Adelaide property market news - key takeaways

- Price growth accelerates: Adelaide home values jumped by +1.4 per cent in October, marking the biggest monthly increase since July last year. This rise adds approximately $11,760 to the median value over the past month, with a +6.7 per cent annual growth. The lower quartile of the market is driving this trend, according to Cotality’s latest data.

- Supply remains constrained: Cotality’s analysis shows Adelaide's property market is facing a significant supply shortage, with listings 36 per cent below the five-year average. This limited supply is pushing prices upward.

- Auction clearance rates stable: Domain data reveals that Adelaide's auction clearance rate was 73 per cent for the week of November 2, 2025, indicating a stable selling environment.

- Rental market tightens: Weekly rents in Adelaide fell by -1.0 per cent over the past month to $613, while the vacancy rate remains low at 0.8 per cent. This points to a tight rental market, as reported by SQM.

- Interest rates hold steady: The Reserve Bank of Australia kept the cash rate at 3.60 per cent in November 2025, following earlier cuts this year. This decision, driven by inflation concerns, suggests stable lending conditions for the foreseeable future.

Get a free property value estimate

Find out how much your property is worth in today’s market.

Adelaide property price movements

The Adelaide property market is on the rise, with home values climbing steadily in recent months. Despite affordability challenges, the limited number of listings is likely to keep pushing prices up.

Adelaide property prices - October 2025

Adelaide's property prices have seen a significant boost, with a monthly increase of +1.4 per cent and a quarterly rise of +3.2 per cent. Over the past year, property values have jumped by +6.7 per cent, bringing the median value to $867,681.

| Property type | Month change | Quarter change | Annual change | Current median price |

|---|---|---|---|---|

| All Adelaide dwellings | 1.4% | 3.2% | 6.7% | $867,681 |

Source: Cotality

The steady growth in Adelaide's property values is mainly driven by the lower quartile of the market, which has experienced the strongest gains. This trend mirrors national patterns, where lower to middle price points are seeing the most substantial increases due to the expanded 5% deposit guarantee scheme.

House prices in Adelaide

House prices in Adelaide are following the overall property market's upward trend, with a monthly rise of +1.4 per cent and a quarterly increase of +3.2 per cent. Over the past year, house values have grown by +6.7 per cent, with the median house price now at $924,126.

| Property type | Month change | Quarter change | Annual change | Current median price |

|---|---|---|---|---|

| Adelaide houses | 1.4% | 4.8% | 6.7% | $924,126 |

Source: Cotality

The Adelaide housing market remains strong, driven by tight supply and consistent demand. The scarcity of listings, with stock levels 36 per cent below the five-year average, continues to support Adelaide house prices. The market's stability is further bolstered by the Reserve Bank of Australia's decision to hold the cash rate steady, offering buyers more certainty.

Unit prices in Adelaide

Unit prices in Adelaide have also been on the rise, with a monthly increase of +1.3 per cent and a quarterly gain of +3.2 per cent. Over the past year, unit values have grown by +7.1 per cent, bringing the median unit price to $633,959.

| Property type | Month change | Quarter change | Annual change | Current median price |

|---|---|---|---|---|

| Adelaide units | 1.3% | 3.2% | 7.1% | $633,959 |

Source: Cotality

The Adelaide unit market is thriving, with increased demand from first-home buyers and investors taking advantage of the expanded deposit guarantee scheme. Despite affordability challenges, Adelaide unit prices are expected to keep climbing, supported by limited supply and strong demand.

Adelaide property market forecasts 2026

Australia’s big four banks regularly release house price forecasts as part of their economic research. This helps them make informed mortgage-lending decisions, manage risk, and demonstrate their market expertise. Here's what they expect for 2026 across the country.

| Market | CBA forecast 2026 | Westpac forecast 2026 | NAB forecast 2026 | ANZ forecast 2026 |

|---|---|---|---|---|

| National | 4.0% | 4.0% | 4.1% | 5.8%* |

| Sydney | 3.0% | 5.0% | 4.2% | 5.3% |

| Melbourne | 2.0% | 3.5% | 3.9% | 6.2% |

| Brisbane | 5.0% | 4.5% | 4.6% | 4.3% |

| Adelaide | 5.0% | 3.0% | 4.1% | 2.5% |

| Perth | 6.0% | 4.0% | 3.7% | 4.3% |

| Hobart | 2.0% | 2.0% | 3.6% | 1.8% |

| Darwin | 5.0% | NA | 3.7% | 2.4% |

| Canberra | 3.0% | NA | 2.8% | 1.6% |

Source: Westpac Housing Pulse, NAB Residential Property Survey, CBA Economic Update, ANZ Housing Outlook.

* ANZ estimate for Capital Cities, not national

Adelaide's property market predictions suggest a steady growth path, with expectations of moderate price increases. Compared to other capital cities, Adelaide's growth is projected to remain consistent, reflecting its stable demand and supply dynamics.

Adelaide home price forecasts 2026

Westpac forecasts a +3 per cent increase in Adelaide property prices for 2026, while NAB predicts a +4.1 per cent rise. ANZ, however, anticipates a growth of +2.5 per cent. These forecasts indicate that Adelaide's property market is expected to continue its upward trend, albeit at a slower pace compared to some other capitals.

The steady growth is supported by a stable cash rate environment and reasonable affordability levels, which help maintain buyer interest without overheating the market.

RBA cash rate forecast 2026

The Reserve Bank of Australia (RBA) kept its cash rate unchanged at 3.60 per cent on 5 November 2025, following three 0.25-per-cent cuts earlier in the year. This decision came as inflation showed a surprise uptick, with the RBA’s preferred trimmed-mean measure hitting 3.0 per cent, the top of its 2–3 per cent target band, and headline CPI running at 3.5 per cent annually. This left no room for another 2025 rate cut. Major bank economists had initially expected a November cut but changed their predictions when those higher inflation figures emerged, correctly anticipating the RBA would hold steady.

Here’s where the major banks see the cash rate heading next:

- Commonwealth Bank (CBA): Expects no further cash rate cuts in this cycle, keeping the rate at 3.60 per cent into 2026.

- Westpac: Also sees no cuts for the rest of 2025 but forecasts a 0.25-per-cent cut in May 2026 and another in August 2026, bringing the cash rate down to 3.10 per cent by late next year.

- National Australia Bank (NAB): Predicts no additional 2025 cuts, with one 25-basis-point cut in May 2026 that would lower the cash rate to 3.35 per cent by mid-2026.

- ANZ: Similarly anticipates no more cuts in 2025, with the next move a 0.25-per-cent cut in February 2026, taking the cash rate to 3.35 per cent at the start of 2026.

What this means for the Adelaide market

Adelaide has maintained a steady upward trajectory, with home values growing around +6 to +7 per cent over the past year. The RBA’s pause gives buyers more certainty, reinforcing recent gains without overheating the market. Supply is tight, affordability is still reasonable, and demand remains broad-based. While Adelaide doesn’t tend to spike or crash with rate changes, it’s clear that stability at 3.60 per cent is supporting slow, reliable growth.

Adelaide house prices graphs and charts

Adelaide's house price growth over the last 5 years has been impressive. In October 2025, dwelling values rose by +1.4 per cent, with a quarterly increase of +3.2 per cent and a +6.7 per cent rise over the past year. This growth has pushed Adelaide’s home values to a record high, showcasing a strong market performance despite previous economic challenges.

Insights from Cotality reveal that Adelaide's housing market has been notably resilient, maintaining nearly all of its gains from the COVID era. Even with rising interest rates, Adelaide saw only a slight dip in prices, which quickly bounced back. The city's relative affordability and low supply of listings have consistently fuelled demand, keeping values on an upward path.

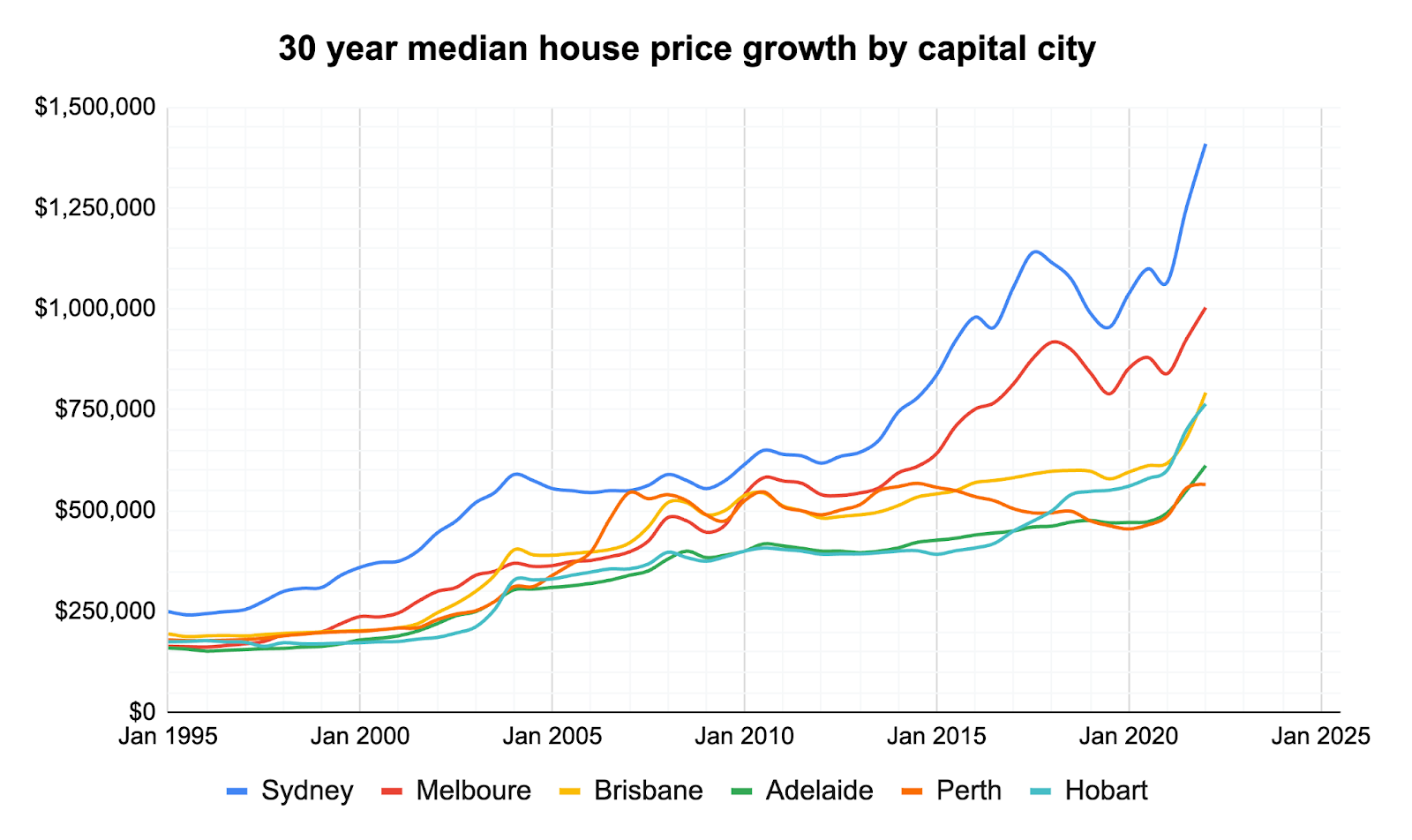

Adelaide property prices graph over 30 years

Adelaide property prices growth over the last 10 years has been significant, with the city experiencing a substantial upswing during the pandemic. This period saw Adelaide join the "million-dollar club" capitals, driven by strong population inflows and limited housing supply. Historically, Adelaide's market has been characterised by cycles of growth and consolidation, with recent years marked by a return to strong growth as interest rates stabilised.

Over the past three decades, Adelaide's housing market has shown resilience, with long-term upward trends despite occasional downturns. Homeowners today face a mix of triumph and concern, as property values have soared, yet affordability remains a pressing issue. The current sentiment reflects cautious optimism, with many recognising the long-term benefits of property investment in Adelaide, even as they navigate the challenges of a competitive market.

Adelaide selling statistics

Adelaide's property market in November 2025 presents a mixed scenario. While some indicators point to stability, others suggest potential challenges. The city's auction clearance rates have remained strong, indicating ongoing buyer interest even as listings decline.

Adelaide sales volume and days on market

Sales volumes in Adelaide have increased, with a growing number of transactions compared to last year. Properties are taking a bit longer to sell, with the median days on market now at 30 days. This is slightly above the national average and reflects a more cautious approach from buyers.

| Adelaide sales volume | Adelaide days on market |

|---|---|

| 2.3% Change from 12mo ago | 30 days 28 days 12 mo ago |

Source: Cotality

The drop in sales volume, along with longer days on market, suggests buyers are taking their time, possibly due to economic uncertainties or higher property prices. Compared to other capitals, Adelaide's market is moving more slowly, with properties taking longer to sell.

Adelaide new and total listings

Adelaide has seen a significant drop in new and total listings. New listings have fallen by 12.2 per cent, and total listings have decreased by 15.0 per cent from the previous year.

| Adelaide new listings | Adelaide total listings |

|---|---|

| -12.2% Change from 12mo ago | -15.0% Change from 12mo ago |

Source: Cotality

This decline indicates a tightening market, with fewer properties available for sale. This could lead to increased competition among buyers for the limited stock, potentially driving prices up if demand stays steady. The reduction in listings is more pronounced in Adelaide compared to some other capitals, highlighting a unique challenge for the local market.

Adelaide vendor discount and auction clearance rates

Vendor discounting and auction clearance rates provide insights into the market's health. Vendor discounting reflects the gap between asking and sale prices, while auction clearance rates indicate buyer demand and market confidence.

Adelaide vendor discount

| Oct 2025 | Sep 2025 | Aug 2025 | Jul 2025 | |

|---|---|---|---|---|

| Adelaide median vendor discount | -3.7% | -3.5% | -3.6% | -3.6% |

Source: Cotality

The vendor discount rate in Adelaide has been stable, with a median discount of -3.7 per cent. This suggests sellers are not significantly lowering their asking prices, indicating confidence in the market. Compared to the national average, Adelaide's discount rate is slightly higher, suggesting a balanced negotiation environment between buyers and sellers.

Adelaide auction clearance rates

| Adelaide | November 23 | November 16 | November 9 | November 2 |

|---|---|---|---|---|

| Clearance Rate | 73% | 66% | 70% | 73% |

| Auctions Scheduled | 204 | 184 | 169 | 158 |

| Auctions Reported | 184 | 155 | 143 | 137 |

| Sold | 135 | 103 | 100 | 100 |

| Withdrawn | 8 | 7 | 6 | 2 |

| Passed in | 41 | 45 | 37 | 35 |

Source: Domain

Adelaide's auction clearance rates have been steady, hovering around 73 per cent over the past month. This stability suggests that despite challenges in listings and sales volumes, there is still healthy buyer activity in the auction space. Compared to other capitals, Adelaide's auction market appears resilient, maintaining steady performance even as other cities experience fluctuations.

Get a deeper insight into how Adelaide sellers are faring in 2025 and what could be on the horizon for the remainder of the year with some of our latest articles.

Adelaide property investing

Adelaide's rental market is experiencing tight conditions, with limited supply keeping rents high. Even though growth rates have slowed a bit, the market still favours landlords. Let's dive into the current rental rates, yields, and vacancy trends in Adelaide.

Adelaide rental market

Rental rates in Adelaide have been on the rise, showing a +4.2 per cent increase from August 2024 to August 2025. The rental yield in Adelaide currently stands at 3.7 per cent, offering a stable return for property investors. These numbers highlight the ongoing demand for rental properties in the city.

| Location | Rental rates | Rental yield | Annual change in rents, houses | Annual change in rents, units |

|---|---|---|---|---|

| National | 4.6% | 3.60% | NA | NA |

| Combined Capitals | 4.0% | 3.40% | NA | NA |

| Combined Regional | 6.1% | 4.30% | NA | NA |

| Sydney | 4.0% | 3.00% | 3.40% | 5.00% |

| Melbourne | 1.8% | 3.60% | 1.60% | 2.20% |

| Brisbane | 5.8% | 3.50% | 5.60% | 6.50% |

| Adelaide | 3.6% | 3.60% | 3.70% | 3.10% |

| Perth | 5.8% | 4.00% | 5.70% | 6.90% |

| Hobart | 6.9% | 4.40% | 6.80% | 7.70% |

| Darwin | 8.5% | 6.40% | 7.60% | 10.00% |

| Canberra | 2.9% | 4.00% | 2.80% | 3.40% |

Source: Cotality

Adelaide’s rental market remains tight due to persistent supply constraints. The annual rent increase for houses is +4.1 per cent, while units have seen a +4.6 per cent rise. This consistent demand, combined with limited new supply, suggests that rental pressures are likely to persist unless there is a significant boost in available stock.

Adelaide vacancy rates

Vacancy rates are key to understanding the balance between supply and demand in the rental market. Nationally, vacancy rates have stayed low, indicating a tight rental market across most capital cities. Adelaide's vacancy rate is particularly low at 0.8 per cent, highlighting the limited availability of rental properties.

| Location | Oct 2025 vacancy rates | Oct 2025 vacancies | Oct 2024 vacancy rates | Oct 2024 vacancies |

|---|---|---|---|---|

| National | 1.20% | 36152 | 1.20% | 36486 |

| Sydney | 1.30% | 9553 | 1.50% | 10874 |

| Melbourne | 1.80% | 9713 | 1.70% | 9052 |

| Brisbane | 1.00% | 3391 | 1.00% | 3580 |

| Adelaide | 0.80% | 1215 | 0.60% | 915 |

| Perth | 0.70% | 1304 | 0.50% | 998 |

| Hobart | 0.40% | 107 | 0.60% | 179 |

| Darwin | 0.70% | 181 | 1.40% | 349 |

| Canberra | 1.40% | 860 | 1.70% | 1059 |

Source: SQM Research

In Adelaide, the vacancy rate of 0.8 per cent has remained stable, reflecting a tight market. This low vacancy rate aligns with the national trend of undersupply, and even minor increases in demand could lead to further rent hikes. Compared to other cities, Adelaide's vacancy rate is among the lowest, indicating strong demand and limited rental options for tenants.

Louis Christopher, Managing Director of SQM Research said in his latest rental market report

“The national vacancy rate holding at 1.2% suggests the rental market remains very tight, with little sign of meaningful supply increases. Sydney and Brisbane continue to see strong tenant demand, while Hobart remains at near record-low vacancy levels. Rents are still rising in most capitals, particularly for houses, despite a slight easing in rental growth rates compared to last year. Overall, we are still seeing an undersupplied rental market, although conditions appear to be stabilising in some cities such as Melbourne and Canberra.”

Adelaide’s vacancy rate increased to 0.8 per cent in April 2025, with vacancies climbing +25.8 per cent year-on-year to 1,233 properties—evidence of the easing Louis highlights across tight markets. This winter bump mirrors his note on seasonal relief giving tenants more options. Yet at 0.8 per cent, Adelaide remains well below the balanced 2–3 per cent range, so the market continues to favour landlords and is likely to tighten again post-winter unless fresh stock enters. Advertised weekly rents fell by -1.0 per cent over the month to $613, reinforcing the easing pressure he describes.

Highest growth areas in Adelaide

| Rank | SA3 Name | SA4 Name | Median Value | Annual % Change |

|---|---|---|---|---|

| 1 | Adelaide Hills | Central and Hills | $954,213 | 9.9% |

| 2 | Gawler - Two Wells | North | $754,884 | 8.9% |

| 3 | Playford | North | $649,137 | 8.7% |

| 4 | Port Adelaide - West | West | $860,679 | 8.4% |

| 5 | Salisbury | North | $745,767 | 8.1% |

| 6 | West Torrens | West | $1,062,118 | 8.0% |

| 7 | Tea Tree Gully | North East | $855,853 | 7.8% |

| 8 | Onkaparinga | South | $822,282 | 7.1% |

| 9 | Mitcham | South | $1,203,993 | 6.9% |

| 10 | Port Adelaide - East | North | $895,001 | 6.8% |

Source: Cotality

Highlights for Adelaide’s high growth areas

- Adelaide Hills takes the top spot in October 2025, boasting a median value of $954,213 and an impressive annual growth of +9.9 per cent. This area remains a favourite for families and professionals who are drawn to its spacious blocks and lush surroundings.

- Gawler - Two Wells comes in at #2 with a median value of $754,884 and an annual growth of +8.9 per cent. Its strong performance is due to its status as a key growth corridor, featuring new housing developments and excellent commuter links.

- Playford holds the #3 position with a median value of $649,137 and an annual growth of +8.7 per cent. The area's ongoing urban renewal and new commercial projects continue to boost its appeal. (Suburbs to watch: Elizabeth East)

- Port Adelaide - West and Salisbury are also showing robust growth, with annual increases of +8.4 per cent and +8.1 per cent, respectively. Port Adelaide - West benefits from waterfront redevelopment, while Salisbury's growth is driven by its affordability and proximity to job centres. (Suburbs to watch: Paralowie, Salisbury Downs)

- West Torrens ranks #6, with a median value of $1,062,118 and an annual growth of +8 per cent. Its close proximity to the city and ongoing infrastructure improvements make it a highly sought-after area.