Australian suburbs where it's cheaper to buy than rent

Emily is a Sydney-based real estate writer.

Learn more about our editorial guidelines.

The great Australian dream of owning a home may be in reach for more Australians as new data shows the suburbs where a mortgage is cheaper than renting.

The latest figures reveal good news for first home buyers wanting to get onto the property ladder.

Data Analyst, Carson Teh says that a combination of factors have allowed properties to become more affordable and more attractive for buyers.

“The closing gap between buying a property and renting can be attributed to three main factors - lower property values, historically low interest rates, and government incentives for first home buyers,” he said.

Over the past decade, skyrocketing property prices coupled with stagnant wage growth has made it increasingly difficult for renters and prospective buyers to enter the market.

The annual Demographia International Housing Affordability Survey 2020 reported that Australia’s five major housing markets were “severely unaffordable” with prices doubling since the early 2000s.

The report ranks the least affordable housing markets in the world, placing Sydney in position three, and Melbourne in position four, behind only Hong Kong and Vancouver.

The latest figures reveal good news for first home buyers wanting to get onto the property ladder.

However, due to Covid-19 and its associated impact on the economy, property prices in many parts of the country have experienced a period of decline or stagnation.

While the real estate market is now in a period of recovery, for the six months through to the end of September,the median house value across the combined capital cities fell by 0.5 per cent and median unit values declined by 3.1 per cent.

To keep stimulate the economy and keep the housing market afloat, the Reserve Bank of Australia announced further cuts to already low interest rates, with the current cash rate sitting at an all time low of 0.10 per cent, which is expected to remain at its current level for the next three years.

Lower values and interest rates, along with greater government incentives and concessions for first home buyers has created a climate where in some cases, it is actually cheaper to take out a mortgage than rent.

Mr Teh comments that while current conditions are ideal for buyers, there may be a small window of opportunity.

“The latest CoreLogic Home Value Index shows that the housing market is recovering with the October index recording growth for the first time in five months.

“As property prices bounce back, the gap will begin to widen again, making properties less affordable,” he said.

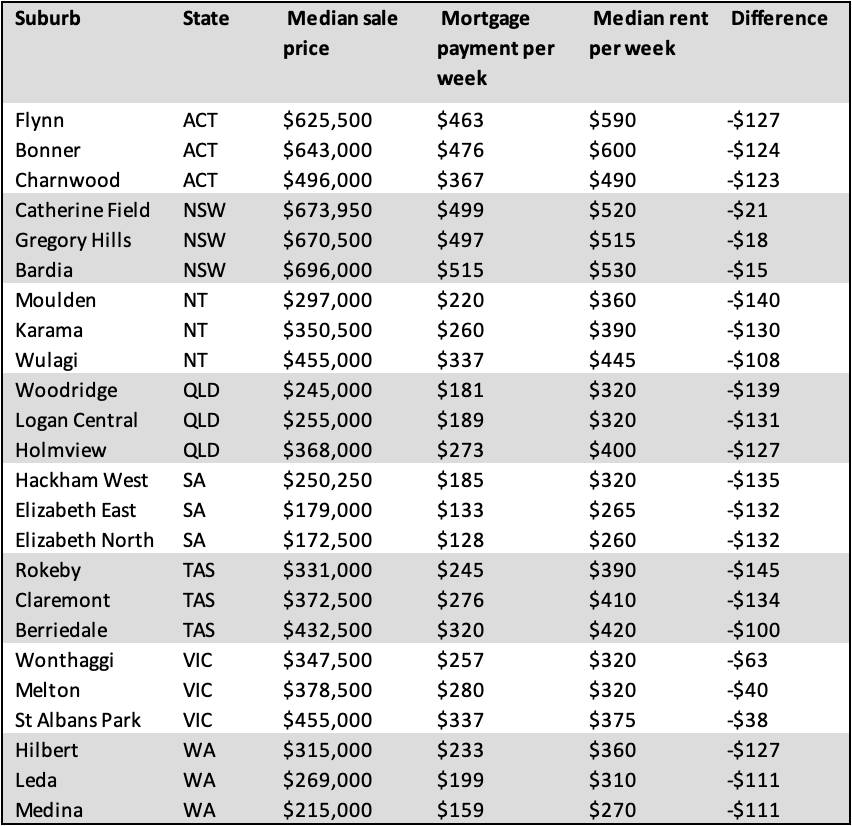

Suburbs where it's cheaper to pay a mortgage than rent for houses

The difference between mortgage repayments and rents varies greatly between the states. Unsurprisingly, Sydney and Melbourne have the smallest price difference due to higher median sale prices.

In Sydney, the south-western suburbs of Catherine Field, Gregory Hills and Bardia are among those where it’s cheaper to buy a house than to rent. The suburbs of Lakemba, Warwick Farm and Oxley Park on the other hand are better for units.

In Adelaide, buyers in the suburbs of Hackham West, Elizabeth East and Elizabeth North could all be over $130 better off per week compared to renters.

In the northern state of Darwin, the suburb of Moulden has one of the biggest price differences between loan repayments and renting. House buyers could save $140 per week compared to renters.

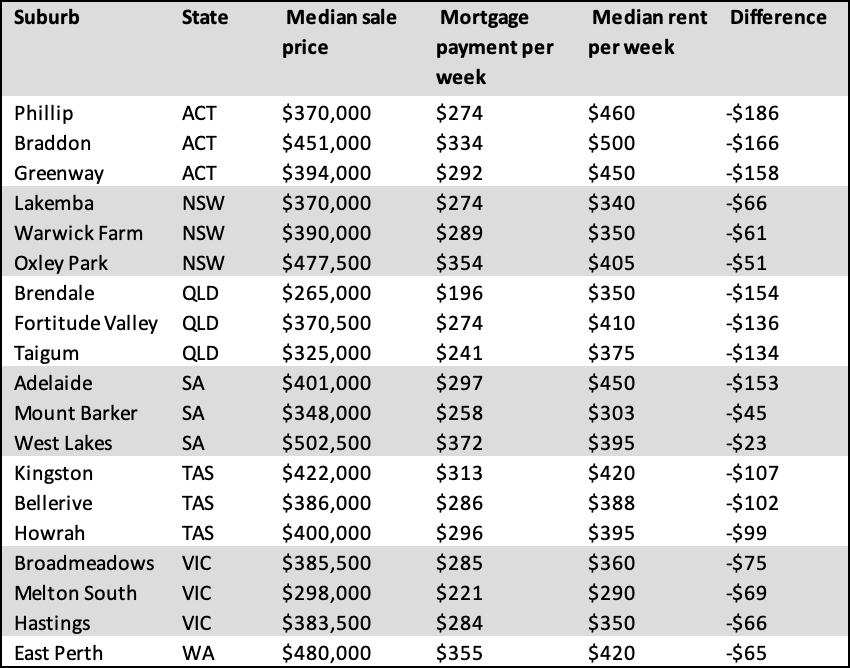

Suburbs where it's cheaper to pay a mortgage than rent for units

When it comes to units, the biggest difference between weekly mortgage repayments and weekly rent is seen in Canberra.

Based on the median unit price of $370,000, buyers in the suburb of Phillip in Canberra could be better off by $186 per week than those renting.

Further up in Brisbane, unit purchasers in the suburbs of Brendale, Fortitude Valley and Taigum, could be saving between $130 - $150 per week compared to those renting.

Disclaimer:

This analysis is done by OpenAgent using CoreLogic median house and rent price data. This is an estimation rather than a prediction, the actual amounts may differ for each owner in each suburb. This estimation does not include any other charges incurred before, during or after the mortgage repayment process. E.g. Strata, stamp duty etc.

Methodology and assumptions:

To compare a suburb’s median asking rent with the suburb’s current average mortgage repayments, we looked at two main values:

The median asking rent for units and houses over the last 12 months

The median sale price for units and houses over the last 3 months

Once we had these figures, the average mortgage repayment for a suburb was calculated by subtracting a purchaser’s assumed 20 per cent deposit.

The resulting figure was then assumed to be a purchaser’s loan amount, taken out over a 30-year loan period at a fixed 2.62 per cent lenders’ rate, as reported by the RBA.

We were then able to work out how much the average weekly mortgage repayment would be, which was then compared to the suburb’s median asking rent.

This analysis resulted in an output of suburbs around the country where it is currently cheaper to buy than rent, broken down by property type.

In addition:

A loan to valuation ratio of 80 percent means that the purchaser is borrowing 80 per cent of the property value and has a 20 per cent deposit.

All suburbs are located in capital cities and have at least 10 sales in the last three months

The interest rate of 2.62 per cent per annum for a new principal and interest home loan is based on the Lenders’ Interest Rate reported by the RBA.

Interest is calculated by compounding on a weekly basis

Interest rates do not change over the life of the loan

Loan period is 30 years

Readers should not solely rely on this information as financial advice. We encourage readers to undertake their own research and seek advice from a professional before making any major financial decisions.