The best suburbs to invest in Australia in 2023

If there’s one thing Aussies love to debate, it’s the state of the property market - and with the year we’ve just had, the debate is getting even more contentious. Unfortunately we’re left with more questions than ever, especially around what’s going to happen to the market in 2021.

If you’re looking to invest in property, knowing where to put your money might feel a little baffling. With the planned repeal of JobKeeper and JobSeeker on the horizon; border closures; a pause in student migration; and proposed changes to responsible lending standards, it’s safe to say that choosing a booming suburb is a little more complicated in the current climate.

While there’s still a bit of economic uncertainty ahead, some industry pundits are pointing to a handful of regions around the country that have not only recorded solid growth over the past year, but are expected to grow in 2021.

Wondering where you might get solid returns? Let’s take a look at these markets below.

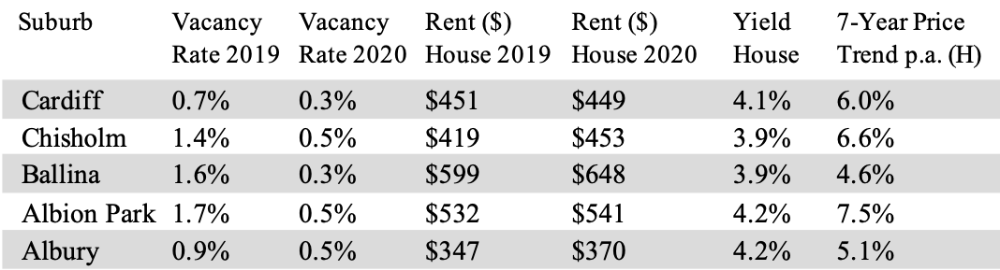

Best suburbs to invest in NSW 2021

What did the Sydney and NSW property market look like in 2020?

According to the latest CoreLogic Hedonic Home Value Index, Sydney property prices had a strong recovery in the second half of 2020 with home values increasing +2.7 per cent over the past 12 months.

Regional NSW property prices climbed a more significant +8.3 per cent over the year.

NSW Investor activity declined throughout 2020 with the investors as a proportion of housing finance falling to 27.4 per cent. The average over the past decade was 41.9 per cent.

Rental market performance has been greatly varied throughout 2020. Gross rental yields for Sydney properties sat at 2.9 per cent which were significantly impacted by border closures.

Regional NSW rental properties were less affected by this, with gross rental yields is 4.4 per cent

Sydney and NSW property market forecast 2021

In the base scenario, Sydney property prices are projected to climb a further +7 to +11 per cent in 2021.

The rental market is projected to continue its downward slope with the 2021 forecast predicting rents to decline -2 to -6 per cent.

Investor activity is expected to be different in 2021 with many to move away from the inner suburb of Sydney where high rise units are oversupplied and have bad press around structural quality issues.

The demand for larger properties as well as property price rises and low interest rates

will likely prompt investors to slowly enter back into the market and venture further into regional NSW where vacancy rates have been low and rents have been on the rise.

While the unit sector is likely to stagnate in 2021, the move towards a tax opt-in may be attractive to investors due to their low land ratio.

Best investment property locations in NSW 2021

These suburbs have been selected due to strong performance in 2020, low vacancy rates, increased rents and high yields.

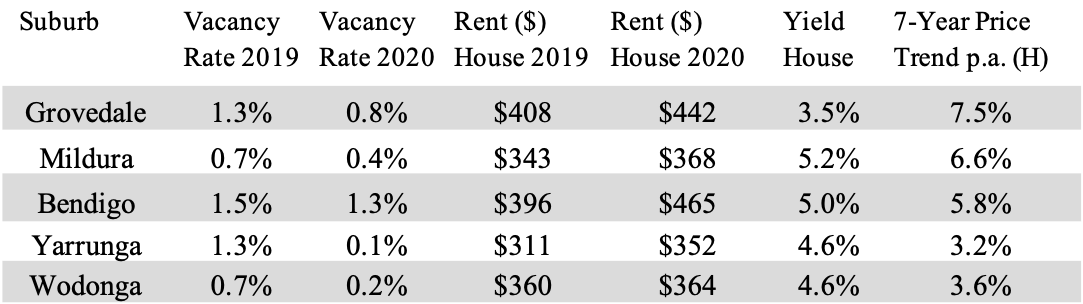

Best suburbs to invest in Victoria 2021

What did the property market look like in 2020?

The latest figures from the CoreLogic Home Value Index show that over the year, regional VIC properties are performing better than those in Melbourne with home values up +5.6 per cent compared to -1.3 per cent in the capital city.

Melbourne’s high exposure to overseas migration as a source for new housing demand prior to the pandemic as well as second lockdown significantly impacted the rental market.

Annual rents in the unit market were particularly affected, down -7.6 per cent, the lowest decline in the country.

Gross rental yield for Melbourne sits at +3.1 per cent and +4.3 per cent in regional VIC.

Melbourne and VIC property market forecast 2021

In the base scenario, Melbourne property prices are forecast to increase +2 to +6 per cent in 2021.

With borders unlikely to open within the year, Melbourne rents are predicted to continue to decline -2 to -7 per cent driven by the weak rental conditions in the unit sector.

In 2021, investor activity is expected to remain low until borders open and international travel returns.

Investors who can afford low or no rental income may choose to take advantage of lower property values during this time.

Best suburbs to invest in Melbourne and Victoria 2021

These suburbs have been selected due to strong performance in 2020, low vacancy rates, increased rets and high yields.

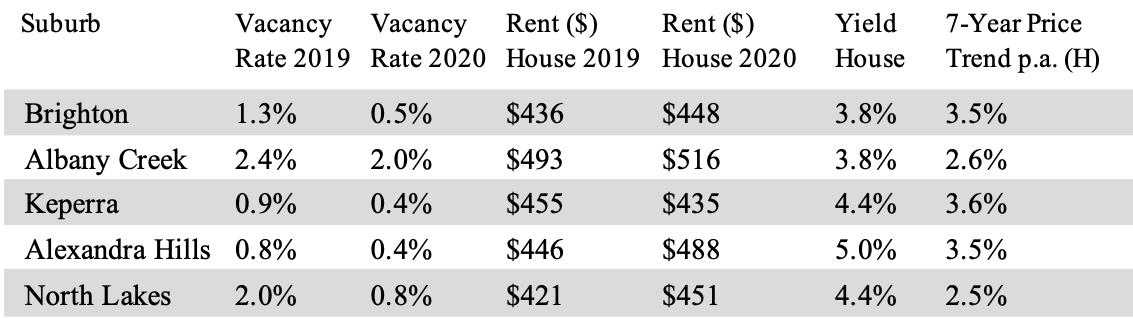

Best suburbs to invest in Queenland 2021

What did the property market look like in 2020?

According to the latest CoreLogic Home Value Index, Brisbane property prices have continued to be very resilient, up +3.6 per cent higher than they were 12 months ago.

Regional QLD saw strong gains throughout the year with prices rising +6.9 per cent over the year.

Despite high supply and declined investor activity, gross rental yields for Brisbane properties are still higher than the main markets of Sydney and Melbourne.

In regional QLD, rental yields are even higher at +5.2 per cent.

Brisbane and QLD proeprty market forecast 2021

In the base scenario, Brisbane property prices are predicted to increase +4 to +8 per cent in 2021.

The rental market is also looking optimistic with Brisbane rents expected to increase +4 to +7 per cent in 2021.

Houses are likely to perform better than units especially in Inner Brisbane where the oversupply of unit developments has placed downward pressure on rents.

Best suburbs to invest in Brisbane and QLD 2021

These suburbs have been selected due to strong performance in 2020, low vacancy rates, increased rents and high yields.

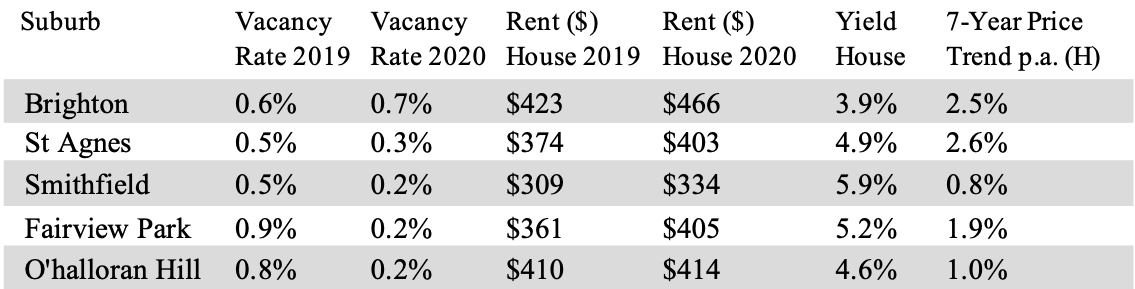

Best suburbs to invest in South Australia 2021

What did the property market look like in 2020?

Figures from the CoreLogic Home Value Index show Adelaide properties have performed quite well over the past 12 months with prices up +5.9 per cent.

Regional South Australia has defied expectations, increasing +8.1 per cent over the year.

The South Australian rental market has been tightening since 2017. As a result, Adelaide recorded the second highest annual rent value growth of all the capital cities in September at 2.6 per cent.

Gross rental yields for Adelaide properties are at +4.3 per cent and an impressive +5.8 per cent in Regional South Australia.

Adelaide and SA property market forecast 2021

In the base scenario, Adelaide property prices are expected to increase +6 to +10 per cent in 2021.

The rental market is expected to continue it’s upwards trajectory, with forecasts of around +4 to +7 per cent growth in rents.

Although the portion of investor finance declined in 2020 from the decade average of +31.7 per cent to +20.4 per cent in August, low mortgage rates, low property prices and a tightening rental market may prompt an increase in investor activity over the coming months.

Regional SA property prices Best suburbs to buy in Adelaide and SA in 2021

These suburbs have been selected due to strong performance in 2020, low vacancy rates, increased rents and high yields.

Best suburbs to invest in Western Australia 2021

What did the property market look like in 2020?

Perth property prices have been slowly increasing and are now in positive territory over the year, up +1.9 per cent.

In regional Western Australia, home values are still in the negatives, down -3.7 per cent over the year.

After many years of slow rental market activity, Perth rents for houses and units skyrocketed in 2020. The change in house rents are the highest in the country up +10.1 per cent and up +6.8 per cent for units.

Gross rental yields for Perth are at +4.3 per cent and +6.2 per cent in Regional WA - one of the highest yields of all the regional states.

Perth and WA property market forecast 2021

Mr Christopher not only forecasts strong growth in Perth over the year but predicts it will be the top performer with home values to rise +8 to +12 per cent.

Unlike the other states which have experienced lowered investor activity, Western Australia has bucked the trend with the share of mortgage finance for investors climbing to +17.0 per cent from +14.3 per cent in April.

Investor activity is expected to continue to rise in 2021 as the rental market is predicted to be in very strong favour of landlords with property rents expected to shoot up +9 to +21 per cent.

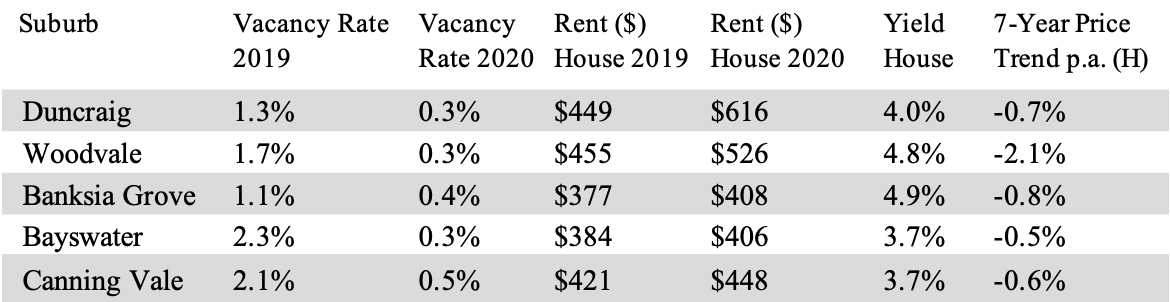

Best suburbs to buy in Perth and WA in 2021

These suburbs have been selected due to strong performance in 2020, low vacancy rates, increased rents and high yields.

Best suburbs to invest in Tasmania 2021

What did the property market look like in 2020?

The property market in Hobart has been quite positive in 2020 with property prices rising +6.1 per cent over the past 12 months.

Regional Tasmania had the highest annual growth, up an impressive +11.9 per cent.

The pandemic disrupted the rental market, increasing vacancies as many Airbnb properties were converted to long term rentals due to closed borders.

Hobart change in rents declined -1.0 per cent for houses and -2 per cent for units.

According to The Conversation, the Airbnb market in Hobart City is around 11 per cent of the total private rental market. Hobart experienced a smaller drop in rental demand than Sydney because of the smaller number of temporary overseas migrants.

The gross rental yield is +4.5 per cent in Hobart and +5.0 per cent in regional TAS

Hobart and TAS property market forecast 2021

In the base scenario, Hobart properties are forecast to rise +3 to +7 per cent in 2021.

Growth is expected to remain quite mild with property rents predicted to increase +0 to +3 per cent.

Although investor participation has declined since March, the return of inter-state travel will likely tighten the rental market again as owners revert their properties back to Airbnb’s.

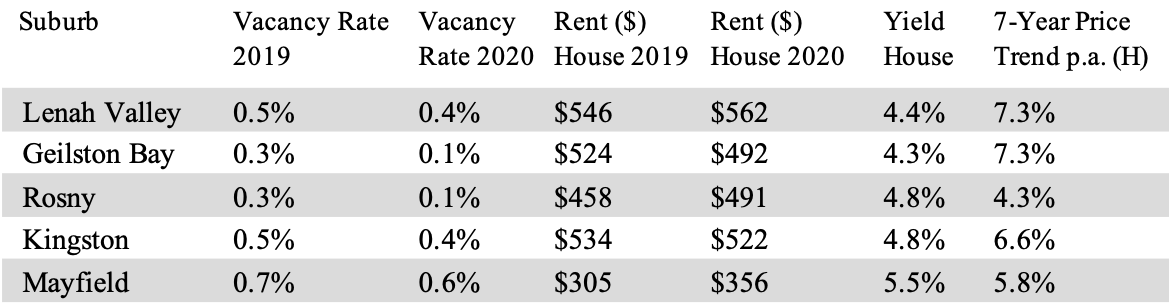

Best suburbs to invest in Hobart and TAS 2021

These suburbs have been selected due to strong performance in 2020, low vacancy rates, increased rents and high yields.

Best suburbs to invest in ACT 2021

What did the property market look like in 2020?

Driven by the low cash rate, low covid-19 case numbers, and a population that is more likely to be employed in stable industries such as the public sector, dwelling values in the ACT soared throughout 2020.

According to CoreLogic’s Hedonic Home Value Index, over the past year, when comparing all capital cities in Australia, Canberra has achieved the second highest change in dwelling values, with annual growth of 7.5%,

The rental market has surged too. With data from CoreLogic showing that Canberra is the most expensive city for renters in the country. The median weekly rent for a house in the capital is now $657, up 3.6 per cent since 2019.

The price of units is also increasing (at a slower pace), with the average setting tenants back $473 per week.

Competition for rental housing is said to be fierce in the capital, with agents telling ABC news that there has already been more interstate migration into the ACT than expected, leaving local tenants, especially students battling it out for a property.

Canberra and ACT property market forecast 2021

SQM research’s base case scenario forecasts Canberra to rise by 5 to 9 per cent in 2021.

Mr Christopher says the market has shown evidence of strong sale turnover and says that over 2020, Canberra had the strongest auction market in the country.

With the ACT First Homebuyers’ scheme, exempting buyers from stamp duty, low interest rates, and an increase in Federal Government spending, 2021 looks to be a strong year for the market.

Mr Christopher notes that the rise of new unit development completions hasn’t translated to an oversupply just yet, and is unlikely to in 2021.

According to CoreLogic, thus far, the portion of investment across the ACT hasn’t been disrupted as a result of Covid-19, but has trended down over time. Gross rental yields have dropped mildly, which is likely a result of dwelling value increases that we’ve seen, especially throughout the pandemic. This rise in prices, and drop in rental yields may weaken investor interest over time.

Mr Christopher says that if Covid is eliminated this year, there’s likely to be piqued interest in inner-city locations, but until this happens, values in affluent suburbs on the outer ring will continue to grow.

He forecasts rent prices in Canberra to rise by 3 to 5 per cent over 2021.

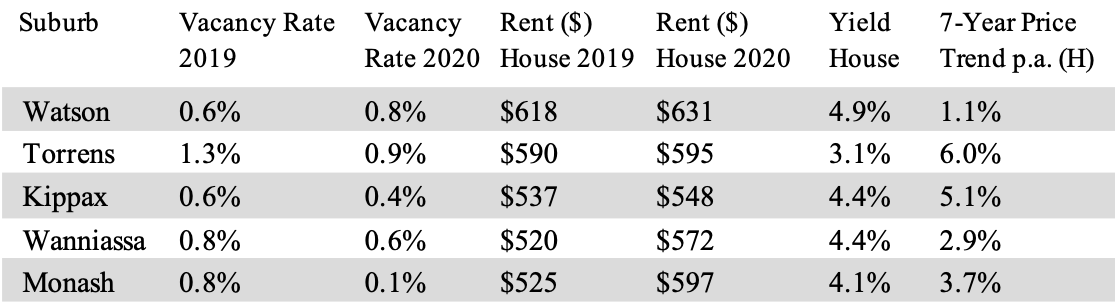

Best suburbs to invest in Canberra and ACT 2021

These suburbs have been selected due to strong performance in 2020, low vacancy rates, increased rents and high yields.

Best suburbs to invest in Northern Territory 2021

What did the property market look like in 2020?

A year ago, investors were avoiding Darwin, but throughout 2020, the market began to turn around. In fact, the Darwin market has recorded the highest annual growth of any capital city in Australia, up 9 per cent.

A number of factors may have contributed to this rise in values: not just low interest rates, but also growing interstate migration into the Territory and stimulus from the Federal Government.

In addition, the state government has a number of incentives on offer for buyers, including the Territory Home Owner Discount, first-home buyer grants, building grants and more. The Territory has also contained Covid-19 quite well, and was one of the first states to open its borders during the height of the pandemic in Australia, which may have attracted more interstate renters and buyers looking for a lifestyle change.

According to CoreLogic’s Tim Lawless, while Darwin is still below its 2014 peak it “has gone from one of the weakest housing markets in Australia to the strongest.”

This steep growth has seen Darwin house and unit rents reach their highest point since back in 2017, going from $420 per week to $550. Over the past 12 months, the cost of renting a house has skyrocketed +27.3 per cent, with unit rents up +5.6 per cent. Vacancy rates are also incredibly low, at 0.9 per cent.

Mr Lawless told ABC news that if you owned an investment property in Darwin, then you have probably had one of the best years ever.

Darwin and NT property market forecast 2021

So what does the Northern Territory have in store for us in 2021? According to SQM Research’s Louis Christopher, the seven-year housing downturn is well and truly over.

With rents rising sharply, so too are vendor asking prices for houses, as listings continue to fall. While some may see this market as a sure-bet for investment, Mr Christopher advises investors to tread with caution as he can’t see any evidence to suggest that the local economy is going to power ahead.

His base case forecast for Darwin is reflective of this economic uncertainty, with a conservative prediction of +2.8 per cent. He forecasts rent prices to rise by 8 to 18 per cent.

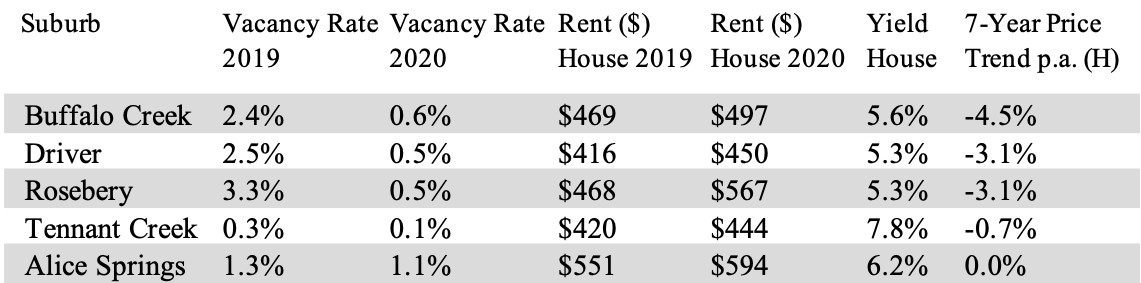

Best suburbs to invest in Darwin and NT 2021

These suburbs have been selected due to strong performance in 2020, low vacancy rates, increased rents and high yields.

A note on where we've sourced our data:

We’ve sourced data from SQM Research’s annual Boom and Bust Report. The forecast for 2021 includes four scenarios, and for the purpose of this article, when we talk about SQM’s forecasts for 2021, we are using data outlined in “scenario 1” which relies on the following factors for ongoing momentum:

- The cash rate remains unchanged at 0.1%

- Qualitative easing expands

- Outbreaks of Covid are contained through lockdowns

- JobKeeper extended to September Quarter 2021

- Progressive roll-out of the Covid vaccine

We also drill-down into suburb level data, using the same SQM Research report. Every suburb in the country is given a rating based on demographics, suburb price volatility, suburb supply, vacancy rates, mortgage stress, long-term price performance, household income growth, and more.

Please note, this is not to be taken as gospel. If you are looking to invest, we encourage you to undertake your own research.