast interest rate rises far sooner than the Reserve Bank of Australia has indicated.

This confidence, Ms Owen says, can be partly attributed to border closures and other Covid limitations changing spending and saving habits over the past 12-plus months.

"Elevated savings accumulated through Covid restrictions last year, along with a more confident consumer sector, has encouraged consumption of larger goods, such as housing."

Aside from the surge in property values around the country, another marker of the change in spending behaviour is found in the number of property transactions being made.

In the year to June, CoreLogic estimates there were around 582,900 transactions made around the country. That's the highest total sales volume since early 2004.

New listings have increased but demand still isn't being met

The narrative of old stock being snapped up faster than new listings can come to the market has continued this month, resulting in more substantial price jumps around the country.

CoreLogic notes there were 126,320 new listings in the three months to June, a full +7.9 per cent above the five-year average for that quarter, but it wasn't enough to match demand.

Over that same three-month period, 167,450 homes were sold—a ratio of around 1.3 sales to every new listing—meaning total stock on the market has continued to dwindle as the months go on.

In fact, total advertised stock levels are around -25 per cent below the five-year average, while nearly every capital and regional market posted double-digit growth in annual sales volumes, illustrating just how hard supply has been squeezed.

What has been a seller's market throughout 2021 so far continued to be so in June, with auction clearance rates remaining high, days on market staying low, and rates of vendor discounting rates staying at a slim -2.7 per cent.

Signs point to a cooling market, and top-end properties are leading the slowdown

Despite low supply and favourable economic conditions, this month's CoreLogic report picks up on indications that there could be an easing of the market on the way.

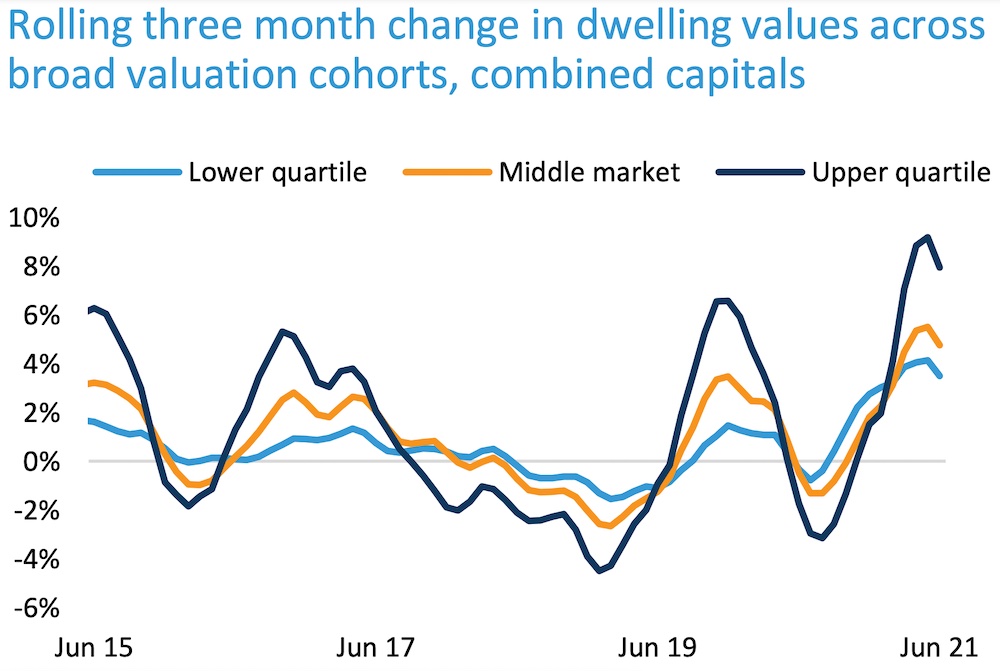

Back in May, the upper quartile of properties (ie. the most valuable 25 per cent) surged dramatically, but the June figures now show growth of those top-tier dwellings slowing faster than the rest of the market.

"This easing in the pace of growth at the top end of the market is another clear sign of a shift in momentum," Ms Owen explains.

"The rest of the market tends to follow movements at the high end, and this is the first time in nine months that the high-tier growth rate has not accelerated."

More broadly, while a +1.9 per cent rise in national median values is significantly more than the decade average of 0.4 per cent, when put into context of recent months, it's 0.3 per cent lower than May's result and a substantial 0.9 per cent less than the March 2021 peak.

Canberra was the only capital to see an increased growth rate in June, while Perth and Darwin demonstrated substantial downshifts.

“The key to understanding the softer performance in these resource-based markets may be a slightly different supply-demand dynamic compared to the other capital cities and regions,” Ms Owen notes.

Runaway regional markets look to have been caught

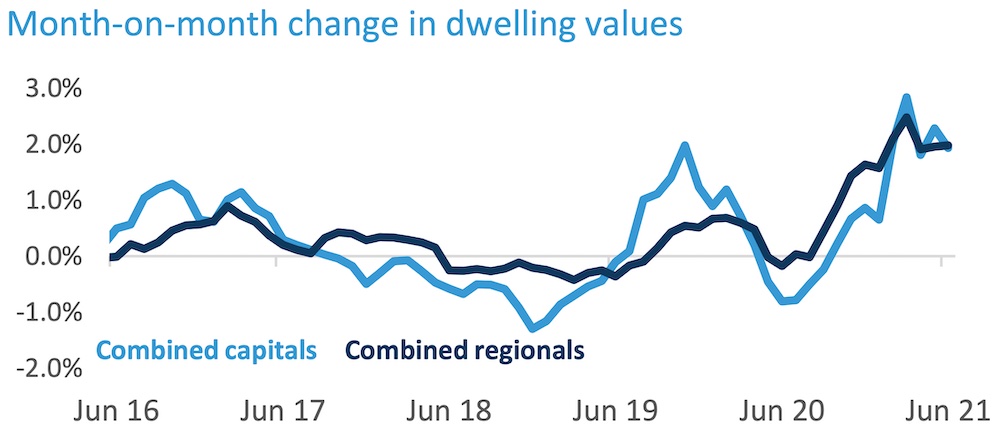

It was just over 12 months ago, when Covid-inspired moves away from cities were very much on the up, that regional markets' pace of growth overtook the capitals.

This past quarter, though, it's been just about neck and neck between regionals and capitals, and that trend solidified in June.

In every state but South Australia, where the regional market has cooled off significantly over the past three months, the growth of capital cities closely resembled their broader state counterparts.

As things have settled down to a degree after 2020, the capital markets have been making up for lost time, and bar further lengthy and broad-based lockdowns, it looks to be a trend that will continue this year.

With parts of the country locked down, what's next for the Australian property market?

In the shorter term, there are questions around how the current Covid outbreaks and subsequent lockdowns will affect the market.

"It is difficult to say whether this dynamic will be maintained in the coming weeks amid lockdown conditions in parts of Australia," Ms Owen says.

"Sales volumes are likely to decline, but new listings added to market also tend to decline during lockdowns, as properties are harder to sell."

She suggests that, while the net impact of these short 'circuit-breaker' lockdowns is usually negligible, "outcomes for the housing market and industry will depend upon how long lockdown conditions last across parts of the country, and whether some of the institutional responses offered through 2020 are reinstated if an extended lockdown occurs.”

Regardless of the current outbreaks, CoreLogic notes that "the housing market has clearly lost some growth momentum."

They say that worsening affordability due to "unsustainable" growth rates and major banks forecasting interest rate increases as early as 2022 are expected to temper the boom to some degree.

As we enter the new financial year, though, selling conditions right now are still looking very healthy.