Interest rates tipped to rise: will the market stay hot?

Learn more about our editorial guidelines.

Each month there's talk of whether or not the Australian property market has peaked, yet each month the growth continues nationwide.

Record low interest rates have been labelled as one of the biggest driving factors behind the boom and, while they aren't expected to change any time soon, there's a sense that the big banks might not see eye to eye with the Reserve Bank of Australia.

If mortgages become more expensive, could that be a catalyst for a cooling of the market, or will the heat of this ongoing surge be too great to douse?

What's happening with interest rate forecasts?

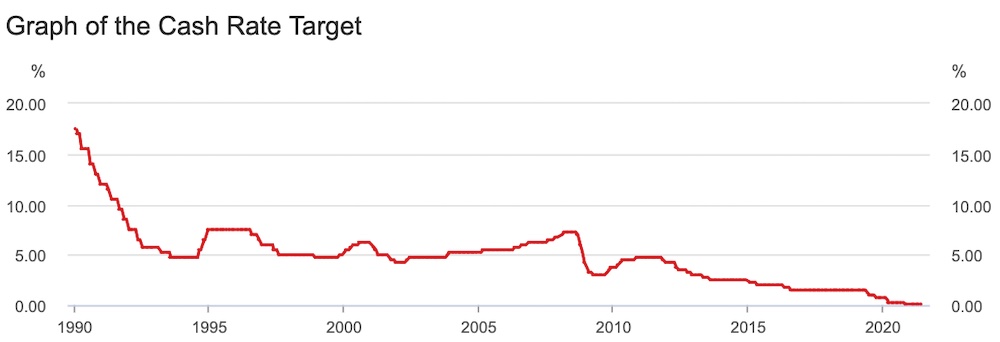

So far this year the RBA has held strong on its message that it doesn't expect to raise the cash rate until 2024 at the earliest.

Currently sitting at an all-time low of 0.1 per cent, it's meant borrowing money is the cheapest it's ever been, and that's driven an army of buyers to the market to make the most of the opportunity while it lasts.

While the RBA's latest monthly statement saw them sticking to their guns about 2024, Westpac, ANZ and CBA have pointed out that Australia's economy is recovering far better than expected, and they anticipate interest rates to be upped earlier.

The CBA's head of Australian economics, Gareth Aird, announced this week the most radical of the banks' forecasts, saying that rapidly declining unemployment and a strong economic outlook has them predicting rate hikes beginning as early as November 22 next year, potentially reaching a 1.25 per cent cash rate by Q3 2023.

Wes Brinckley, mortgage broker at OpenAgent's sister company Doorsteps Finance, says people should be wary of giving too much weight to the banks' commentary.

"Different agendas are likely driving the messaging being made by certain banks versus the RBA," he says.

"The RBA has been very clear on what factors will contribute to a rise in the cash rate and their expectation that those criteria are unlikely to be met before 2024."

In any case, the low-rate environment we currently find ourselves in shouldn't be changing any time in the near future.

Are mortgages already getting more expensive?

With the banks' increasingly bullish talk around interest rates, there's talk of fixed rate mortgages being bumped up, which could act as a deterrent to buyers.

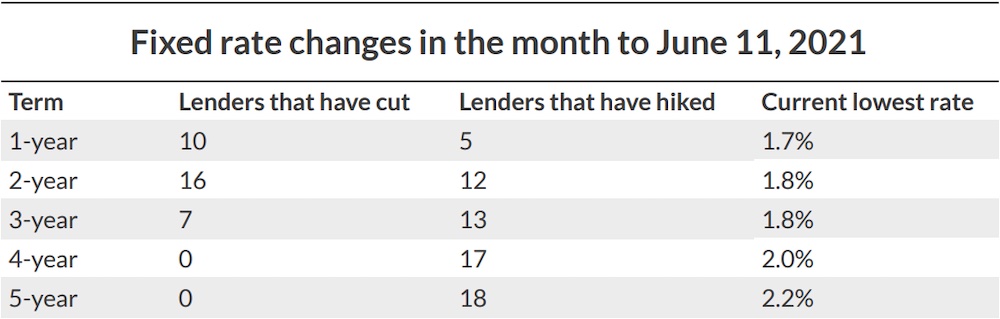

Some lenders are beginning to notch up their longer-term fixed rates from the low-to-mid 2 per cent range, and there are questions around whether this shift could have a cooling effect on the market.

Mr Brinckley points out that it's currently only four and five year fixed rates that are being upped, and shorter-term commitments are remaining relatively flat for the time being.

But it's the direction things will start to head, and he says “the consensus is that rates will climb steadily over the next 18 to 24 months." So what impact might this have?

"With the property market still at the top of the cycle, small increases in interest rates are likely to have little to no effect on the boom," he predicts.

"With the view that, even with a rate increase, the baseline interest rates would still remain lower than they were some three or four years ago, leaving buyers in a strong position to obtain finance.”

Even if lenders continue to up their rates over the coming months, it's unlikely to be the factor that puts this year's boom on ice.

Hot market conditions look set to continue for now

Regardless of the RBA's messaging around interest rates, it seems the banks are set on moving things along at a faster pace.

Even so, the most recent ABS figures show home loan commitments still tracking at record levels, and it remains relatively easy for buyers to secure finance.

"From a lending point of view, banks' lending criteria is the best it’s been in years, with a more 'common sense' approach being undertaken by credit assessors," Mr Brinckley explains.

"The main buyer challenge at the moment is simply being priced out of the market."

Existing stock is still being bought up faster than new properties can come to market, and the usual winter lull doesn't seem to be hurting auction clearance rates in any major way.

As some owner-occupiers—and especially first home buyers—feel the squeeze of rising prices and begin to consider adjusting their plans, investors look to be returning to the market in a significant way which will likely keep adding to the upward pressure.

The recent Covid flare-ups in Sydney and Melbourne are stark reminders that there's never any certainty in what's around the corner, but for the moment it's still very much a seller's market.