'I believe it has peaked' - property boom finally takes a turn, experts say

It's the question that's been on everyone's lips for months now: when will Australia's once-in-a-generation property boom finally hit the ceiling and flatten out?

The numbers from November at last show a substantial downshift in momentum for most markets, and that's backed up by what agents and analysts are seeing on the ground.

We spoke to one of the country's leading property experts who believes we've passed the peak of this cycle and that the boom conditions are now in the rearview mirror.

Market conditions have been softening since October

"I definitely think the market's peaked," declares Lloyd Edge, founder of Sydney-based buyer's agency Aus Property Professionals and author of the investment strategy book Positively Geared.

He explains that he's seen a number of clear indicators that market dynamics have shifted since mid-October, including easier negotiations as a buyer and vendors accepting lower offers.

"Auction clearance rates are starting to go down and there's definitely been less property making it to auction, where we're putting in offers before auction and winning," he says.

"For some of the ones we have won at auction, there have actually been fewer registered bidders and fewer attendees. So there's definitely been a bit of a cooling."

That's all thanks to a handful of factors including affordability pressures, government incentives ending, and a surge in new listings topping up low stock levels which is finally meeting the huge buyer demand we've seen throughout 2021.

"I don't think we're going to see a big crash in the markets, but coming back next year I think that things will be a little bit softer, a bit different to what we've seen," he says.

Drilling into the different capital city markets

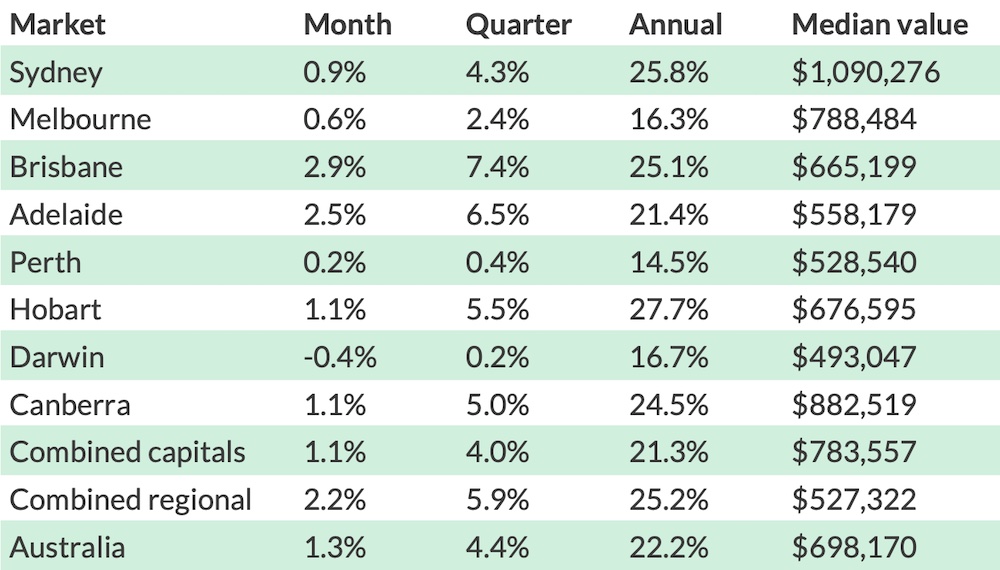

CoreLogic's data for November shows three of 2021's biggest growth markets—Sydney, Hobart and Canberra—all dipping below +1.0 per cent price gains for the month, a significant decline from the rest of the year.

Melbourne, which has seen its growth stunted by half a dozen lockdowns, also fell to just +0.6 per cent in the same period.

"I think that there's going to be a bit of a flattening of the curve in those sorts of markets," Mr Edge says. "They will have a bit of a downwards trend but it's not going to be a huge crash."

Brisbane and Adelaide, by contrast, both posted record monthly growth for the year, suggesting there's still some lasting heat in those markets.

"People have been predicting Brisbane to move for years. Suddenly it's started to happen this year and everyone's jumped on the bandwagon—everyone tried to buy property. There's a lot of FOMO and interstate buyers and everyone just started to pay too much," Mr Edge says.

He also points out that Brisbane and Adelaide are significantly more affordable than Sydney and Melbourne which has drawn more priced-out buyers to those cities and boosted their growth, but it's still a matter of time before they level out.

"They're probably going to plateau sometime next year, and the problem that I fear for Brisbane is that I feel there may be some people that have paid a bit too much for property. They might be left with a little bit of negative equity."

As for Perth and Darwin, both capitals look to have hit their peaks mid-way through 2021, with little in the way of price growth since then.

Have regional markets also passed their peak?

The reported exodus from capital cities to regional areas since the pandemic began is a phenomenon that, judging by CoreLogic's latest numbers which show a uniform rise in property values throughout November, is ongoing.

"The regions have been really interesting this year. It's a bit of an unknown whether that is going to be long term, but I think people have started to reevaluate their lives during Covid, and there are people who would be moving there for the long term," Mr Edge explains.

"There are probably prices in some regional markets that have been artificially inflated for that reason."

He cautions that the huge growth seen in regional markets like northern NSW and South East Queensland over the past 18 months may not be sustainable, as has been the case in the past.

"I don't think in five years time that we're going to be getting that same growth, so we might find some of those markets start to drop a little bit in value," he says.

"I know myself as a buyer's agent—and I do buy a lot in regional areas—that we've got to be careful that we're not overpaying and we're really trying to make sense of what true market value would be."

In the short term, though, any regional downturn looks like it may be more delayed than some of the key capital city markets.

What to look for in 2022

On the one hand, there are several headwinds that look set to dampen further growth in the market.

Affordability has put the squeeze on buyers, APRA has tightened lending conditions and may impose more restrictions, fixed mortgage rates are rising as interest rates are forecast to rise sooner than 2023, and rising stock on the market is balancing out buyer demand.

Mr Edge points out, though, that there are some positives to look at too, including high vaccination rates, a resilient economy, and the fact that interest rates will still be far lower than they have been historically.

Even so, he says that "there has to be a limit on how expensive property can go before people on the average income can afford it," and that's going to play a significant role in how things pan out over the next few years.

He also notes that, after this year's house-led boom, units may make a comeback as an alternative for those seeking more affordable housing.

When it comes to sellers and the market having peaked, Mr Edge says "it's probably going to be apparent that you're going to get less for your property next year than you would if you sold it now."

That's all a matter of context, though. If you're buying and selling in the same market, that may not be such a bad thing depending on what your goals are.

If you're thinking of selling and unsure of how or when to proceed, speaking to a top local agent with in-depth knowledge of your market is one of the best first steps a seller can take.