2022 property market outlook - what the experts forecast

There's no doubt the 2021 boom has been a once-in-a-generation phenomenon for the Australian property market, with breathtaking growth seen all around the country.

As the year winds down it's a good moment to take stock of what's happened and, with the help of some expert industry analysis, look to what comes next.

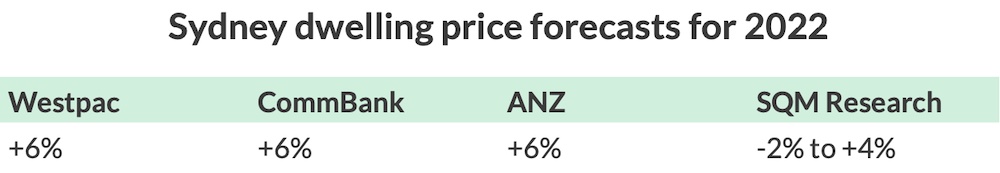

We'll be comparing 2022 forecasts from Westpac, ANZ, Commonwealth Bank and independent financial analyst Louis Christopher's SQM Research to find out what path the market may take over the next 12 months.

The 2021 surge should be followed by more moderate growth in the new year

Following the unprecedented effects of the pandemic throughout 2020, many economists tipped 2021 to be a dark year for real estate growth.

Instead, we've seen staggering gains in just about every city and state. The final rate of national growth for the year is expected to be around +22 per cent, the largest annual jump since 1989.

There are a number of factors that look to be putting the brakes on that rapid increase, though.

Affordability pressures are putting the squeeze on buyers. A surge in new listings is evening out supply and demand. Fixed rate mortgages are on the rise and there may be further tightening to lending standards by APRA.

On the other hand, the Australian economy is proving to be very robust, vaccination rates are high, immigration is set to return in earnest, and interest rates, even if they do rise, will remain around record lows.

That's led economists to predict a reduced but still strong national rate of price growth of between about +5 and +8 per cent for 2022.

Let's take a look at what's in store for each state.

Sydney and NSW market outlook

The Sydney and regional NSW markets have been flying in 2021. Sydney home prices are up around +25 per cent for the year so far, with regional NSW soaring even higher to nearly +27 per cent.

Having now seen those incredible rates of growth, the expectation is that things will slow down considerably in NSW in 2022, though those numbers should still be safely in the green.

SQM Research's Louis Cristopher, who takes the most pessimistic view of the forecasters, predicts that "there will be a Sydney housing market peak next year sometime either in the June or September quarters" potentially caused by APRA tightening lending standards again.

He also expects the RBA to lift the cash rate in the second half of the year, all of which could lead to price changes of between -2 per cent and +4 per cent for the year.

The big banks see things differently, all forecasting gains of +6 per cent for Sydney in 2022.

Westpac predicts "very strong gains centred on houses" for the year, although affordability and APRA tightening will contribute to the overall slowing.

Looking to regional NSW, Mr Christopher says he expects "a correction in prices and rents… as a number of city dwellers move back to the large capital cities.”

He does add a caveat that there should be "longer term gains for those townships located on Australia’s coast" as more people seek that sea change lifestyle outside metro areas.

Melbourne and VIC market outlook

Victorians have done it tough these past two years, enduring six lockdowns that have caused major disruption to the property market.

Melbourne price growth looks set to finish this year at above +15 per cent, a fair way lower than most other capitals but still a very sizeable shift. So where to from here?

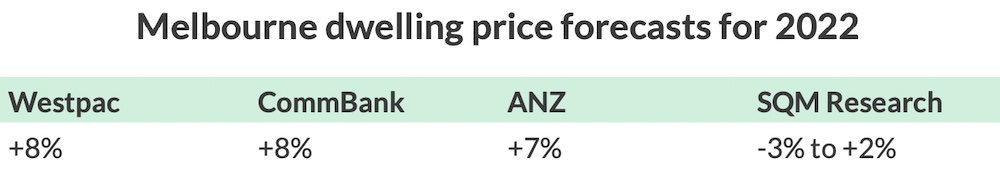

The big banks seem to agree that there's still strong growth ahead for the Victorian capital, settling around the +7 to +8 per cent mark for 2022.

Even so, Westpac does caution that the high rate of rental vacancies presents an issue, particularly around the CBD, while migration—something the city has relied on for its growth—remains weak.

Mr Christopher takes a more cautious approach, suggesting price changes could be between -3 and +2 per cent for the year.

Like Sydney, he says that "the Melbourne market is susceptible to a price correction on any further intervention by APRA."

He also warns of an unhealthy CBD unit market, saying there is "too much stock there for sale right now… with more on the market next year due to yet another 65,000 dwellings due for completion."

In terms of regional Victoria, QBE forecasts the markets to "slightly underperform Melbourne in the coming three years,” mainly due to “the end of the HomeBuilder scheme, and the reduction in the $20,000 Regional First Home Buyer grant.”

Brisbane and QLD market outlook

Brisbane and the wider South East Queensland area have had a stellar year for growth, and judging by November's record month it's far from over.

Interstate migration, as well as overseas interest, remains high thanks to the state's desirable lifestyle and relative affordability when compared to cities like Sydney and Melbourne, and that continues to drive growth.

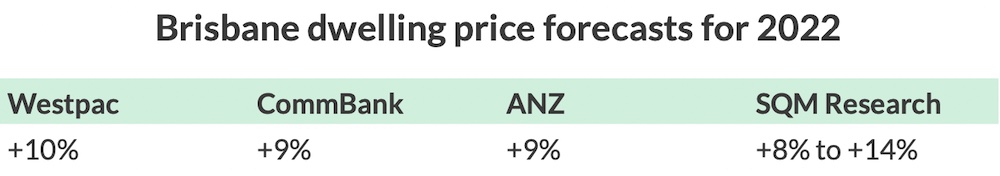

The big banks all more or less agree on a 2022 growth figure close to +10 per cent for Brisbane. While this is significantly less than the +24 per cent seen so far in 2021, it's still the highest forecast of any of the capitals.

Westpac explains that this is because the city has strong fundamentals and currently represents a very tight market, again due to the positive migration seen since the beginning of the pandemic.

SQM Research's Louis Christopher also predicts Brisbane being the biggest gainer for 2022 with growth of between +8 and +14 per cent.

He says that we can "expect outperformance of the Brisbane housing market compared with other Australian cities over the next decade. It will also benefit over the short term from interstate migration inflows."

Looking regionally, QBE notes that the Gold Coast and Sunshine Coast have experienced even higher performance to Brisbane thanks to similar rates of interstate migration.

They say this "has strengthened in the past 12 months, putting the pace of house price growth in these two areas much higher than that of Brisbane."

Adelaide and SA market outlook

Adelaide has had a strong and steady 2021, with its growth sitting close to the national average at around +20 per cent for the year.

Like Brisbane, though, the SA capital had a big boost in November, and it's been tipped as a market to watch in the new year.

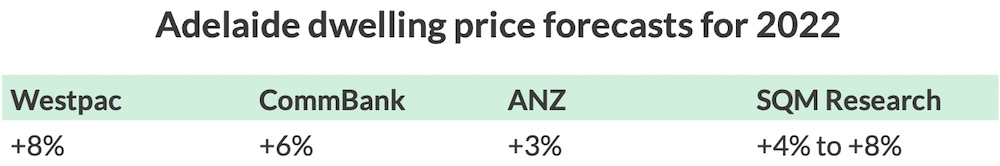

In terms of what economists are predicting, there's more of a spread here, from Westpac's +8 per cent prediction down to ANZ's +3 per cent.

Westpac notes that SA has been relatively unaffected by Covid which has minimised disruptions to the housing market, although the state is at risk of losing more of its populations to other states like QLD.

Louis Christopher's take on Adelaide is also on the positive side. He explains that it has "the lowest asking price for all cities, making Adelaide, the most affordable housing of any capital city in Australia," which feeds into the appeal and room for further growth.

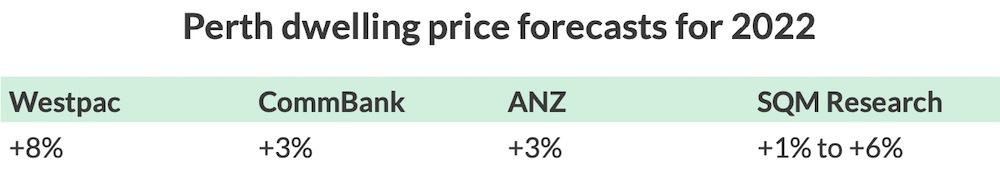

Perth and WA market outlook

Like Adelaide and SA, Perth and the rest of WA remains one of the least affected parts of Australia when it comes to the pandemic.

Even so, property price growth within the state's ironclad borders has stagnated since mid-way through 2021, with Perth gains looking to be around +13 per cent for the year.

Considering there's been such a significant dropoff in growth, forecasts for Perth's housing market look relatively promising, though there is a widespread of predictions.

Westpac tips prices to rise another +8 per cent next year, saying that the 2021 slump seen since mid-year "is hard to reconcile with the wider market picture, suggesting it may prove to be transitory."

Louis Christopher at SQM Research forecasts up to +6 per cent growth, saying "Perth housing prices are still below where they stood in 2010, offering the second-best value (Adelaide the best) of any Australian capital city when comparing rents to prices or indeed wages to prices."

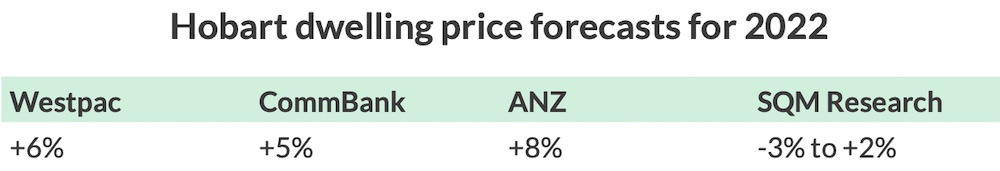

Hobart and TAS market outlook

2021 has been a remarkable year for the Tasmanian property market, with Hobart prices rising higher than any other capital city—around +27 per cent.

Considering supply is so limited in the state, there have been questions around how much further that growth can go in the new year.

According to the banks' forecasts, gains could be around the +6 or +7 per cent range, a big drop from the 2021 boom but still a healthy increase.

Westpac acknowledges that, while the market is very tight and demand continues to outstrip supply, the run of growth that Hobart has seen is ramping up affordability pressures, so further price increases should be more restrained.

The SQM Research prediction takes a more conservative approach. Louis Christopher explains that "Hobart is now an overheated housing market. Good value has long gone."

As a result, he expects anything from a -3 per cent drop to a slight +2 per cent boost in prices for 2022.

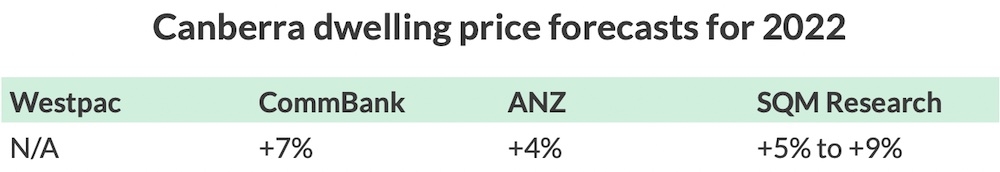

Canberra and ACT market outlook

Similar to Hobart, Canberra has had a massive 2021 in terms of growth, clocking up gains of around +24 per cent for growth.

Again, given the smaller population and tight market, analysts have questioned the potential longevity of the boom. Even so, forecasts for 2022 still look relatively strong.

CommBank and ANZ both agree on smaller rates of growth for the nation's capital, while Louis Christopher's prediction for SQM Research is more robust.

QBE sees considerable further growth in the ACT as a probability, noting that Canberra "benefits from being one of the most affordable capital cities in the country, with above-average incomes combining with below-average property prices."

They expect that the return of overseas students will greatly help the city's unit market, which has moved at a far slower pace than houses throughout 2021, thanks to renewed investor interest.

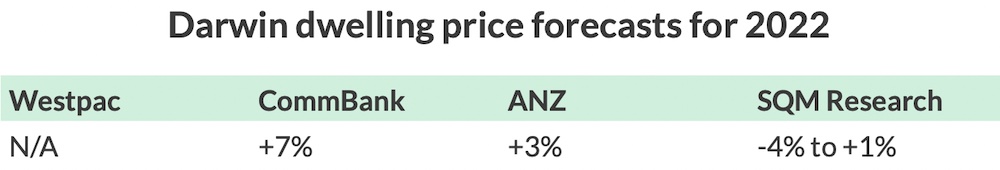

Darwin and NT market outlook

After a strong first half of 2021, Darwin, like Perth, hit the brakes in terms of growth.

Over the past three months, prices have more or less flatlined. As a result, forecasts have varied.

On the optimistic end of the scale, CommBank sees Darwin property prices getting another +7 per cent boost in 2022, while ANZ rounds that number down to +3 per cent.

SQM Research's Louis Christopher warns against the NT's boom-or-bust potential, suggesting that a downturn could be on the way.

"One significant bearish indicator is the sales listings which suggest sales turnover is slowing as I can see a rise in stock levels and days on market have been increasing of late," he says.