How to choose the right agent to sell your home

Finding the right agent for you can make all the difference when selling.

Selling property in South Australia comes with its own set of rules, steps and considerations. Whether you're relocating, adjusting to life changes or selling an investment, understanding the local process can help you avoid delays and maximise your result. With the right preparation and support, you can navigate the market with confidence.

Expect to pay a real estate agent commission in South Australia of around 1.2% to 3.2% of the sale price, depending on your location and agent. Metro areas like Adelaide often attract lower rates than regional towns like Berri.

On top of commission, you’ll need to budget for marketing, legal fees, and optional extras like home staging or professional photography. Costs can vary based on how you choose to advertise and present your property.

Use our Selling Costs Calculator and Commissions Calculator to estimate your expenses and plan with confidence.

Read the full guide on how to find the right agent to sell your home.

Please select your suburb from the drop down

Use our handy selling calculator to crunch the numbers and get an estimate.

In South Australia, most properties are sold by private treaty, but auctions are also popular in areas like Adelaide and other high-demand suburbs. A knowledgeable agent can help you weigh up your options and choose the best method based on your goals, property type, and the current market in your suburb.

Private treaty gives you more control over the price, terms, and negotiation timeline—ideal for buyers who need flexibility. Auctions, on the other hand, create urgency and can drive strong competition, potentially leading to a higher sale price.

A well-presented property can make a strong first impression. Make sure to:

These steps can significantly improve your online listing and inspection turnout.

Read the full guide on how to prepare your property for sale.

Getting your price right from the start can have a big impact on how quickly you sell and what offers you receive. For private treaty sales, you'll need to work with your agent to set a competitive asking price based on recent sales, current market conditions, and the unique features of your property.

If you’re selling via auction, your agent will also help you determine a realistic reserve price, the minimum you're willing to accept on auction day. Overpricing can turn buyers away, while a well-researched, market-aligned price will attract serious interest early on.

Getting a property report with recent sales in your suburb and an online property value estimate can be a useful starting point.

Marketing in SA will depend on your suburb, property type and ideal buyer. Your agent might recommend a combination of:

In South Australia, you need a conveyancer or solicitor to prepare a Form 1 (Vendor’s Statement) and a Contract of Sale, according to the Legal Services Commission of South Australia.

Private treaty buyers in South Australia will legally get a cooling-off period of two business days where they can change their minds.

Settlement in SA is typically 4 to 12 weeks but can be negotiated between the buyer and seller.

Read more on settlement and how to negotiate a settlement date.

Finding the right agent for you can make all the difference when selling.

From obvious expenses to hidden costs, get the full rundown of what's involved.

See expert predictions, and current pros and cons to help you decide.

Please select your suburb from the drop down

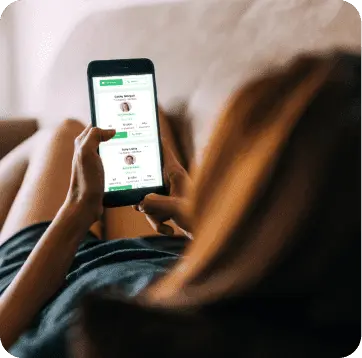

Remove the guesswork. Use OpenAgent to help you find, compare and shortlist the top agents in your suburb.

Selling property in South Australia? Our calculators can help you estimate agent commissions and selling costs, giving you a clearer picture from the outset.

Calculate the costs involved in selling your property and budget effectively.

Pay the right commission for your suburb and maximise your sale price.

Our 7-day email course will guide you through every step of the selling journey.

To sell a property that’s currently tenanted in SA, there are regulations you have to follow:

For inspections and open homes:

To end a due to a sale:

For full details, refer to the SA Government.

Capital gains tax (CGT) is a federal tax that you’ll pay if the property was not your main residence and you made a profit on the sale. For example, if you bought an investment property for $400,000 and sold it for $500,000, you may pay tax on the $100,000 gain.

If you’ve owned the property for 12 months or more, you may qualify for the 50% CGT discount. There are exceptions, including if the home was your principal place of residence or inherited under certain conditions.

Refer to the ATO or your accountant for personalised advice. Read more on tax for selling investment property.

In order to sell a deceased estate property in SA, you need a copy of the deceased’s Will and Grant of Probate, or the letter of administration if there is no Will, from the Supreme Court of South Australia. You cannot sell the property until the grant is received.

Capital gains tax may apply if the property is sold more than two years after the deceased’s date of death. However, there are typically exemptions if the property was their primary place of residence. We recommend consulting a solicitor and accountant for assistance with the legal and tax implications.

Yes, selling a property For Sale By Owner (FSBO) is legal in South Australia. While you can save on agent commission, you'll need to handle pricing, paperwork, advertising and buyer negotiations yourself. Many sellers find that a good agent helps secure a higher sale price, streamlines the process and avoids common pitfalls.

Start by researching local agent commissions and selling costs to understand your budget. Choose the right agent based on your goals and location. They will be able to help you choose between a private treaty and auction.

Get your legal documents in order with help from a conveyancer or solicitor, including a Contract of Sale and Form 1 (Vendor’s Statement). Work with your agent to present, price, and market your home. Once an offer is accepted, you'll move through conveyancing and settlement, which typically takes 4 to 12 weeks.

Timeframes vary depending on your suburb, property type, and market conditions. In Adelaide, the median days on market (DOM) is around 22 days, but this can shift depending on the season and buyer demand. Properties in regional South Australia often take longer to sell. You can get a free property report to see the average DOM in your suburb, or speak to a local agent for tailored advice.

There are no state-specific seller taxes, but CGT may apply if the property was an investment. Stamp duty is paid by the buyer. It’s always wise to speak with a tax advisor before selling.

Private treaty is the most common way to sell in SA, especially in regional areas and suburbs with steady demand. Auctions are more popular in competitive Adelaide suburbs like Norwood or Unley, where buyer interest is high. Private treaty gives you more flexibility with pricing and terms, while auctions can create urgency and push prices higher. Your agent can help you choose the best method for your area and circumstances.

Buyers in South Australia have a 2 business day cooling-off period after signing a contract unless the property is purchased at auction or on the same day as an auction. The cooling-off period starts once the buyer receives the signed Form 1 disclosure document. As a seller, it’s important to be aware of this window, as the buyer can withdraw from the sale during this time.